Yardi Matrix: An End to San Francisco’s Bull Run?

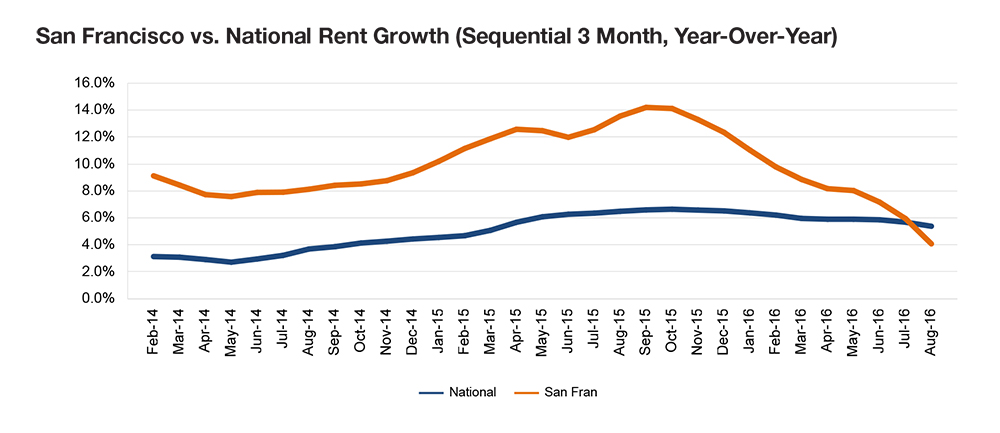

Affordability has become a pressing problem for San Franciscans, after years of double-digit rent growth in the metro.

A Millennial hotspot and an economic juggernaut, home to more than 30 international financial institutions and a plethora of iconic tech brands, San Francisco continues to be a key city for multifamily investors. However, rent growth has finally ended its bull run after years of double-digit increases, as properties are bumping up against the limits of affordability.

Broad-based job growth and an influx of skilled young professionals have propelled rental rates to extreme highs, reaching a record average of $2,216 in 2015. Homeownership is out of reach for most San Franciscans, and the lack of affordable housing options is pushing workers toward commuter towns in the East Bay, where home prices are slightly lower. Future supply is robust, with more than 15,000 units underway and over 66,000 in the planning stages. Major projects, such as the $4.5 billion Transbay Transit Center, which will accommodate more than 100,000 passengers each weekday and as many as 45 million people per year, are likely to spur on further investment and attract renters looking for transitfriendly apartments.

Job growth remains strong, and supply is increasing—though not more than demand. But the drop-off in rents is primarily a function of their surpassing what tenants can bear to pay. That’s not a short-term issue, and we see rents moderating for the rest of the year and even beyond.

You must be logged in to post a comment.