Yardi Matrix: Detroit — Transforming from the Core

Multifamily Summer Report 2016: Nearly 1,800 housing units are scheduled for completion in 2016, a 600 percent increase compared to 2015.

Detroit’s multifamily market is gaining momentum. Young workers are attracted to the city’s downtown by an improving job market. In turn, rents are starting to grow and the development pipeline is refilling, with more than 8,000 units on the way. Even so, the metro must overcome its blighted neighborhoods and address an affordable housing shortage.

The auto industry, still the area’s main economic driver, continues to thrive, sending a ripple effect through the economy. Auto sales have cooled slightly from 2015’s record levels, but are on pace to top 17 million in 2016. Financier Dan Gilbert and the Ilitch family are leading downtown redevelopment. Projects that aim to attract activity include the QLINE railway project and Little Caesars Arena, which is scheduled to open in 2017. The revival of the Paradise Valley entertainment district is also underway, with total investments exceeding $52 million.

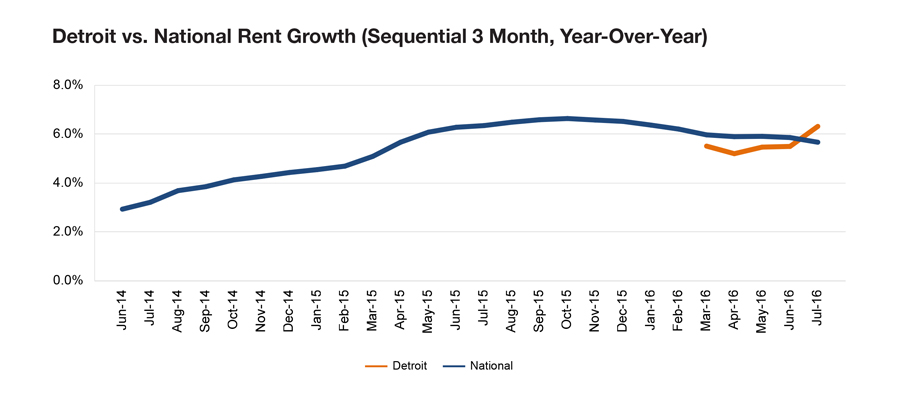

Multifamily fundamentals reflect the improving climate. Transaction volume in 2015 reached $535 million, a post-recession high. Nearly 1,800 housing units are scheduled for completion in 2016, a 600 percent increase compared to 2015. Rents are on the upswing due to strong demand, especially in core submarkets, which have become attractive to both multifamily and commercial developers. Rents jumped 6.3 percent year over year through July, but we expect that a cooler second half will lower that increase to 3.4 percent for the full year.

You must be logged in to post a comment.