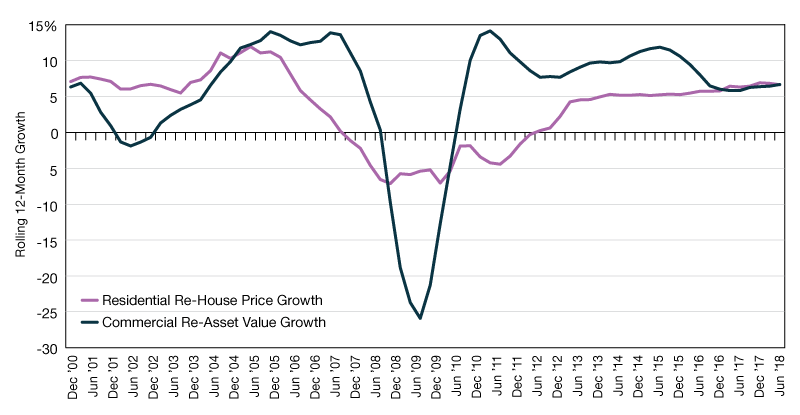

U.S. Commercial vs. Residential Real Estate

The downturn for commercial real estate did not set in until later than for residential real estate but once it did, the shock to commercial markets was much more pronounced.

With the housing market often seen as the genesis for the financial crisis, America’s residential real estate markets have been closely scrutinized over the last decade. But how have they fared against commercial real estate markets? Using the MSCI U.S. Quarterly Property Index, we can calculate the rolling annual asset value growth for U.S. commercial real estate and overlay this against the rolling annual house price growth recorded by the U.S. Federal Housing Agency’s House Price Index. What we observe is the downturn for commercial real estate did not set in until later than for residential real estate but once it did, the shock to commercial markets was much more pronounced. However, it was also shorter and commercial markets bounced back much faster than residential markets with growth in commercial asset values outpacing residential for much of the last decade. Over the last few quarters, we have seen growth rates converge and track together quite closely with modestly positive momentum for both commercial and residential real estate.

You must be logged in to post a comment.