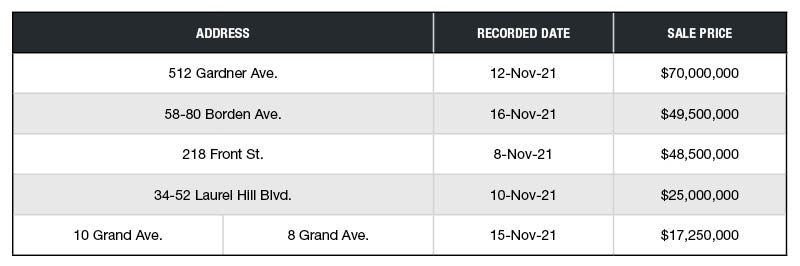

Top 5 NYC Industrial Building Sales—November 2021

PropertyShark compiled the city’s top deals for the sector.

- 512 Gardner Ave., Brooklyn

Sale Price: $70,000,000

Realterm acquired the 24,456-square-foot truck terminal in a transaction facilitated by Cushman & Wakefield. The parcel totaling 197,188 square feet is within an Opportunity Zone and includes an additional 394,376 buildable square footage. The 52-door, high flow-through facility located along Interstate 278/Brooklyn Queens Expressway, also offers easy access to Interstate 495 and is within 6 miles of LaGuardia Airport.

- 58-80 Borden Ave., Queens

Sale Price: $49,500,000

Truck King International sold the property totaling 31,600 square feet to Sitex Group. The new owner secured $30.1 million in acquisition financing originated by CIT Bank. The property last traded in 2004, when the current seller paid $4.5 million for the single-building asset. The one-story property was completed in 1965 and also includes an office space totaling 2,600 square feet.

- 218 Front St., Brooklyn

Sale Price: $48,500,000

A private investor sold the five-building property in the Vinegar Hill neighborhood to Urban Realty Partners. The new owner financed the transaction with a $36 million loan provided by Popular Bank. The 1960-built property encompasses 41,871 square feet and underwent renovations in 1967. The 49,200-square-foot lot also includes an additional 105,780 buildable square footage.

- 34-52 Laurel Hill Blvd., Queens

Sale Price: $25,000,000

Industrial gas supplier, American Compressed Gases Inc. sold the 20,800-square-foot facility to Realterm. The final mile warehouse in the Maspeth neighborhood features a cross-dock configuration with 30 loading positions. The facility offers easy access to Interstates 495 and 278, it is some 5 miles southeast from LaGuardia Airport and within 8 miles of the Port of New York and New Jersey.

- 10 Grand Ave., Brooklyn

Sale Price: $17,250,000

Workable City Development sold the 58,905-square-foot facility along with 8 Grand Ave. totaling 14,780 square feet to a partnership between Meadow Partners and Glacier Equities. Fortress Investment Group provided an acquisition and development financing package totaling $22.5 million. All three mortgages are set to mature in October 2024. Glacier Equities plans to invest $6 million in capital improvements to reposition the two-building property according to Commercial Observer.

You must be logged in to post a comment.