Understanding the HVCRE Bill

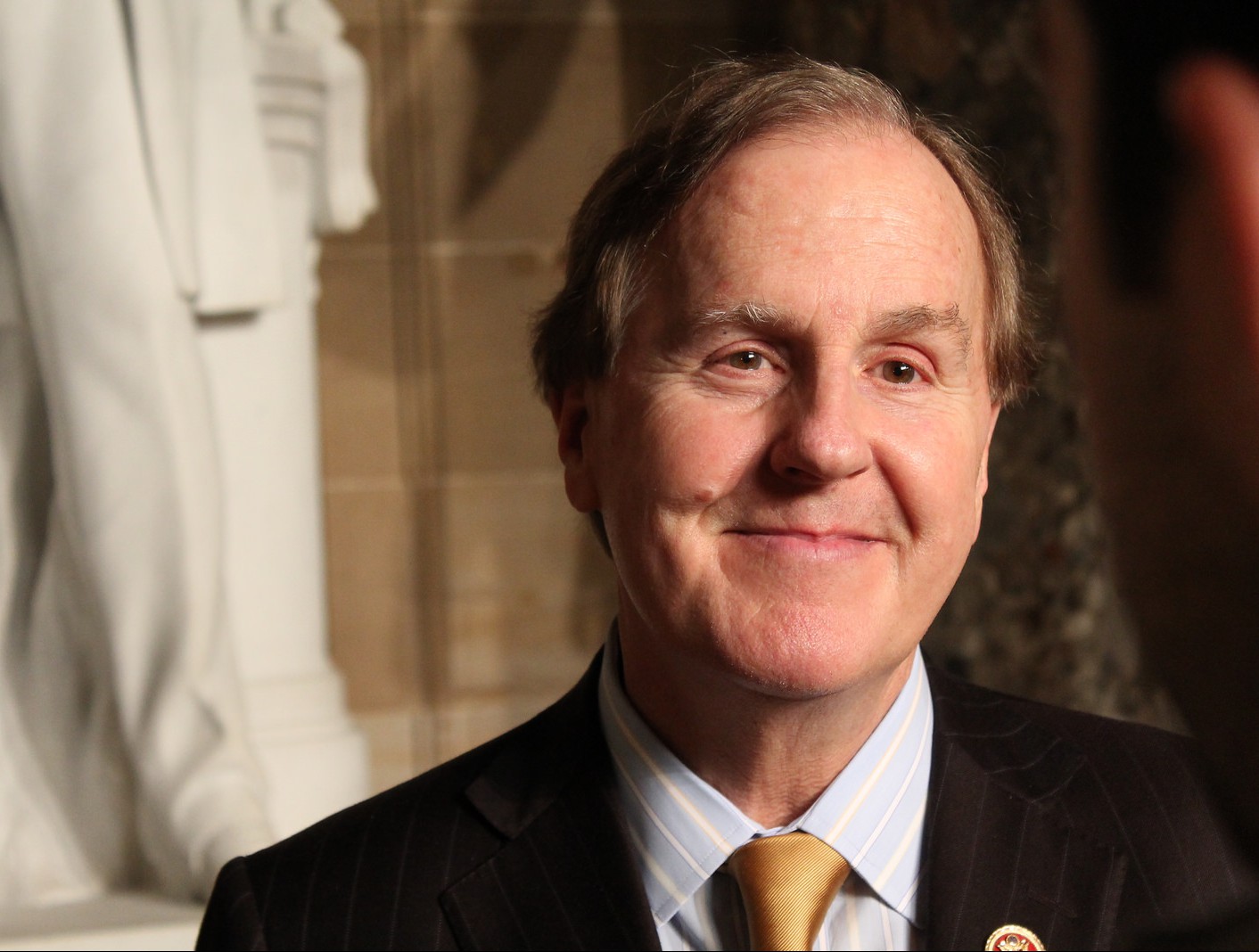

Reps. Robert Pittenger (R-N.C.) and David Scott (D-Ga.) introduced the H.R. 2148 bill in hopes of clarifying capital requirements for HVCRE loans. But when and if the bill will be passed in its current form is still unknown.

By Razvan Cimpean

Reps. Robert Pittenger (R-N.C.) and David Scott (D-Ga.) recently introduced H.R. 2148 in an attempt to clarify what qualifies as a high volatility commercial real estate (HVCRE) loan and what doesn’t. The bipartisan bill, titled Clarifying High Volatility Commercial Real Estate Loans, has since been co-sponsored by Republican representatives for North Carolina, Ohio, Florida, Kentucky, Missouri and Colorado. On July 12, a subcommittee of the House Financial Services Committee held hearings to examine nine pieces of legislation that would provide regulatory relief for community financial institutions, including H.R. 2148.

Under new regulations effective since the beginning of 2015, HVCRE loans are assigned a risk rating of 150 percent. That means banks are required to set aside 50 percent more capital in reserve when dealing with HVCRE loans. That constitutes a significant increase from the 12 percent that lenders were previously required to reserve. Because a loan can be classified as high-risk after closing, traditional lenders are becoming reluctant to provide acquisition, construction and development (ACD) loans.

Provisions

H.R. 2148 seeks to better define the existing HVCRE rule by:

- revising the definition of ‘real property’ to include the assessed value of the property, even if it comes from cash used to acquire it or from its appreciation

- allowing capital generated internally to be withdrawn from the project

- allowing a construction loan to be reclassified as a non-HVCRE ACD loan if the construction has been completed and the borrower has enough cash flow to support the debt service and expenses of the real property

- providing an exemption for loans made prior to Jan. 1, 2015

- not classifying as high-risk mortgage loans for improvements to existing assets that produce an income

Despite gaining support among Republican representatives and being originally cosigned by members of both parties, it is unclear whether H.R. 2148 would pass or become law in its current form. In an interview with Multi-Housing News, real estate attorney Gregg Loubier, an Alston & Bird’s Finance Group partner, explained why he believes the bill won’t pass anytime soon.

Criminal investigation

Pittinger’s decision to introduce the bill in the House came under scrutiny because he faced a two-year federal criminal investigation into his former real estate company, Pittenger Land Investments (PLI), now run by his wife. The FBI and IRS examined whether the Republican congressman improperly transferred personal money and contributions from PLI to his 2012 congressional campaign.

Talking to two investors Pittenger previously worked with, The Charlotte Observer reported in October 2015 that the lawmaker continued to play a role in PLI, despite claiming to have sold his part in the business before taking office. This puts the lawmaker’s support for the bill under question, seeing how his family’s business would stand to gain financially if H.R. 2148 would become law. However, in May, federal authorities announced that they were closing the investigation and that no charges would be filed.

Image courtesy of Rep. Robert Pittenger

You must be logged in to post a comment.