ULI Consensus Forecast Projects Some Slowing in CRE Market after Years of Growth

The latest survey by the Urban Land Institute predicts that CRE transaction volume will decline over the next three years.

By Gail Kalinoski

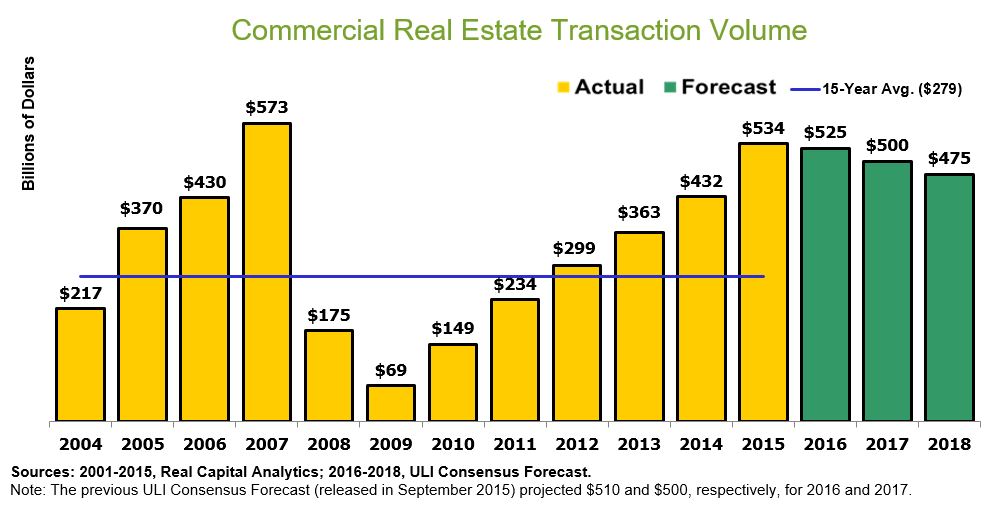

Washington—Commercial property transaction volume in the United States is expected to gradually decline from $534 billion in 2015 to $475 billion by 2018, and real estate prices are projected to grow more slowly over the next three years, going from 5 percent this year to 3 percent by 2018.

Real estate economists surveyed for the latest ULI Real Estate Consensus Forecast projected “continued economic expansion over the next three years,” just at a somewhat slower pace than seen in the past two years.

The semi-annual outlook, a survey by the Urban Land Institute Center for Capital Markets and Real Estate of 48 of the industry’s top economists and analysts, was accompanied by a webinar this week where the results were discussed.

“What really came out yesterday is that none of this is scary. This makes sense after quite a long period of recovery,” Anita Kramer, senior vice president of the ULI Center for Capital Markets and Real Estate and a webinar participant, told Commercial Property Executive.

“There was a feeling of this is not another traumatic recession. If anything, it’s more the cycle,” she added.

The survey, conducted in March, provides forecasts on broad economic indicators, real estate capital markets, property investment returns for four property types, vacancy and rental rates for five property types and housing starts and prices. While the respondents are not sounding alarm bells, some of the forecasts are less optimistic than the last ULI survey done in September when the CRE market was projected to “continue expanding at healthy and fairly steady levels for 2015 through 2017.” In that survey, which was released in October, CRE transaction volume was expected to increase for two more years and level off at around $500 billion by 2017. CRE prices were projected to slow to a 6.0 percent increase this year and 4.5 percent growth next year, a bit better than the current survey’s prediction of a 5.0 percent increase this year, 2.7 percent increase next year and 3.0 percent by 2018.

“Compared to six months ago, real estate researchers are predicting slower economic growth, slipping real estate fundamentals and lower returns from both the public and private markets,” William Maher, director of North American strategy for LaSalle Investment Management, said in a prepared statement. “As was the case six months ago, there is no imminent downturn on the horizon, although global economies and markets remain fragile and volatile.”

Even with some softening projections, the ULI report notes that CRE transaction volume has consistently increased for six years and reached a volume in 2015 surpassed only by 2007’s volume. The volume expected for this year through 2018, while down, would still be surpassed only by 2007 and 2015.

In addition to the relatively still high but declining CRE transaction volume, the current forecast projects: continued commercial price appreciation and positive returns but at more subdued and decelerating rates; above-average but decelerating rent growth rates in all property sectors and better than average vacancy/occupancy rates, except for retail and single-family housing which start to continue to increase but remain below the long-term average.

The ULI survey found one reason for more caution about transaction volumes is that expected commercial mortgage-backed securities (CMBS), a key source of financing for commercial real estate, has been downgraded. The report notes the economists predict a decline to $85 billion in 2016 from $101 billion in 2015.

“New regulations taking effect later this year will impede new issuance even more: the 2017 forecast of $100 billion is down from the forecast of $140 billion last September,” according to Maher. “CMBS spreads have risen since the start of the year, partly due to lower base rates, but also as a reflection of concerns about economic growth and defaults.”

Other key findings of the Consensus Forecast:

- Institutional real estate assets are expected to provide total returns of 8.1 percent in 2016, moderating to 7.2 percent in 2017 and 7.1 percent in 2018. Returns are expected to be strongest for industrial and office, followed by apartments and retail, in 2016. By 2018, there is little variation among the property types, according to the projections.

- Commercial property rents are expected to increase for the four major property types this year ranging from 2.0 percent for retail up to 4.0 percent for office and 4.5 percent for industrial. Hotel RevPar is projected to rise by 4.6 percent.

- Office rate vacancy rates are projected to be 12.6 percent in 2016 and 12.3 percent in 2017 and 2018.

- Apartment vacancy rates are expected to increase slightly to 4.9 percent this year followed by 5.2 percent in 2017 and 5.4 percent in 2018.

- Industrial/warehouse availability rates are expected to decline to 9.2 percent this year and inch up a bit in 2017 and 2018 but still remain below the long-term average. Survey respondents predict healthy but moderating rental rate growth with increase of 4.5 percent this year, 3.0 percent in 2017 and 2.7 percent in 2018, all above the 20-year average growth rate. The forecasts are more optimistic than the previous Consensus Forecast.

You must be logged in to post a comment.