Top Retail Trends: Uncertainty Shifts Demand Dynamics in 2025

There's both deceleration and opportunity in the market, a new Cushman & Wakefield report shows.

A handful of key retail fundamentals are dampening in 2025, as the sector faces noise and headwinds coming from shifting trade policies, as well as rising store fit-out costs, to name just two key factors. Yet, midyear, the retail ecosystem is still adjusting, once again showing its resilient side.

While the sector realignment is ongoing, a few primary trends emerge. Here are our top takeaways from Cushman & Wakefield’s second-quarter U.S. retail report.

1. Retailers’ cautious stance

As tariffs and trade policy evolve, the sector becomes more exposed to uncertainty. Plenty of retailers began taking a strategic leasing pause, waiting for a clearer picture to emerge. Moreover, rising store fit-out costs likewise fuel the wait-and-see sentiment.

With many expansions placed on hold, retail store closures have been outpacing openings since July 2024. Some of the chains that closed up shop or are going to include Dollar General, Foot Locker and Macy’s, as well as 7-Eleven.

2. Softening retail space demand

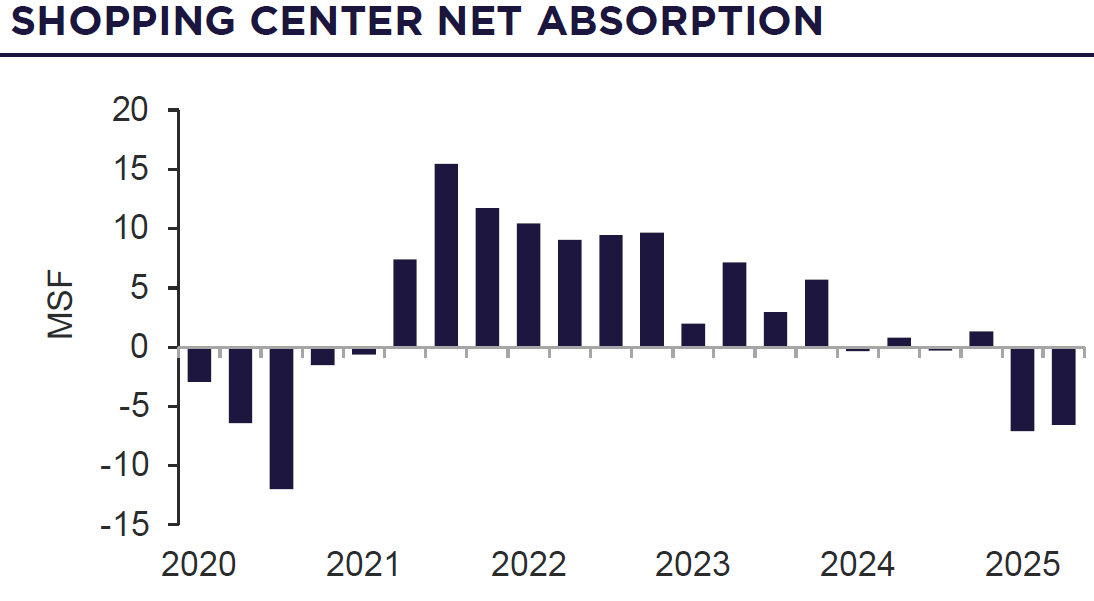

While tenants continue to hesitate, retail leasing activity dropped 20 percent during the first half of 2025, compared to the same period of last year. Consequently, retail owners felt a substantial pullback in demand as national net absorption clocked in at negative 6.5 million square feet during the second quarter.

READ ALSO: Retail’s Resilience Draws Private Capital Back

That’s a slight improvement compared to the first three months of 2025, when the figure stood at -7.1 million square feet. However, this six-month period marked the poorest performance since 2020, as well as the first instance where absorption went negative for two quarters in a row during the post-pandemic era.

3. An emerging tenant market

This risk-averse tenant approach drove the national retail vacancy up, with the index climbing 50 basis points year-over-year to 5.8 percent in June. The figure was still below the average of 6.4 percent registered between 2017 and 2019. However, as owners pressed to fill up empty units, concessions were made regarding rents.

The average asking retail rate stood at $25 per square foot in June, representing a 2.3 percent increase compared to last year. For reference, rent growth was in the 4 percent ballpark in early 2024 and now it’s trending below the current rate of inflation. Such developments may give occupiers the upper hand in negotiating a new lease or renewal.

4. Metros bucking national trends

As current retail trends continue shaping the market, a handful of metros stood out as seemingly shielded from ongoing turbulence. Charlotte, N.C., managed to improve its retail absorption during the second quarter, after being in the red the prior quarter. Additionally, the metro’s vacancy stood at 3.8 percent in June, 200 basis points below the national average.

Phoenix’s absorption during the first half of 2025 landed at nearly 380,000 square feet, yet its vacancy was closer to the national average, settling at 5.2 percent. Notably, the Valley of the Sun’s retail rent growth clocked in at 3.9 percent year-over-year, 160 basis points above the U.S. average.

5. Retail’s silver lining

While examples of metros significantly overperforming are few—just 25 of the 81 markets tracked by Cushman & Wakefield experienced an absorption increase—there are glimmers of retail positivity.

A back-to-school bounce in sales could be right around the corner, especially if customers continue their spending habits. For instance, retail sales were up 0.6 percent in June compared to May, 40 basis points above the figure predicted by economists polled by The Wall Street Journal.

You must be logged in to post a comment.