Yardi Matrix: Albuquerque Brightens Up

Multifamily Summer Report 2016: Population growth is feeble, but development is almost on par with the national growth rate.

Despite its prime position at the center of the New Mexico Technology Corridor, a cluster of high-tech companies and government institutions along the Rio Grande, Albuquerque’s multifamily market continues to struggle with limited population and employment growth, not to mention a crime rate ranking among the highest in the country.

Historically a ranching and mining state, New Mexico still gets a major economic contribution from its natural resources, despite the decline in oil prices. Renewable energy is an emerging force, as well. More than 110 solar power-related companies employing nearly 2,000 people call New Mexico home. In 2015, the state ranked 13th nationally in installed solar capacity. In Albuquerque, the University of New Mexico recently broke ground on Innovate ABQ, a $35 million project envisioned as a research and innovation hub.

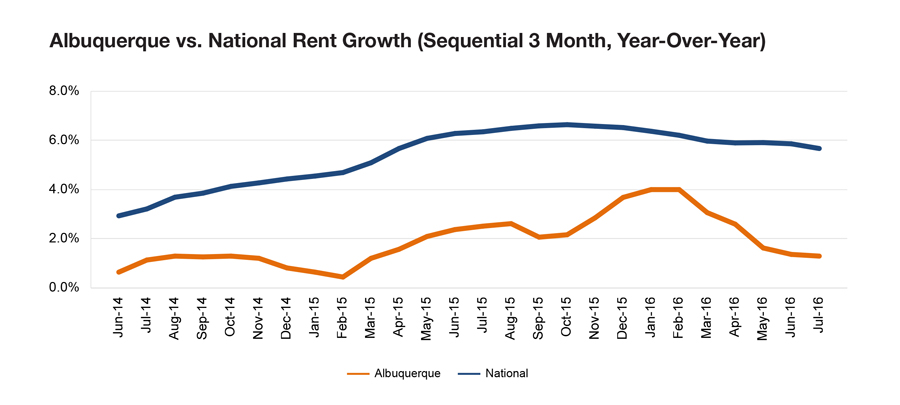

The metro’s multifamily fundamentals are generally weak, in contrast to the gains seen in most metros. Population growth is feeble, but development is almost on par with the national growth rate. Transaction volume more than doubled from 2014 to 2015, a sign of rising interest from investors. On the minus side, rent growth was less than 1.5 percent year-over-year through July, disappointingly behind the national rate of 5.7 percent. We expect continued tepid growth of 1.0 percent in 2016.

You must be logged in to post a comment.