What the Market May Bear Can Still be a Bear

By Marcelo Bermúdez, President, Figueroa Capital Group, subsidiary of Charles Dunn Co.: Over the last six months, headlines like, “Improvements in Fundamentals Mean Big Returns,” “Secondary Markets Heating Up,” and even, “The Return of the Boom” continue to bring encouragement to the marketplace.

By Marcelo Bermúdez, President, Figueroa Capital Group, subsidiary of Charles Dunn Co.

Over the last six months, titles like, “Improvements in Fundamentals Means Big Returns,” “Secondary Markets Heating Up,” and even, “The Return of the Boom” continue to make headlines to bring encouragement to the marketplace. For the investor and broker, this is exciting news – until they fill out the loan application to finance the property.

Similar to attorneys, those of us in the financial markets facilitating access to capital have been called “the deal killers” because the due diligence process is often separate from what the market will bear in the agreed sales price.

Investor and broker … meet debt yield. Debt yield … meet investor and broker. Let’s see if we can get along.

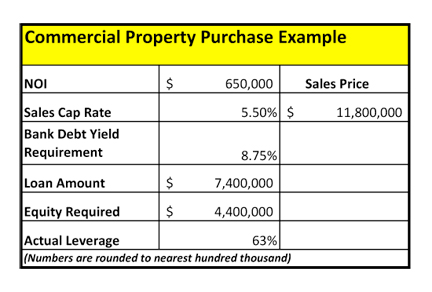

Debt yield is the NOI (Net Operating Income) divided by the loan amount, times 100. It is the cash-on-cash return a lender gets assuming they had to foreclose on a property. If a property’s NOI is $650,000, and the loan amount offered is $7.43 million, the debt yield is about 8.75 percent. If the purchase cap rate on the deal is 5.5 percent, (a value of $11.8M), we have a leverage point that looks like approximately 63 percent. This can be stressful for a buyer, who after a conversation with a banker or mortgage broker is promised loan-to-value ratios of upwards to 75 percent. So what’s the deal?

Believe it or not, some lending sources have learned their lesson and would rather use the debt yield versus the debt service coverage ratio to fend off pricing bubbles. As banks and other lending sources come back to health, there will be some flexibility in the actual dollars offered, especially if the appraisal is strong. Debt yield will continue to be the predominant metric for banks to underwrite your transaction and a helpful way to manage your expectations when approaching a purchase or reposition of a property.

You must be logged in to post a comment.