The Course of Capital: Accepting the New Normal

While the recession and ongoing recovery have presented opportunities for the industry, it is safe to say that many commercial real estate professionals would like to put this time period behind them and return to the good old days.

By Mike Ratliff, Senior Associate Editor

While the recession and ongoing recovery have presented opportunities for the industry, it is safe to say that many commercial real estate professionals would like to put this time period behind them and move on. But as much as one can wish for the good old days—and can perhaps justify their imminent return with the recent performance of the macro economy—there is still much uncertainty and many challenges ahead according to the annual commercial real estate outlook report issued by the Real Estate Research Corp., Deloitte and the National Association of Realtors. This year’s report is appropriately titled Expectations & Market Realities in Real Estate 2013—Turn the Page.

One of the report’s major findings is that while many investors spent much of 2012 focused on traditional safe haven investments, new requirements for higher yields and a new wave of easing by banks has drawn some investors into riskier strategies. The good news is that the capital markets are willing to support such endeavors, and lending continues to expand.

“The search for yield is going to be a challenge in coming years for all investments, and we anticipate slightly lower returns for commercial real estate as well,” said Ken Riggs, chairman & president of RERC. “As such, it is not surprising that investors are searching beyond core and value-add property investment strategies into opportunistic strategies for apartment, industrial and retail property development.”

According to Riggs, such strategies will involve expanding into secondary and tertiary markets, as well as focusing on niche properties like student housing, medical office buildings, senior housing, and even on portfolios comprised of single-family home being used as rental properties. Value-add plays will also factor in, as investors are taking risks on properties with lower occupancy, making bets on capital improvement and more prudent management policies.

Exhibit 1-1. Historical Availability and Discipline of Capital

Responses from RERC’s institutional investment survey shows that the availability and discipline of capital are once again becoming more closely aligned (see exhibit 1-1), as capital availability declines and the discipline of capital increases. As capital becomes more selective, certain segments will find it harder to land financing. While commercial real estate loan originations have been rising for larger, core properties, smaller properties are going have a harder time landing capital due to smaller banks having trouble meeting the cost of regulatory measures. The report cites a finding by the American Bankers Association that shows the cost of regulatory compliance as a share of operating expenses is approximately 2.5 times greater for small banks than for large banks. As a result, financing poses the largest single risk for investors in properties under $2.5 million.

“In the long run, I believe our leaders thought that by fixing financing at the top—the investment bank level—the fixes would trickle down to the regional level,” Riggs said. “That may still happen, but it is happening much slower than expected. There needs to be a focus and commitment to truly allow regional banks to lend without having to look back over their shoulders wondering what regulation is about to paralyze them.”

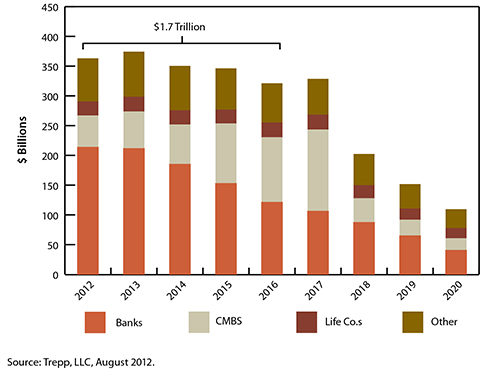

Still, second quarter 2012 originations for commercial banks were up 58 percent from second quarter 2011, and up 50 percent for Fannie and Freddie. CMBS originations were up 16 percent during the same time frame, while life insurance company originations were up 10 percent.

Exhibit 1-2. Debt Maturities by Lender Type

Between the property types, retail reported the highest growth in originations at 56 percent year over year (2Q11 vs. 2Q12). Hospitality saw the second highest growth in mortgage originations with a 22 percent year-over-year increase. Multi-family followed with a 19 percent increase. Office saw a 15 percent increase in originations year over year, while industrial saw a 5 percent decrease. Riggs was able to offer some insight into why retail came out on top.

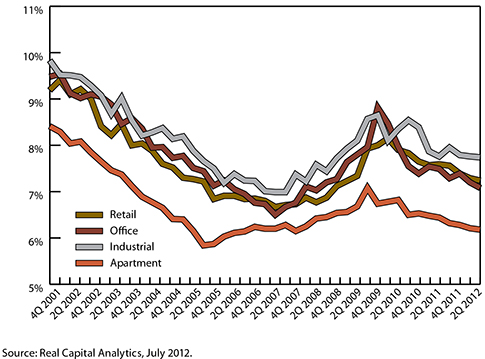

“Retail investment metrics were as good as, and in some cases better than, office, industrial and even apartment properties—the leader in recent years. This might be because retail, fueled by the erratic consumer, was viewed as riskier than other property categories. But as investors demand pushed down cap rates for less risk (and lower yielding) assets, some investors took a second look at retail, which is now playing catch-up.”

Riggs added that the wealth loss of $16.0 trillion from the great recession was almost replenished to $13.5 trillion through the stock market and a rebounding housing market. Consumers have more money to spend, and retail sales remained strong throughout 2012, not just in the second quarter.

Exhibit 1-3. Cap Rates Continue to Compress

Summing up where commercial real estate stands on a macro level, Riggs pointed out that we are slightly more than half-way through the recovery, and that top-tier properties have already recovered the majority of their lost value. The recovery for second-tier properties is lagging behind, but it has begun. When asked about what advice he would give to industry investors, Riggs urged them to lower their expectations and focus on long-term gains and income returns rather than capital returns. Lenders, according to Riggs, should “focus on in-place cash flow, and recognize that commercial real estate is poised to demonstrate extremely high risk-adjusted returns over the next 10-year period.”

You must be logged in to post a comment.