These Asset Classes Stood Out in DLA Piper’s Mid-Year Outlook

Insights into what’s driving investment now from the global law firm’s annual update.

Barbara Trachtenberg, Co-Vice Chair of the US Real Estate practice, DLA Piper. Image courtesy of DLA Piper

Like many in the commercial real estate sector, the real estate attorneys at DLA Piper have seen a slower market in the first half of 2023 as lingering inflation, rising interest rates and maturing loans are making investors and lenders cautious, resulting in lower transaction volumes and reduced values for many asset classes.

But deals are getting done and the law firm’s annual Mid-Year US Real Estate Trends Report found most of the activity has been in the purchase and sale of multifamily housing, particularly the senior housing segment, and in the industrial sector.

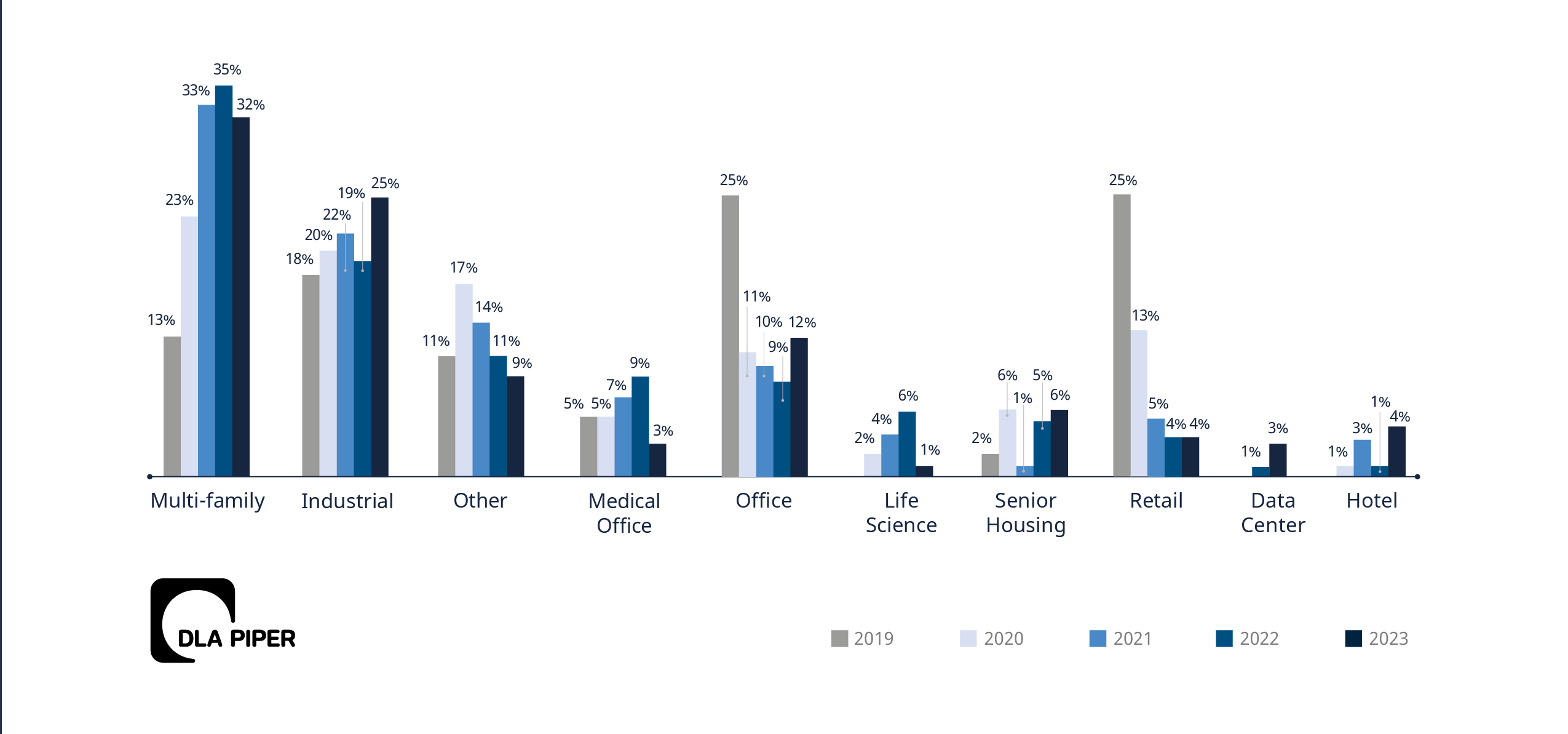

As the firm’s recent State of the Market survey predicted, industrial properties, including logistics hubs, warehouses and cold storage facilities, are attractive investments in the current market. The firm’s real estate group also saw an increase in retail, hotel and data center deals in the first half of 2023. Life science deals slowed, mainly due to a venture capital crunch and possible concerns of overbuilding in recent years. Although the office sector continues to struggle, office deals represented 12 percent of the transactions handled by DLA Piper in the first six months of the year, compared to 9 percent in the first half of 2022.

READ ALSO: How Will Office Space Values Fare in 2030?

“The uptick in office I thought was very interesting,” Barbara Trachtenberg, co-vice chair of the US Real Estate practice at DLA Piper, told Commercial Property Executive. “I think that shows people are trying to figure out how to reposition their office, how to refinance their office, maybe redo the capital stack.”

While the percentage of deals done in the first half of 2023 was down slightly from the same time in 2022, multifamily was still the top asset class handled by DLA Piper, according to the report.

“Midway through 2023, multifamily properties, including apartment complexes, student housing and mobile home communities, continue to drive a sizable portion of our acquisition and disposition work,” the report stated.

Multifamily represented 32 percent of the firm’s deals followed by industrial (25 percent); office (12 percent); other (9 percent); senior housing (6 percent); retail and hotel (4 percent each); data centers and medical office (3 percent each) and life science (1 percent).

Trachtenberg said data centers are a small segment of the overall real estate market, but there has been activity in the first half of the year, both at DLA Piper and elsewhere. She said people still have confidence in those investments.

“AI (artificial intelligence) is creating a need for more cloud space, which means you need more data center space,” she said.

Inflation, interest rate impacts

Trachtenberg said the overall CRE deal volume for the first half of the year is “nowhere near as slow as during the global financial crisis but volume is definitely down.”

She said the rise of inflation—followed by the Federal Reserve’s actions to tame it by raising interest rates—tracked with the slowdown in transactions.

“Once the Fed started getting aggressive with interest rates, that’s when people started to say I don’t know how to price this. There’s inflation, cap rates are moving, the interest rates are going up. How do I sit down today and say what I think this property is really worth.”

Trachtenberg said there is plenty of capital available for deployment but the bid-ask gap continues to be a problem resulting in many investors waiting on the sidelines.

For those buyers who are going after deals, Trachtenberg said they are being more demanding resulting in two new trends in the report—financing contingencies and longer representation and warranty survival periods.

“Buyers who are willing to pay more want to get what they’re paying for and I think that’s bearing out when you see longer rep and warranty survival periods or when you’re starting to see, albeit it’s relatively small, but starting to see financing contingencies,” Trachtenberg told CPE.

Because of the reduced availability of capital this year, DLA Piper added financing contingencies to the list of tracked metrics for the report to see what percentage of acquisitions were contingent on either the buyer obtaining new financing or assuming the existing financing on a property. The firm found it’s still rare, with more than 94 percent of the transactions proceeding without contingencies.

But Trachtenberg said seeing them at all was surprising and something she had not encountered at all in the past several years.

“If we went back and looked at all our deals in 2021, that number would be zero,” she said.

Trachtenberg said they began to notice a trend toward 270-day rep/warranty survival periods in 2022 and it has continued into 2023 with nine months being the most frequent rep/warranty period in the purchase and sale agreements they negotiated during first half of the year.

In 2021, she said only 23 percent of the deals negotiated had a nine-month survival period.

“Now we’ve got 67 percent at nine months or more,” she said. “It’s significant. It’s not just an increase on the nine-month, but also an increase on the year or more so it’s been an interesting dynamic.”

You must be logged in to post a comment.