Talent Wars: The CPE 100 Weigh In

Industry leaders offer their take on the challenges of recruiting professionals and the industry’s prospects for 2020.

The talent war is top of mind for commercial real estate executives as 2019 draws to a close, according to the latest CPE 100 Sentiment Survey.

The talent war is top of mind for commercial real estate executives as 2019 draws to a close, according to the latest CPE 100 Sentiment Survey.

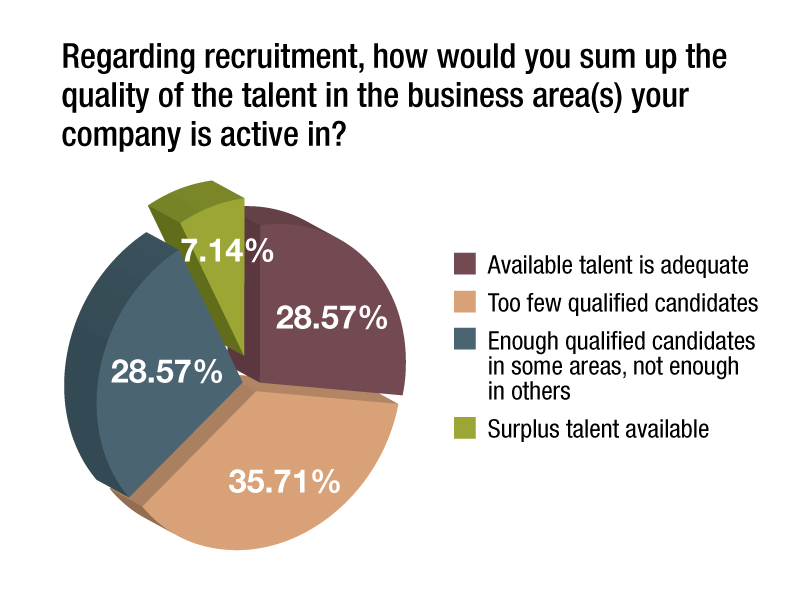

A plurality, 36 percent, say that too few qualified candidates are available to meet their needs. Only 29 percent of participants report that the talent pool is adequate. Another 7 percent said that surplus talent is available. The results are based on a survey of the CPE 100, an invited group of real estate industry leaders.

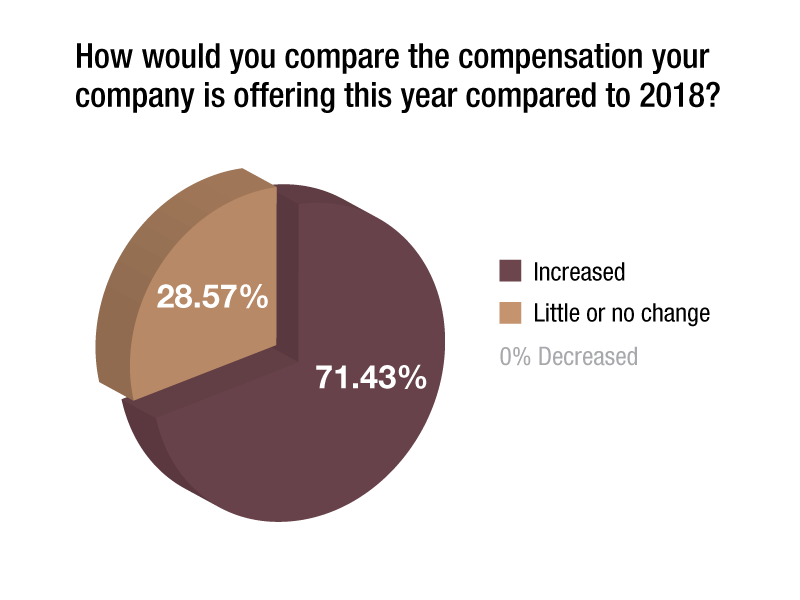

That trend appears to be exerting upward pressure on compensation. Seven out of 10 respondents said that they are offering increased compensation compared to 2018.

That trend appears to be exerting upward pressure on compensation. Seven out of 10 respondents said that they are offering increased compensation compared to 2018.

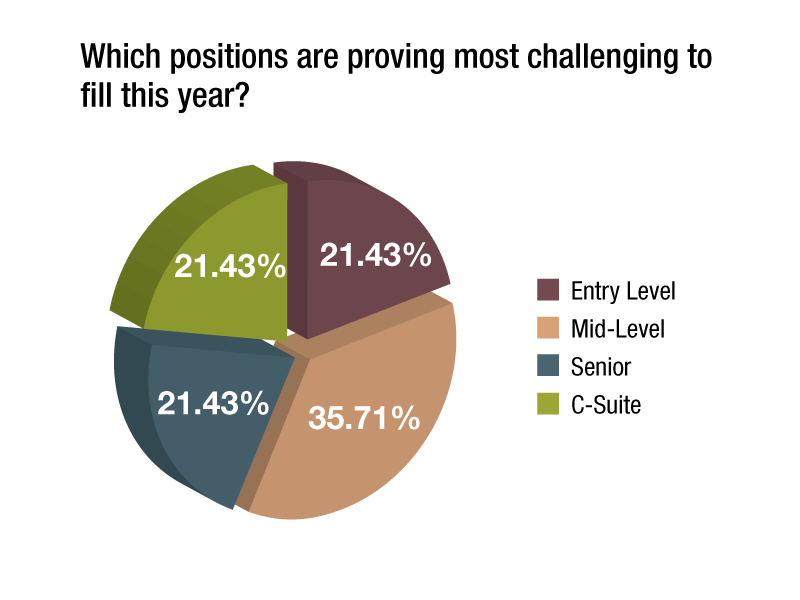

Mid-level positions, cited by 36 percent, are the most challenging to fill; equal numbers of respondents regarded entry level, senior and C-suite positions as difficult to find qualified candidates for.

Upbeat Outlook

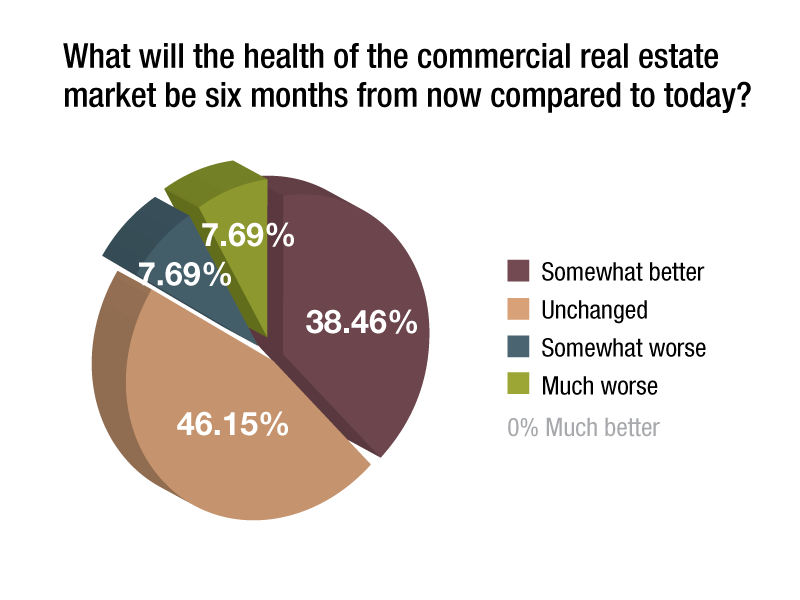

In another striking finding, the CPE 100 are noticeably more upbeat about the prospects for the commercial real estate sector. In the first-quarter survey, no participants were willing to predict that the market would improve in six months.

That caution has turned to optimism for many participating executives. Remarkably, 38 percent of survey respondents now predict that the market will be healthier in six months. Only 15 percent of respondents believe that the market will be worse six months from now, a significant drop from 40 percent in the first quarter. Fewer than half—46 percent—expect conditions to be unchanged, down from 60 percent in the first quarter.

That caution has turned to optimism for many participating executives. Remarkably, 38 percent of survey respondents now predict that the market will be healthier in six months. Only 15 percent of respondents believe that the market will be worse six months from now, a significant drop from 40 percent in the first quarter. Fewer than half—46 percent—expect conditions to be unchanged, down from 60 percent in the first quarter.

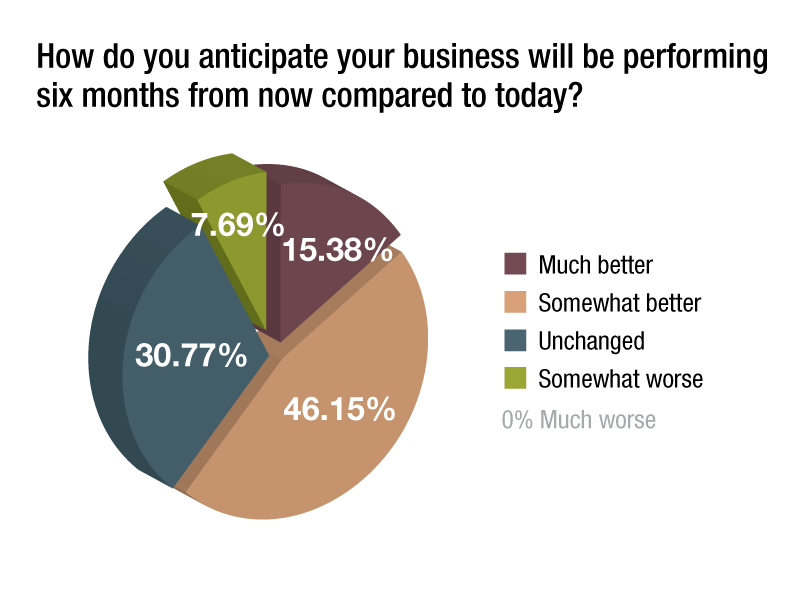

Executives are also decidedly more upbeat about their own businesses than they were during the first quarter. Only 27 percent then expected their companies to be performing somewhat better in six months; that number has jumped to 46 percent. The share of CPE 100 members that believe their companies will be performing much better in six months has more than doubled from 6.7 percent to 15 percent. Only 7.7 percent predict a decline in performance, down from 20 percent in the first quarter.

Executives are also decidedly more upbeat about their own businesses than they were during the first quarter. Only 27 percent then expected their companies to be performing somewhat better in six months; that number has jumped to 46 percent. The share of CPE 100 members that believe their companies will be performing much better in six months has more than doubled from 6.7 percent to 15 percent. Only 7.7 percent predict a decline in performance, down from 20 percent in the first quarter.

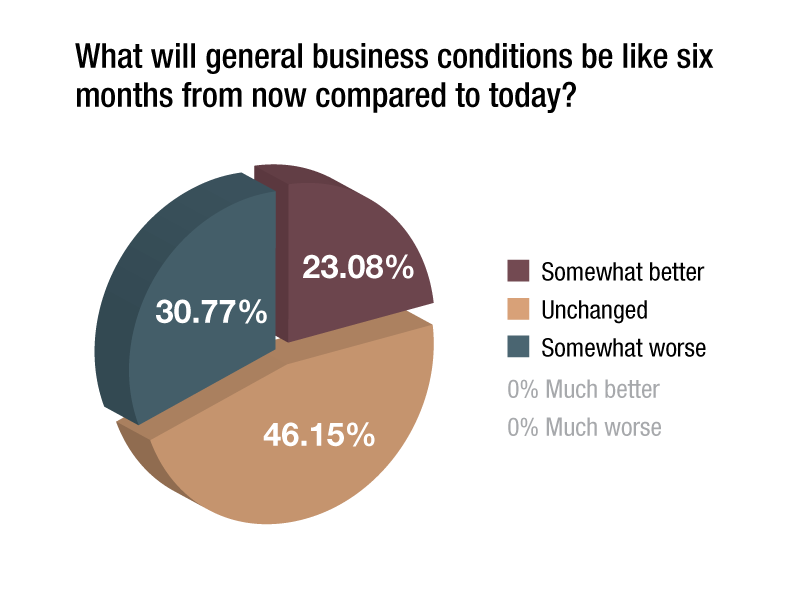

This somewhat more optimistic tone may step from an anticipation of improved business conditions. During the first quarter, two thirds of survey participants expected business conditions to be unchanged, while none predicted an improvement. Now, 23 percent predict better conditions and 46 percent say conditions will be unchanged. The share of the CPE 100 that expects conditions to worsen is 31 percent, comparable to the 33 percent who expressed that concern during the first quarter.

This somewhat more optimistic tone may step from an anticipation of improved business conditions. During the first quarter, two thirds of survey participants expected business conditions to be unchanged, while none predicted an improvement. Now, 23 percent predict better conditions and 46 percent say conditions will be unchanged. The share of the CPE 100 that expects conditions to worsen is 31 percent, comparable to the 33 percent who expressed that concern during the first quarter.

You must be logged in to post a comment.