The Human Capital Balance Sheet: What CRE Executives Need to Know

By widening their perspective and stripping away legacy assumptions of how the industry workforce functions, CRE executives can begin to address the existing talent crisis in a truly meaningful way for their organizations. Here’s how.

By Steven Bandolik and Rob Dicks

People have always been the key driver for successful real estate platforms. Still, commercial real estate companies are facing many talent concerns today, from an ever-growing gap in skilled workers to traditional and outmoded approaches to attracting talent and managing the organization. These challenges are exacerbated in the move to a more digital world in real estate. While human capital executives in the industry are working to address these problems, we see this as a topic that the entire executive team needs to address, collaboratively. CRE firms that can bypass legacy cultural attributes in order to drive greater value for the business and workforce will differentiate in the market.

People have always been the key driver for successful real estate platforms. Still, commercial real estate companies are facing many talent concerns today, from an ever-growing gap in skilled workers to traditional and outmoded approaches to attracting talent and managing the organization. These challenges are exacerbated in the move to a more digital world in real estate. While human capital executives in the industry are working to address these problems, we see this as a topic that the entire executive team needs to address, collaboratively. CRE firms that can bypass legacy cultural attributes in order to drive greater value for the business and workforce will differentiate in the market.

Against this backdrop, we are seeing organizations shift toward a bolder, business-driven, balance sheet approach to making decisions about optimizing human capital investments. We are calling this the Human Capital Balance Sheet, wherein executives team across human resources, finance and operations to better understand the value of their workforce and how to increase that value as a business asset through investments.

Tradition vs. innovation

So what exactly do we mean by this? Consider this example: On average, property management fees cost real estate companies and investors anywhere from 4 to 7 percent of gross monthly income per property on the balance sheet. However, potentially, those costs could be controlled or even pushed downward by bypassing the traditional property management business model. For instance, a consortia of real estate companies could pool together to challenge the traditional model and create an industry-owned service hub. A hub could enable participating CRE companies to put property management resources to work more efficiently and ultimately improve their human capital balance sheets.

It is this out-of-the-box thinking that most human capital—and even finance—executives in CRE have yet to fully embrace or understand yet. By widening their perspective and stripping away legacy assumptions of how the industry workforce functions, CRE executives can begin to address the existing talent crisis in a truly meaningful way for their organizations.

As real estate executives work on improving their human capital balance sheets, we could see new compensation and incentive structures emerge to replace traditional salary and equity ownership options. Or we could see new teaming structures materialize that enable talent to float between partnering companies to address staffing shortages and employee development, and even fill skills gaps in critical functions such as cybersecurity.

3 steps for managing human capital in 2018

3 steps for managing human capital in 2018

In order for CRE companies to dig into these issues effectively and innovate on their human capital balance sheets, it’s important that three key concepts are in place within the organization:

C-suite 3.0: Working in siloes doesn’t cut it in today’s business environment and often stymies innovation. Instead, executive leaders need to team together—from the CFO to the CHRO—to share new ideas and bring them to life across the organization.

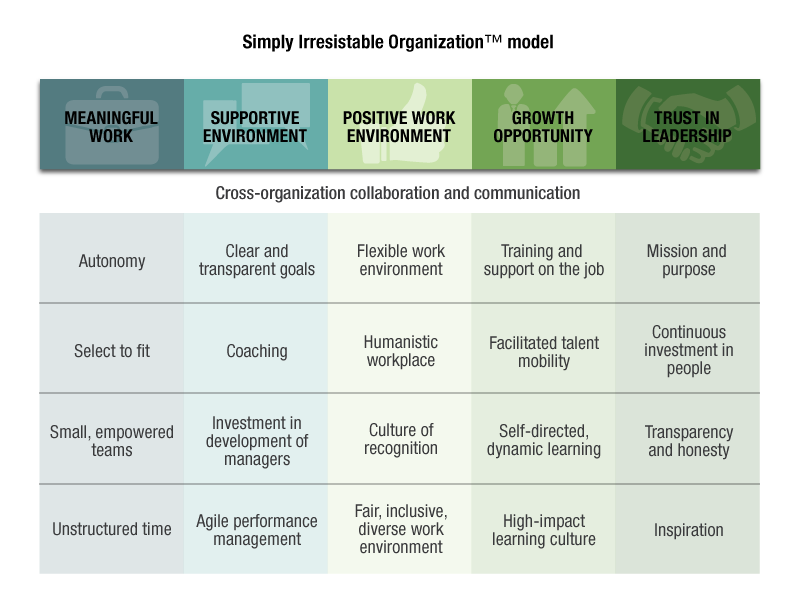

Creating the Simply Irresistible Employee Experience: Managing human capital isn’t only about cost cutting. Today, it’s also about generating value, driving engagement and enhancing your workforce. This concept is perfectly aligned to the Human Capital Balance Sheet, which aims to optimize value against strategic investments.

Partnerships and Creative Thinking: We’re in a new era of doing business where oftentimes real value lies outside the four walls of an organization – and yes, that means partnering with other companies, startups and even competitors to find better solutions. For real estate firms, partnering with other companies could yield economies of scale or smarter technology solutions that would otherwise be unachievable.

Steven Bandolik is a managing director with Deloitte Services LP and a senior leader in Deloitte’s real estate and construction practice. Bandolik provides advisory services in capital markets (debt and equity), corporate finance, mergers and acquisitions, investments, strategy, restructuring and reorganization, and asset recovery. Bandolik brings more than 30 years of effective, hands-on real estate investment, finance, development and asset/property management experience, both as a leader and as a strategic advisor.

Rob Dicks is the leader of Deloitte’s human capital CFO market offering and also leads Deloitte Consulting’s investment management practice. He has served Deloitte’s clients for over a decade with a focus on bringing finance and HR executives together to solve industry challenges, including talent management, sales and service effectiveness, and distribution redesign.

You’ll find more on this topic in the April 2018 issue of CPE.

You must be logged in to post a comment.