US Market Stacks Up Well Against the World

Despite a $600 billion drop in value globally, the U.S. is No. 1 by a wide margin, according to an analysis by MSCI.

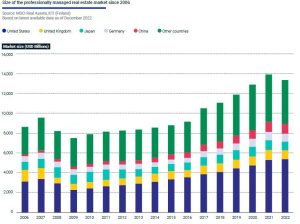

Size of professionally managed real estate market globally since 2006. Image courtesy of MSCI Real Assets

Macroeconomic factors, primarily rising inflation and increasing interest rates, took their toll on commercial real estate across the globe last year. The size of the professionally managed real estate investment market dropped 4.1 percent from $13.9 trillion in 2021 to $13.3 trillion in 2022, according to the latest MSCI Real Estate Market Size report.

The Americas continued to represent the largest share of the professionally managed market with 43.9 percent, followed by EMEA at 30.4 percent and Asia Pacific with 25.7 percent. The report states the market size of the Americas grew slightly by 0.6 percent to $5.9 trillion. The EMEA market size dropped the most at 9.8 percent to $4.1 trillion while the APAC market declined 4.6 percent to $3.4 trillion.

READ ALSO: Fed Rate Hike Ahead. What’s in It for CRE?

For the first time, MSCI estimated the size of the overall investable market at $19.5 trillion.

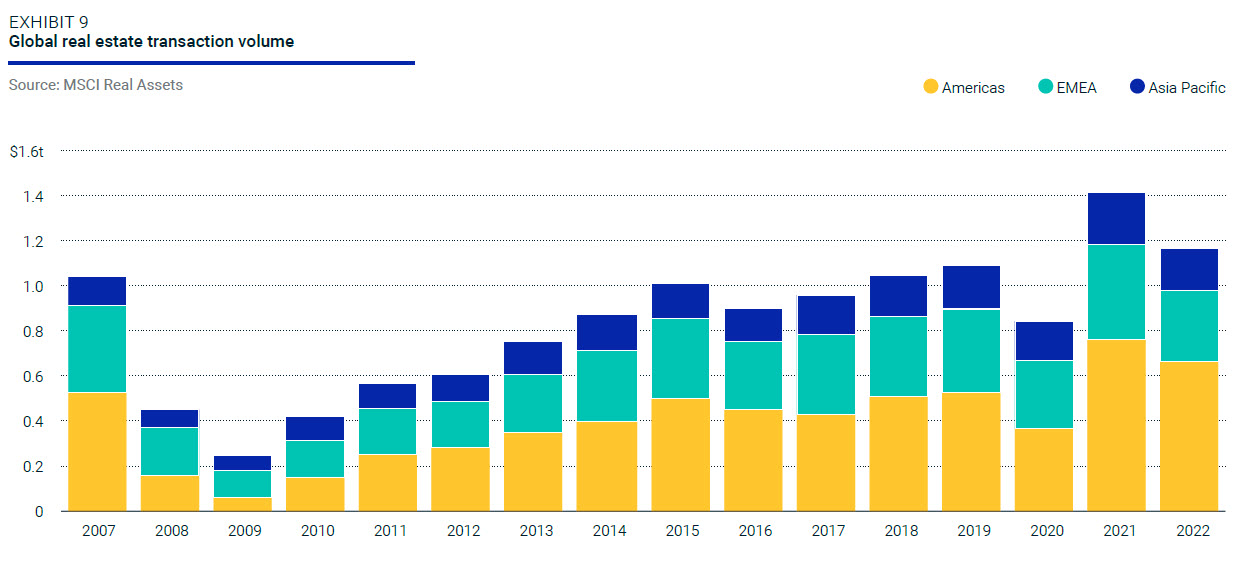

“The speed and magnitude of interest-rate movements have comprehensively changed the investment environment, resulting in a dramatic decline in transactional volumes over the last 12 months,” René Veerman, head of Real Estate Assets with MSCI, stated in a foreword to the report.

Veerman said the decline in activity felt more intense because it followed a record 2021, when the U.S. in particular saw a surge of deals with an 8.1 percent increase from 2020 during the height of the pandemic.

Since the second half of 2022, MSCI recorded declines in deal volumes of more than 50 percent in all three global regions. However, Veerman noted that valuations have adjusted at different speeds from country to country. He stated the U.K. has led the price adjustment followed by continental Europe. The U.S. and Asia Pacific have lagged, particularly the Asia Pacific region which is only now beginning to see signs of valuation modification.

READ ALSO: How Will Office Space Values Fare by 2030?

The report also states currency has played a role in the decline of the market size. The overall currency impact showed a decline of 4.6 percent. MSCI noted the U.S. dollar strengthened against most global currencies in 2022, except for the Brazilian real and Singapore dollar. The currency impact was the greatest for Sweden krona, down 13.1 percent versus the U.S. dollar, and the Japan yen, down 12.7 percent versus the U.S. dollar.

Global commercial real estate markets, one by one

The MSCI analysis covers 37 markets—three from the Americas, 23 EMEA nations and 11 from Asia Pacific. The U.S. remained the largest market by far, with a size of roughly $5.4 trillion, followed by China at $990 billion. Japan overtook the U.K. in 2022 to become the third-largest market ($886 billion), $5 billion more than the U.K. ($881 billion). Germany rounded out the top five ($793 billion). Those five markets represented about 67 percent of the global professionally managed real estate markets and the top 10 countries accounted for about 84 percent, according to MSCI.

The report stated the drop in the U.K.’s overall market size was due to a sharp decline in the industrial sector performance in the second half of 2022.

One of the other major changes in the top 10 rankings for 2022 was Hong Kong moving into the eighth position ($428 billion) ahead of Canada ($403 billion) and followed by Switzerland ($355 billion). The other top 10 markets for 2022 were France in sixth place ($610 billion) and Australia in the seventh spot ($477 billion).

MSCI stated 10 of the 37 markets tracked, comprising 58 percent of the professionally managed real estate markets around the globe, increased in weight for 2022, while the remaining 27 markets had declines.

The decline in transaction volume due to the economic headwinds around the world also impacted turnover ratio. The report noted the global average turnover ratio for 2022 was 8.7 percent compared to 10.0 percent in 2021.

You must be logged in to post a comment.