Yardi Matrix: Boston Brawn

The city's multifamily market continued to expand in 2016, especially the in-demand waterfront, although escalating rents have left the metro with an affordability problem.

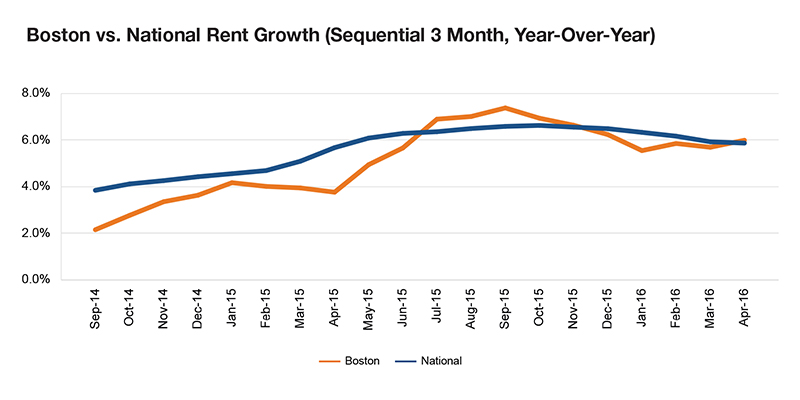

Boston’s multifamily market continued to expand in 2016, especially the in-demand waterfront, although escalating rents have left the metro with an affordability problem. Additionally, the much-anticipated national moderation in rents has caught up with the metro, especially in the luxury Lifestyle segment.

Anchored by a litany of universities, which continue to provide a stream of highly skilled workers, Boston’s economy is thriving. Driven forward by the education and health services, information, research and life sciences sectors, the metro is nonetheless rapidly adding jobs on both ends of the wage spectrum. This has intensified demand across asset classes, although developers continue to favor upscale projects and the antiquated city infrastructure badly needs updating. To address some of those concerns, the Massachusetts Bay Transportation Authority is in the permitting stages for the restoration of a commuter rail line linking the city to the state’s South Coast.

Developers are focusing on upscale projects along the waterfront and in the downtown submarkets, where rents average well above $2,000. As one of the country’s core markets, Boston remains highly liquid, with institutional investors preferring its stability to the higher yields of nearby secondary locales. And the solid job market is driving strong demand, which should translate to a rent uptick of roughly 4.2 percent for 2016.

You must be logged in to post a comment.