Yardi Matrix: Dallas’ Outsize Growth

Rapid growth is the theme for the multifamily market in Dallas.

Rapid growth is the theme for the multifamily market in Dallas. Employment gains in diverse industries are driving demand for units. That, in turn, is producing rent increases and new development across the Metroplex.

Rapid growth is the theme for the multifamily market in Dallas. Employment gains in diverse industries are driving demand for units. That, in turn, is producing rent increases and new development across the Metroplex.

Last year’s strong hiring in the hotel, restaurant, retail and transportation industries has encouraged rent growth in the working-class Renter by Necessity segment, while the metro’s expanding high-paying industries have sustained strong absorption of luxury units. As a result of this diversification, Dallas will not be as affected by the oil price collapse as some of its neighbors. The metro is in fact expected to achieve net job gains in 2016 and outperform the state average. Corporate expansions are attracting newcomers, especially Millennials, who prefer to live in urban environments with a high walkability factor. Another reason is that the first-year earnings for young professionals in Dallas are substantially higher than the national average.

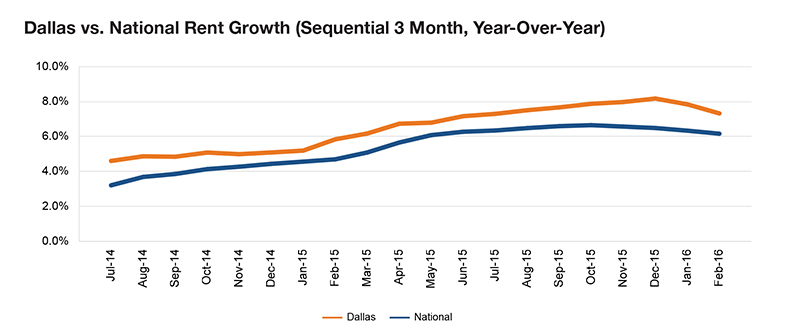

Dallas being Dallas, oversupply is always a concern. A significant influx of apartments came online in 2015, and a record 101,500 units are currently in the pipeline. Investors have also been active, as multifamily transaction volume rose to $3.9 billion, marking a peak in the current cycle. Dallas is at the top of the list of secondary markets because of its international business climate and liquidity. We see another strong year for rents, with an increase of 7 percent likely in 2016.

You must be logged in to post a comment.