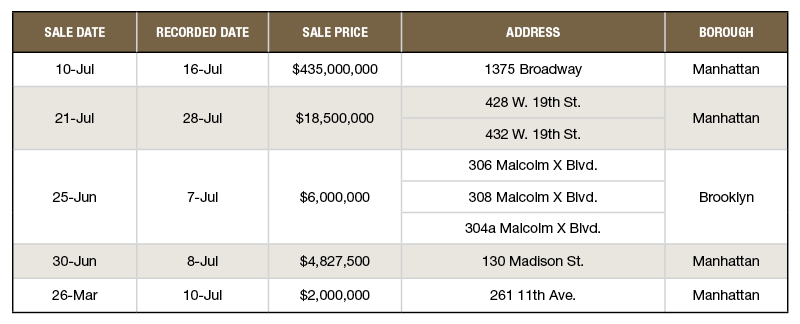

Top 5 Office Building Sales—July 2020

PropertyShark compiled the top 5 sales in office recorded in July 2020 in New York City.

- 1375 Broadway, Manhattan

Sale Price: $435,000,000

Savanna purchased the 465,000-square-foot Garment District office tower for $435 million from Westbrook Partners, after entering into a sales agreement earlier this year in February. The deal marks the first purchase out of Savanna’s fifth private equity fund, launched late last year. Aareal Capital and Deutsche Bank provided $200 million in acquisition financing, which carries a 6.4 percent interest rate and is scheduled to mature in July 2030.

- 428 W. 19th St., Manhattan

Sale Price: $18,500,000

An entity affiliated with Anbau, an investment and development firm headed by Stephen Glascock and Barbara van Beuren, acquired the 17,940-square-foot property at 428 W. 19th St., along with an adjacent 8,700-square-foot building located at 432 W. 19th St. The buyer paid $12.3 million and $6.2 million, respectively. According to the brokers who arranged the deal, the site represents a rare residential development opportunity in Chelsea.

- 306 Malcolm X Blvd., Brooklyn

Sale Price: $6,000,000

The 3,520-square-foot property changed hands in a portfolio sale with the adjacent, 3,405-square-foot asset at 308 Malcolm X Blvd. and the 2,640-square-foot building at 304 A Malcolm X Blvd. Each commercial building commanded $2 million in three separately recorded transactions. Connectone Bank facilitated the deal by providing $4.5 million in acquisition financing. The seller had owned the portfolio since July 2019.

- 130 Madison St., Manhattan

Sale Price: $4,827,500

The 2,914-square-foot property, which features 2,014 square feet of office and 900 square feet of retail space, changed hands in early July. The seller had owned the asset for more than 12 years, since August 2008. The new owner obtained acquisition financing from NewBank—the $4 million permanent SBA loan carries a 6.67 percent interest rate and is scheduled to mature in June 2030.

- 261 11th Ave. #, Manhattan

Sale Price: $2,000,000

In a co-op sale recorded in early July, Paramus North America Corp. transferred the ownership it held related to the Terminal Warehouse project. L&L Holding Co. owns the former warehouse in a partnership with Normandy Real Estate Partners. The joint venture paid $880 million for the 1.2 million-square-foot structure in October 2018 and received approval in January 2020 from the New York City Landmarks Preservation Commission for the restoration and revitalization of the historic Chelsea property.

You must be logged in to post a comment.