Things Are Looking Up for 2021, CPE 100 Say

Industry leaders sound an optimistic note about the prospects for next year in the latest Sentiment Survey.

After the most tumultuous year in memory, commercial real estate executives are cautiously upbeat about prospects for the industry in general and investment in particular, according to the results of the latest CPE 100 Sentiment Survey.

After the most tumultuous year in memory, commercial real estate executives are cautiously upbeat about prospects for the industry in general and investment in particular, according to the results of the latest CPE 100 Sentiment Survey.

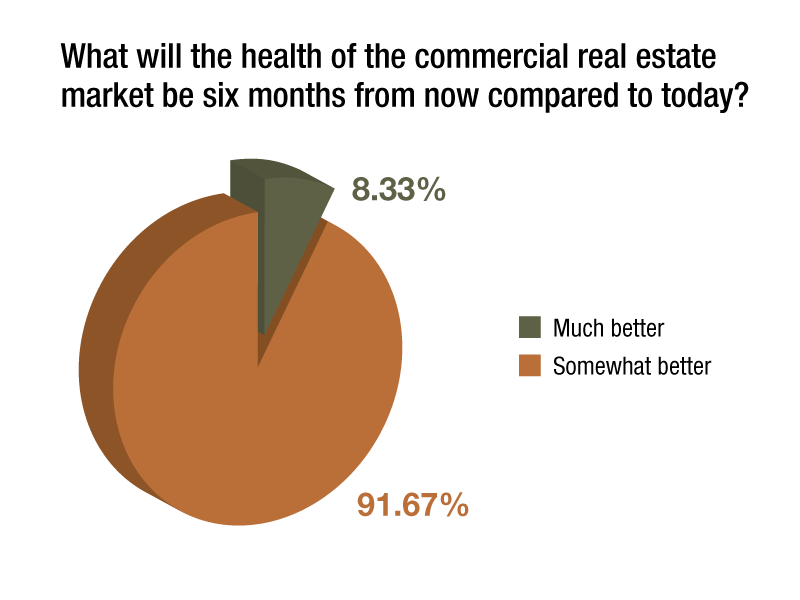

In a show of optimism that things are looking up after a long, difficult stretch, 92 percent of the CPE 100 predict that the commercial real estate market’s health will be somewhat better in six months. At midyear, that figure stood at only 63 percent, while 32 percent expected the health of the commercial real estate market would be worse in six months. In the year’s initial Sentiment Survey last February, executives believed the market would be unchanged by a 62 percent majority. The findings are based on a quarterly survey of the CPE 100, an invited group of industry leaders.

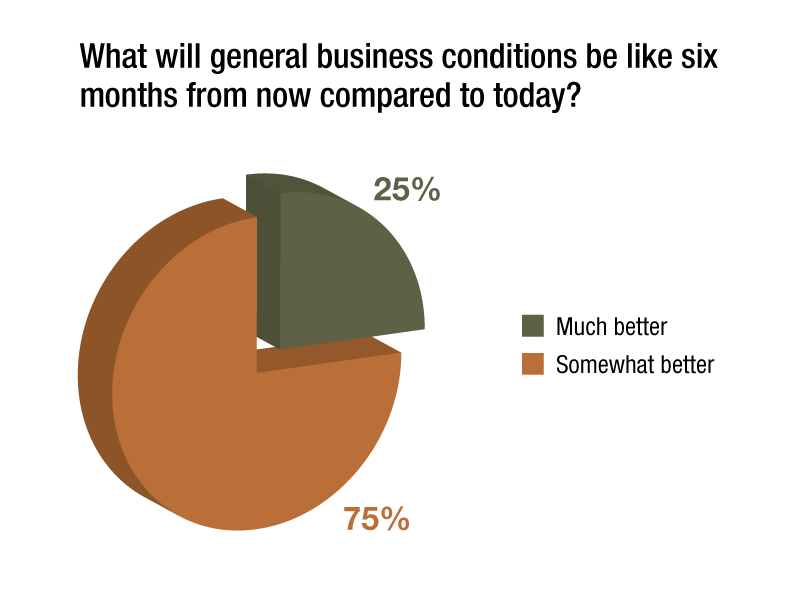

The change in mood about the outlook for the economy at large is similarly striking. Seventy-five percent of those polled believe that business conditions will be at least better in six months than they are now. That is a significant uptick from the midyear survey, when only 56 percent of respondents offered that positive view. It is also a dramatic shift from the CPE 100’s initial forecast for 2020 at the beginning of the year. Before the pandemic upended the market and the economy, the consensus view among executives was that stability would prevail this year. A significant majority—69 percent—expected economic conditions to remain largely unchanged.

The change in mood about the outlook for the economy at large is similarly striking. Seventy-five percent of those polled believe that business conditions will be at least better in six months than they are now. That is a significant uptick from the midyear survey, when only 56 percent of respondents offered that positive view. It is also a dramatic shift from the CPE 100’s initial forecast for 2020 at the beginning of the year. Before the pandemic upended the market and the economy, the consensus view among executives was that stability would prevail this year. A significant majority—69 percent—expected economic conditions to remain largely unchanged.

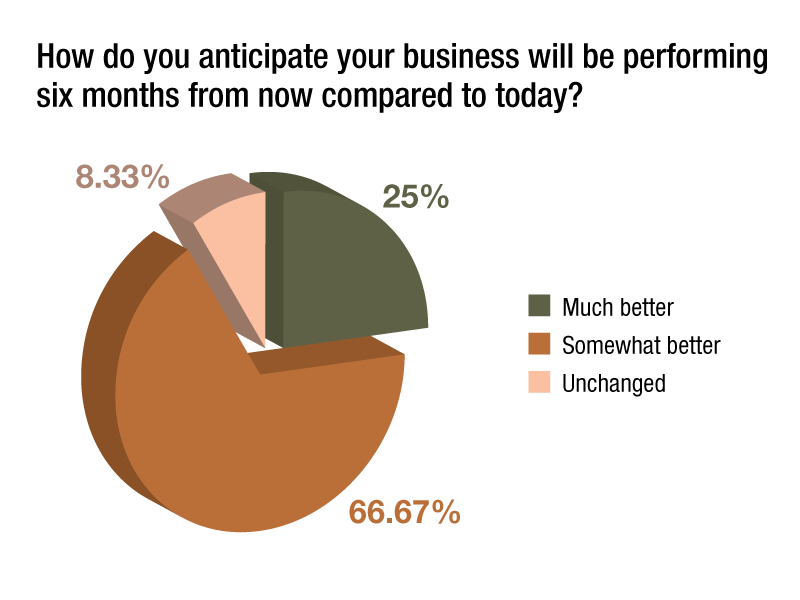

Survey participants’ projection for their own company’s performance has undergone a comparable reset. At the start of 2020, two thirds of respondents predicted that their firms’ performance would be unchanged in six months, while only 33 percent expected it to become somewhat better. Now, the dominant outlook is for modest improvement, as 67 percent believe that their shops will be doing at least somewhat better, and another 25 percent say that the performance will be much better.

Survey participants’ projection for their own company’s performance has undergone a comparable reset. At the start of 2020, two thirds of respondents predicted that their firms’ performance would be unchanged in six months, while only 33 percent expected it to become somewhat better. Now, the dominant outlook is for modest improvement, as 67 percent believe that their shops will be doing at least somewhat better, and another 25 percent say that the performance will be much better.

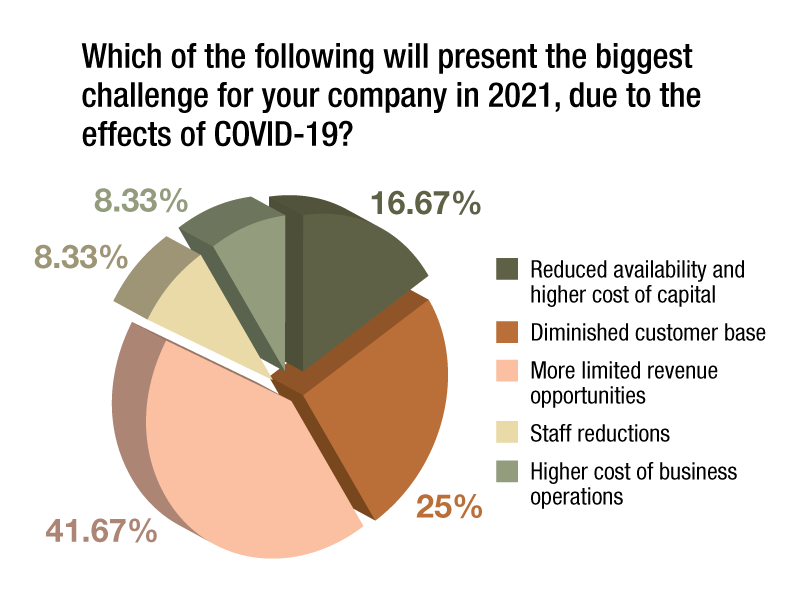

That relatively upbeat outlook remains tempered with concern about the continuing effects of COVID-19. Asked to predict the biggest pandemic-related challenge their companies will likely face in 2021, a plurality of respondents—42 percent—named limitations on revenue opportunities. One quarter named a diminished customer base as the most likely problem.

That relatively upbeat outlook remains tempered with concern about the continuing effects of COVID-19. Asked to predict the biggest pandemic-related challenge their companies will likely face in 2021, a plurality of respondents—42 percent—named limitations on revenue opportunities. One quarter named a diminished customer base as the most likely problem.

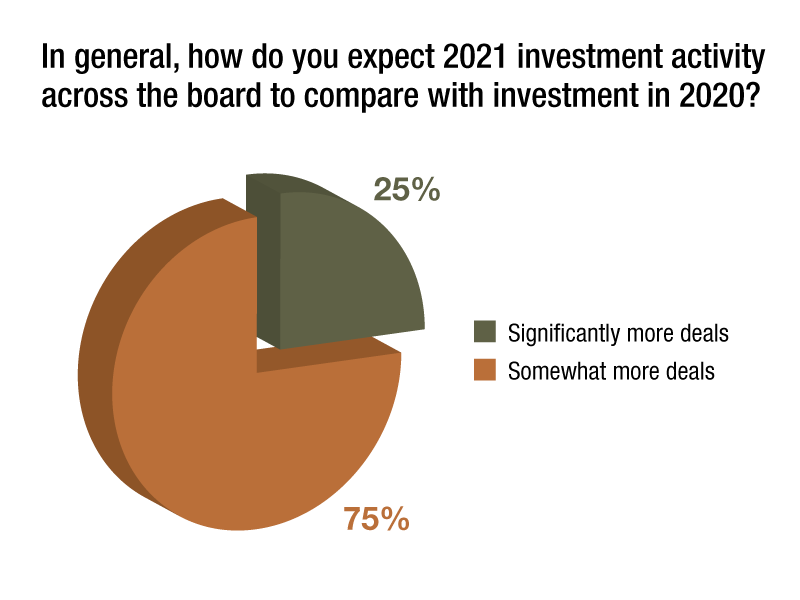

As with market conditions and company performance, the latest CPE 100 survey findings suggest a marked improvement ahead on the investment front. At the beginning of the year, 46 percent of the CPE 100 expected somewhat more activity, while 38 percent predicted that fewer deals were ahead in 2020. That has now shifted to a decidedly upbeat forecast. Fully 75 percent expect somewhat more deals in 2021, and the remaining 25 percent believe that the increase in deal volume will be significant.

As with market conditions and company performance, the latest CPE 100 survey findings suggest a marked improvement ahead on the investment front. At the beginning of the year, 46 percent of the CPE 100 expected somewhat more activity, while 38 percent predicted that fewer deals were ahead in 2020. That has now shifted to a decidedly upbeat forecast. Fully 75 percent expect somewhat more deals in 2021, and the remaining 25 percent believe that the increase in deal volume will be significant.

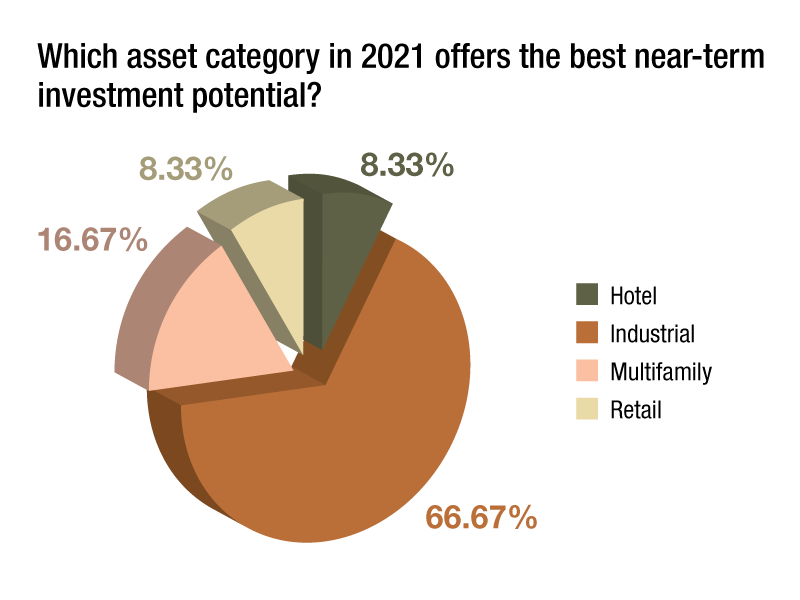

The pandemic’s impact can be seen particularly clearly in the CPE 100’s evolving view of the various asset categories. By a wide margin, industrial properties are believed to offer the strongest investment potential and were cited by 67 percent of participants. Multifamily assets finished a distant second at only 17 percent. As with other findings in the new survey, the results show a major shift in the perceptions of decision-makers. As recently as the beginning of 2020, multifamily and industrial properties were each named by 46 percent as the most promising asset categories.

The pandemic’s impact can be seen particularly clearly in the CPE 100’s evolving view of the various asset categories. By a wide margin, industrial properties are believed to offer the strongest investment potential and were cited by 67 percent of participants. Multifamily assets finished a distant second at only 17 percent. As with other findings in the new survey, the results show a major shift in the perceptions of decision-makers. As recently as the beginning of 2020, multifamily and industrial properties were each named by 46 percent as the most promising asset categories.

You must be logged in to post a comment.