Western Alliance Expands Downtown Phoenix Footprint

The bank has signed one of the largest office leases in the Valley since the onset of the pandemic.

Just a few months after expanding its headquarters at Phoenix’s CityScape, Western Alliance Bank has signed another downtown lease. Arizona’s largest locally headquartered bank will occupy the entire sixth floor at Block 23, RED Development’s 1.3 million-square-foot mixed-use property. The leased space, totaling 45,541 square feet, will accommodate more than 700 employees starting early 2022.

Completed in 2019 at 101 E. Washington St., Block 23 is a live-work-play destination encompassing 230,000 square feet of office space, 332 luxury apartments, and 81,000 square feet of retail and restaurant space that includes Fry’s Food and Drug, downtown’s only full-scale grocery store. The property also has a parking structure totaling 523,000 square feet.

The building’s office component spreads across five floors, featuring floor-to-ceiling windows and 45,000-square-foot open floorplans, among the largest in Downtown Phoenix. Western Alliance will join other big companies on the roster, such as Ernst & Young, the development’s first office tenant, and CVO Holding Co., which moved to the location in late March.

Situated near Phoenix Suns Arena and Chase Field, Block 23 is across the street from CityScape, the other headquarters location of Western Alliance Bank. The immediate area has numerous shopping and dining venues.

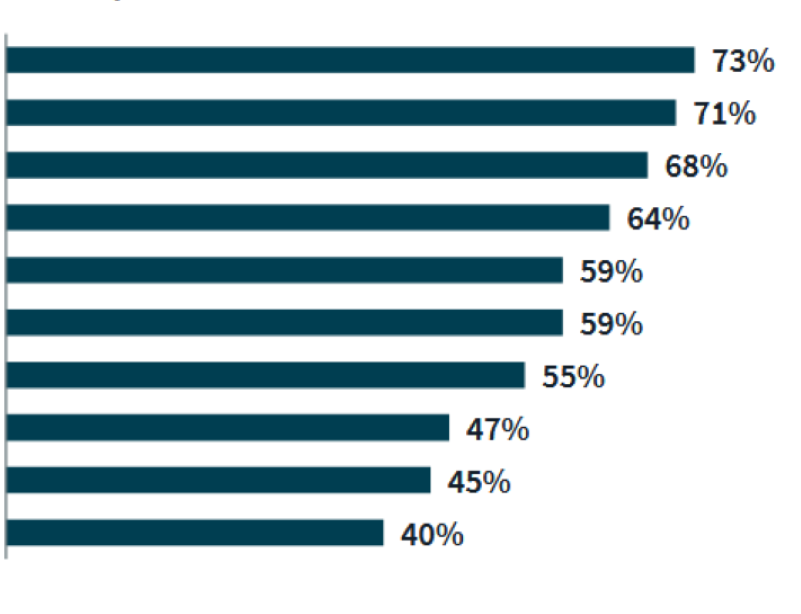

Downtown Phoenix leasing activity

Western Alliance’s second downtown lease marks one of the largest office transactions in the Valley since the onset of the COVID-19 pandemic. The largest was the 115,000-square-foot contract signed by Snell & Wilmer at CityScape in May, while the second in size was Western Alliance’s headquarters expansion in February.

Despite the large leases involving properties located in the Central Business District, office direct vacancy was 16.8 percent in Phoenix’s Downtown submarket in the first quarter of 2021, with Class A offices at 18.4 percent vacancy, according to a recent Colliers report.

The metro’s office vacancy averaged 13.8 percent in the first quarter of 2021, on par with the year-over-year rate. This was also the second consecutive quarter with negative absorption, ending at -372,905 square feet.

You must be logged in to post a comment.