Thorpe Predicts Continued Expansion

We are well into the economic cycle, but that's no reason to be scared, according to Kevin Thorpe, chief economist for Cushman & Wakefield Inc. There may be more growth to come.

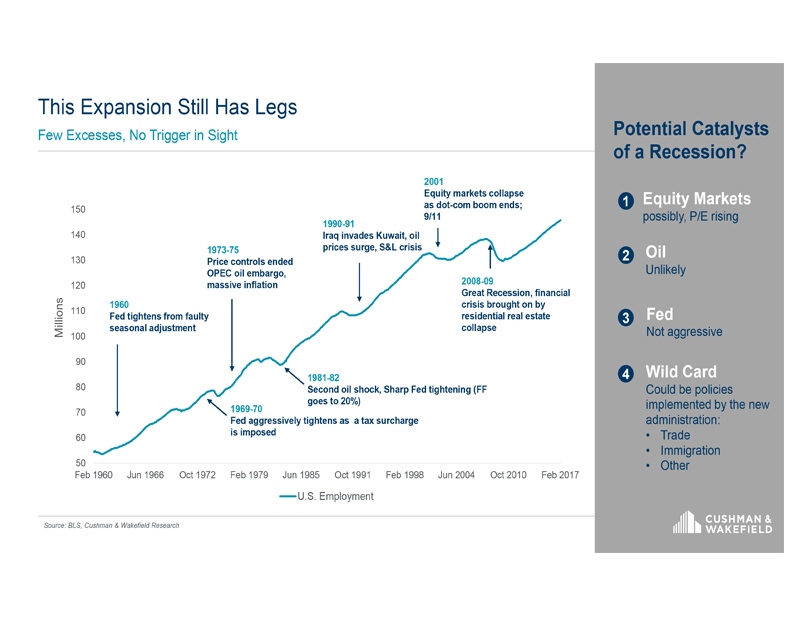

We are well into the economic cycle, but that’s no reason to be scared, according to Kevin Thorpe, chief economist for Cushman & Wakefield Inc. “The odds are still really good that the expansion will continue, and the odds are good that the next recession won’t be as nasty,” he declared while delivering his Global Economic Outlook at the National Association of Real Estate Editors’ Real Estate (NAREE) Journalism Conference in Denver last week.

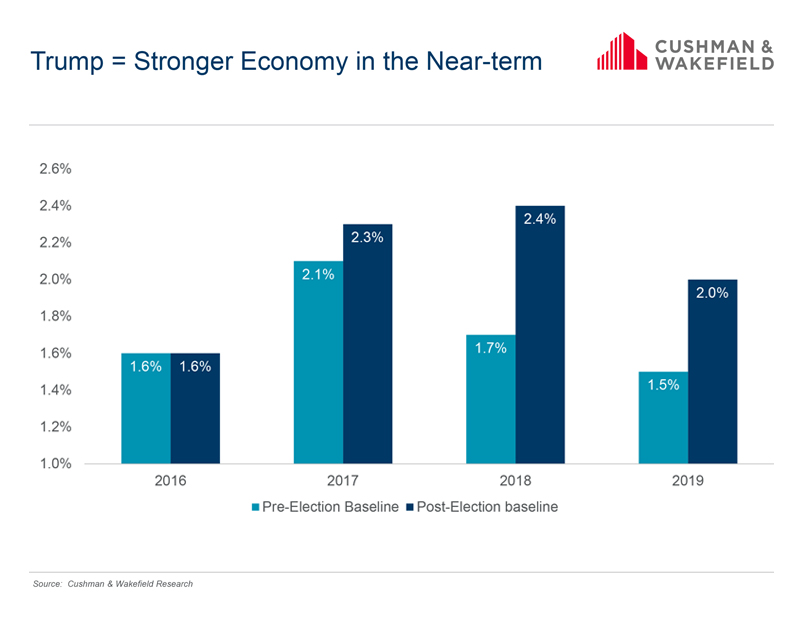

In fact, there may have already been a slight recession last year, setting up the market for some growth acceleration this year and deferring the next downturn for awhile longer, he noted. He predicted 2.4 percent GDP growth this year and next year, an improvement over last year’s 1.6 percent increase. “Maybe we have reset the economic cycle.” He pointed to continued tightening of the employment market and acceleration of wage growth as reasons for the uptick, on top of a sound financial system and aggressive performance by the central banks.

The impact of having a real estate developer as President has yet to be felt, but Thorpe believes it will have a favorable effect on the economy. He noted that with reduced taxes, increased government spending, some tax reform–most likely including corporate tax reform–and trade policy changes, growth most likely will reach 2.5 to 3 percent but could even rise as high as 4 to 5 percent.

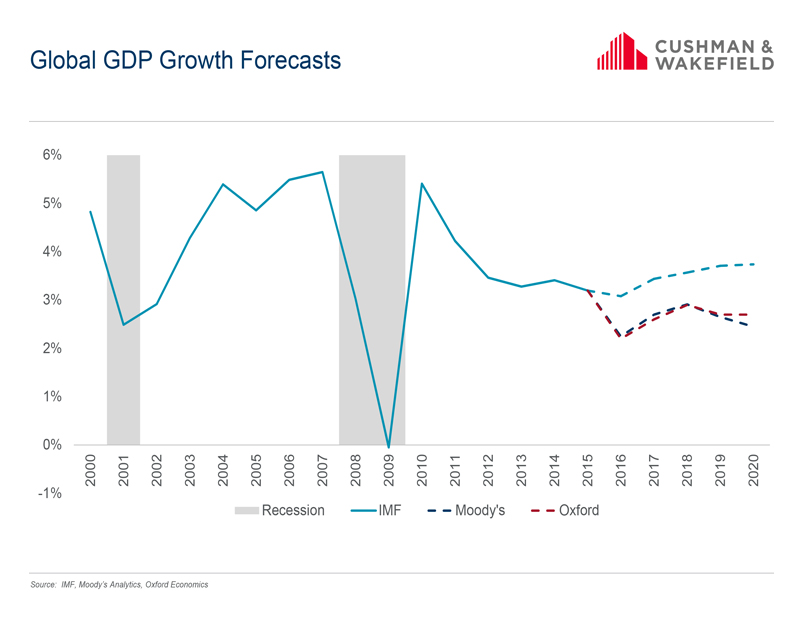

And the U.S. is not the only economy experiencing favorable performance. The global markets are well aligned now, with even Europe seeing the highest confidence levels since 2011, although the increase was only moderate and it still has a way to go. Europe, Canada and India have all seen increases in their manufacturing indexes for several months now, while the U.S. PMI did not drop until this year. The global equity markets have also performed well, with Germany, Japan and the U.S. all seeing two-digit improvement since November, and Canada, Hong Kong and the U.K. rising between 6 and 8 percent.

Global dearth of labor

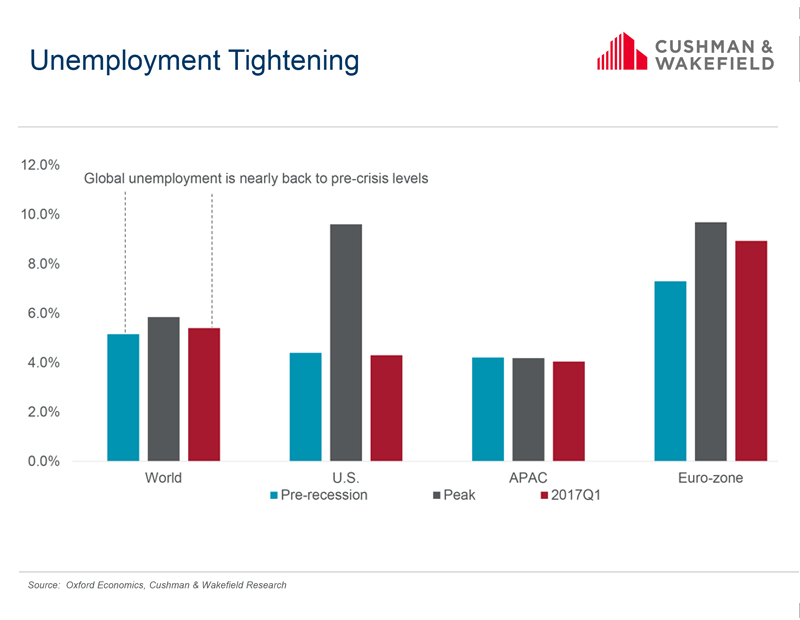

The biggest challenge globally is a growing labor shortage. In fact, with the exception of the dot-com boom, the labor market hasn’t been this tight in more than 40 years. Denver tops the U.S. charts, with 2.3 percent unemployment, while London and Singapore are even tighter, with 2.1 percent. Budapest is at 3 percent, and Tokyo, Hong Kong, Boston, San Francisco and Dallas are all also below 4 percent. Job growth will decelerate in some places in EMEA and the Americas, but overall job openings are at an all-time record high, making for a favorable employment climate for workers.

The limitations on employment growth, though, will challenge developers’ ability to fill office space, which is multiplying at too great a rate worldwide. In all, 700 million square feet is under construction, well below the net absorption level. That promises to continue over the next few years. Trophy buildings and the much-needed Class B and C assets will be fine, Thorpe affirmed, but A-minus and B-plus space will feel some pain.

The U.S. development market has been more cautious and thus is in better shape. It has been slow to adapt to changing demands for sustainable, wellness and other features, lagging other property types, but is “finally giving tenants what they want,” Thorpe said.

You must be logged in to post a comment.