The Risk of It All

By Kenneth P. Riggs Jr., Chairman & President, Real Estate Research Corp.: When the financial crisis began, most investors agreed that the economy needed the various stimulus programs initiated by the administration and the easy money policies provided by the Federal Reserve. However, a quick look at the debt clock shows us that several years later we are stuck with a $16.8 trillion national debt and a Fed balance sheet of $3.1 trillion, while job and economic growth remain tepid.

By Kenneth P. Riggs Jr., Chairman & President, Real Estate Research Corp.

When the financial crisis began, most investors agreed that the economy needed the various stimulus programs initiated by the administration and the easy money policies provided by the Federal Reserve. However, a quick look at the debt clock shows us that several years later we are stuck with a $16.8 trillion national debt and a Fed balance sheet of $3.1 trillion while job and economic growth remain tepid. It is not surprising that increasing numbers of investors wonder whether such policies—especially QE3—are becoming less a fundamental support and more a psychological crutch.

Real Estate Research Corporation’s (RERC’s) institutional investment survey respondents, in fact, take this view a step further. Once seen as one of the strongest assets to the economy, monetary policy is now viewed as contributing to investor uncertainty and increasing risk for investors. Some RERC survey respondents noted that such accommodative support by the Fed is “becoming more harmful than helpful,” and that it is “re-inflating asset bubbles.” Others noted that the “distortions and uncertainty” caused by the Fed’s easy money policies are “rewarding risk-taking and borrowing, while punishing saving.”

We have only to watch the stock market to see what hints of “tapering” the Fed’s purchase of securities can do to diminish returns, and conversely, how reports of economic weakness can cause returns to rally because of the expectation that the Fed will continue to stoke the money supply. This is too much volatility for many investors, and we are seeing a transition from a “risk on” environment where investor appetite for risk taking is high, to a “risk off” period where investors will likely gravitate toward less risky investments.

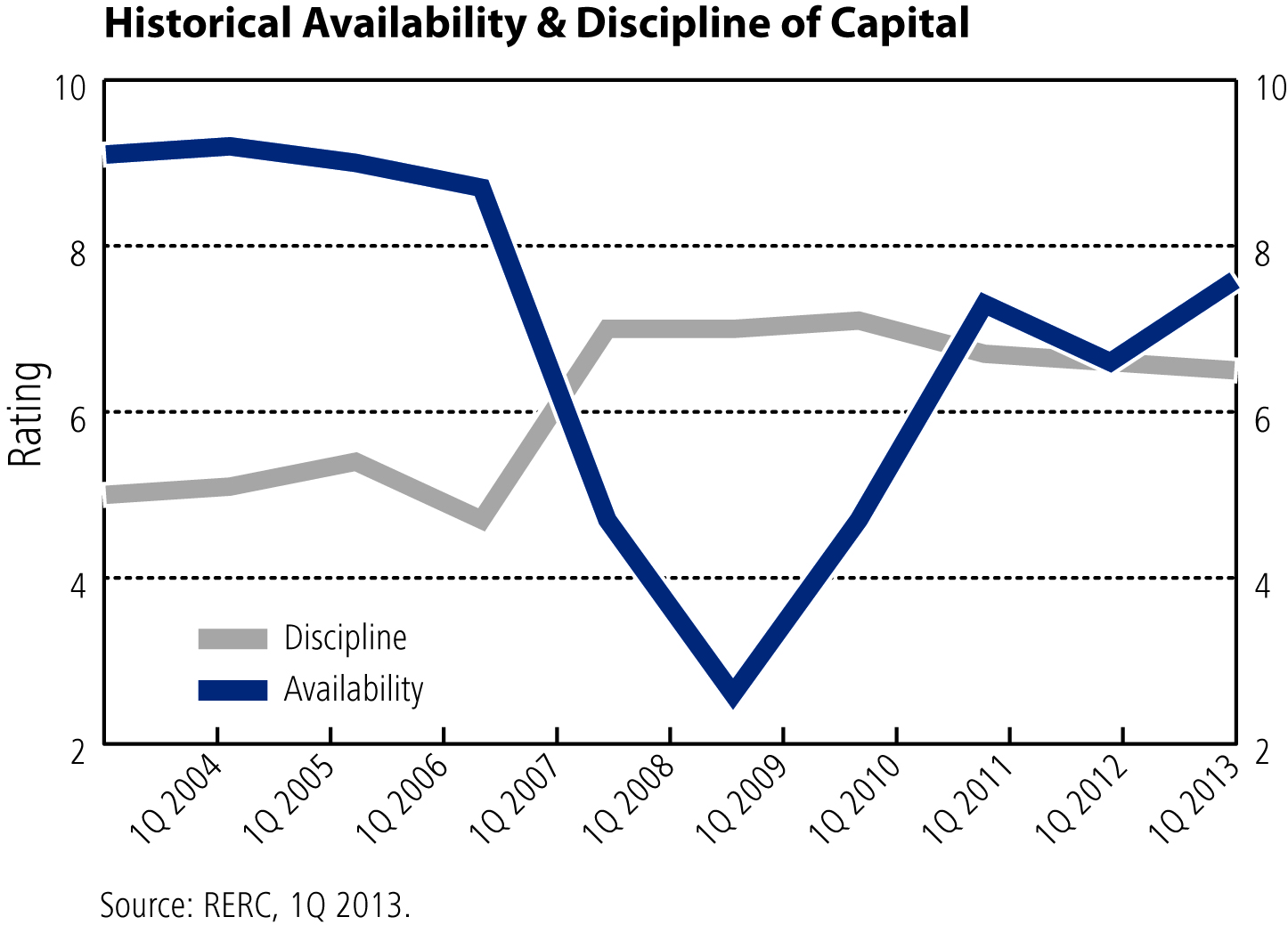

Capital remains amply available, however, even in this transition to risk off environment. As shown below, the availability of capital (as reported by RERC in the spring 2013 issue of the RERC Real Estate Report) has been increasing during the past few quarters while the discipline has been inching down. In first quarter 2013, investors rated the supply of capital at 7.6 on a scale of 1 to 10, with 10 being high, and the discipline has decreased to 6.5. Although the difference isn’t large so far, the trend for a growing disparity between the availability and discipline of capital is there, and it is important to note that the last time the difference between the two was this significant was before the credit crisis in 2007.

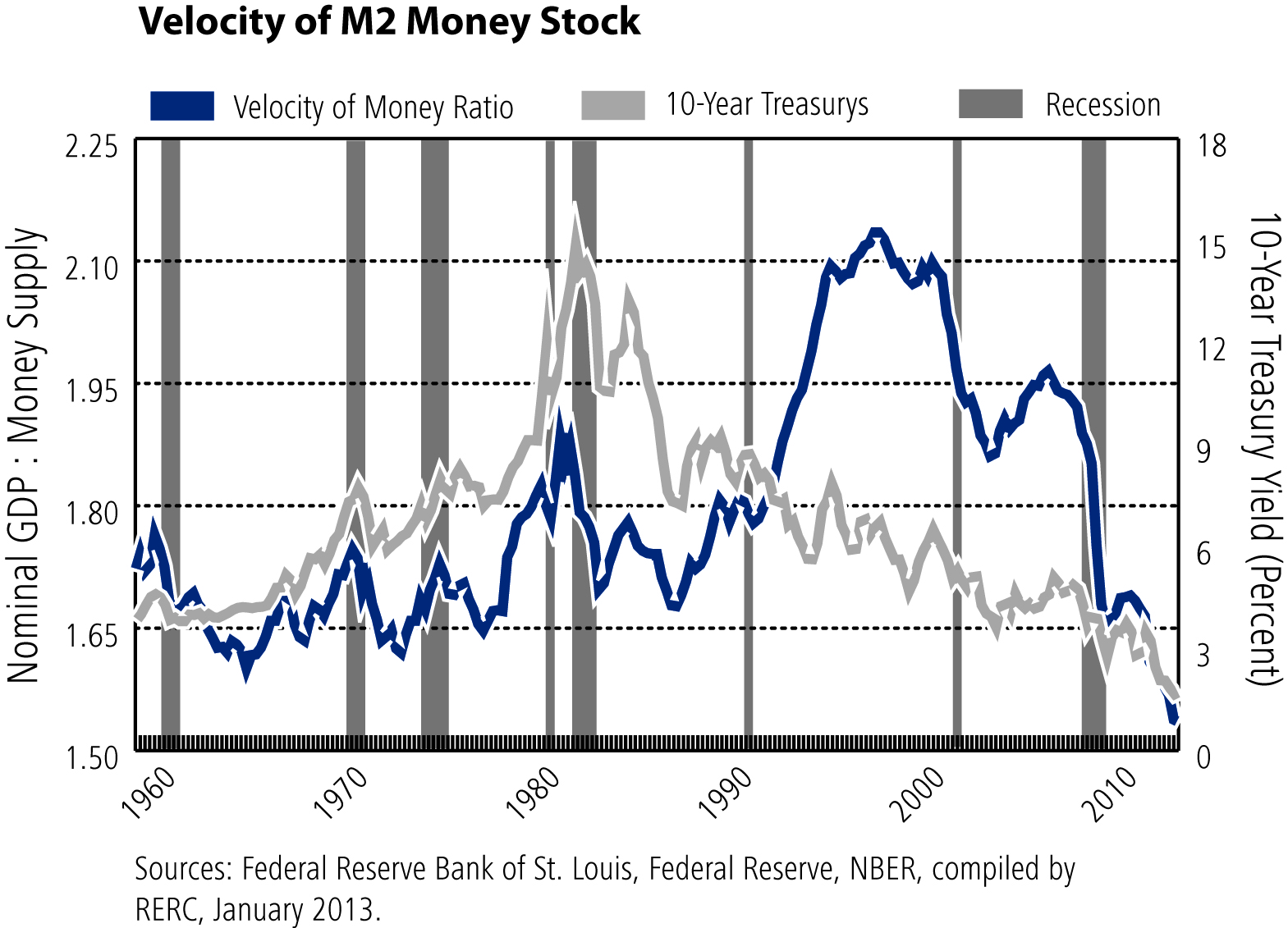

With the availability of capital spiking, it is also interesting to look at the rate of turnover in the money supply. As shown in the velocity index below, the number of times $1 is used to purchase final goods and services included in the GDP is the lowest in history (as are Treasury rates). This means there is little growth, almost no inflation, and with lagging commodity prices and increasing asset prices (stocks in particular), cash and other low-risk investments are preferred.

RERC also surveys respondents about the major investment alternatives, including stocks, bonds, cash, and commercial real estate. In first quarter 2013, investors increased their ratings for commercial real estate and cash (less risky investments), while slightly lowering their rating for stocks and keeping their rating for bonds unchanged. Commercial real estate received the highest rating, at 7.1 on a scale of 1 to 10, with 10 being high, while stocks were rated at 5.7, and both cash and bonds were rated at 3.6.

Commercial real estate has traditionally served as a lower-risk investment because of its transparency, general stability, and relatively reasonable returns in the form of income, and the cheap capital we are currently enjoying serves this asset class well. However, as the Fed tapers their purchases and we transition to a self-supporting economy, we can expect new risks to emerge:

- Increasing interest rates. Interest rates may increase sooner than originally expected, particularly for mortgages. There is also the question of how the pace of mortgage-backed security purchases will be affected when the Fed begins tapering.

- Increasing Treasury bond yield rates. Treasury yield rates have been on the rise for more than a month already, and bond prices have fallen. In addition, according to the U.S. Treasury, foreign investors sold record levels of long-term Treasuries in April.

- Stock and bond market pull back/correction. We are very bullish about the U.S. over the long term (7 to 10 years), but it will be a scary time over the next year or so as the Fed begins to take the economy off the life-support of QE-3. Investors should expect the stock market to pull back about 15 percent (some analysts say closer to 25 percent), and the bond market to correct in relation to rising rates with bond prices forecasted to decline by 25 percent (possibly higher if rates are higher) over the next 12 months, as the market digests the Fed’s actions to transition off these extremely accommodative policies.

- Global dislocation. As the Fed begins to taper their monthly purchases of $85 billion in securities, watch for a ripple effect in the global markets that will put other central banks and currencies on edge and on notice as they come to terms with the differences between their financial markets and their economies vs. those of the U.S.

In the face of these risks, commercial real estate is holding up relatively well. It is a hard asset, it is located here in the U.S. in the largest economy in the world, and it has realistic fundamentals. Approximately 80 percent of returns are based on the income component, as well as there being a return on capital. And in an investment environment like the one we are experiencing, commercial real estate may very well be the best place for investors to put their capital.

You must be logged in to post a comment.