Yardi Matrix: Cleveland’s Fundamental Promise

Multifamily fundamentals are strong in the City of Champions, with more than 11,500 multifamily units in different stages of development.

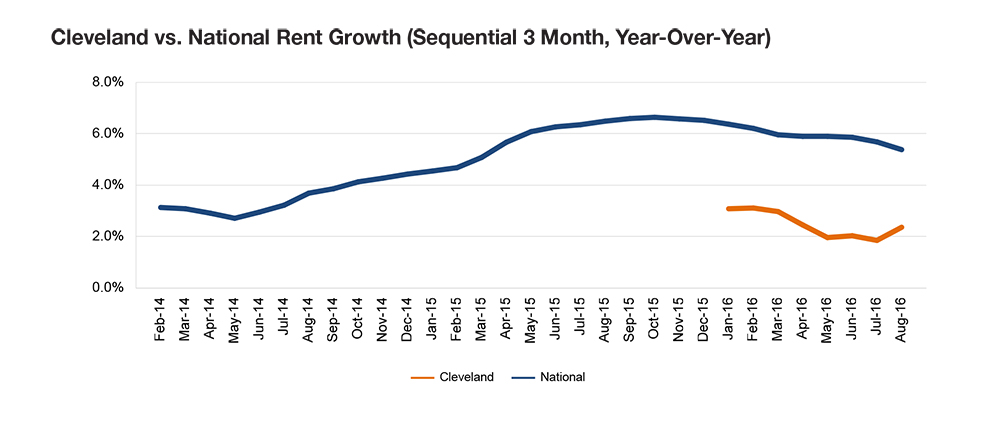

As a component of the slow-growth Rust Belt, Cleveland’s multifamily rent levels have historically lagged the national rate. However, despite recording a below average 3.1 percent year-over-year rent growth through August 2016, the metro is displaying relatively stable fundamentals.

The Weston/Citymark project, the nuCLEus high-rise and the 925 Building renovation—three Downtown investments that add up to more than $1 billion in value—are on the verge of redefining the city’s skyline and adding 2,300 units to Cleveland’s multifamily stock. As skilled Millennials and downsizing Baby Boomers are renting more and more in downtown Cleveland and surrounding submarkets, old office buildings are being converted to upscale residential or mixed-use properties. The hospitality industry was boosted by this summer’s Republican National Convention and the Cavaliers’ National Basketball Association championship. The education and health services sector continues to add consistent numbers of highly paid jobs, easing the city’s transition from a postindustrial center to a diversified economy.

Taking into account the city’s still-shrinking population, multifamily fundamentals are promising. Strong demand has increased occupancy levels by 210 basis points in recent years, development reached cyclical peaks in 2015 and more than 11,500 units are currently in different stages of development.

You must be logged in to post a comment.