Spring Outlook for Multifamily is ‘More of the Same’, Says Yardi Matrix

Yardi Matrix's newest report forecasts a slight slowdown in rent growth despite continually strong demographic fundamentals.

By Mallory Bulman, Associate Editor

Yardi Matrix’s newest report, released May 25 and entitled “Multifamily Votes for ‘More of the Same’”, assessed the first few months of 2016 and offered insight on what’s to come for the rest of the year. “This deeply researched report offers valuable insight for all participants in the U.S. multifamily housing sector,” commented Jeff Adler, vice president of Yardi Matrix.

Yardi Matrix’s newest report, released May 25 and entitled “Multifamily Votes for ‘More of the Same’”, assessed the first few months of 2016 and offered insight on what’s to come for the rest of the year. “This deeply researched report offers valuable insight for all participants in the U.S. multifamily housing sector,” commented Jeff Adler, vice president of Yardi Matrix.

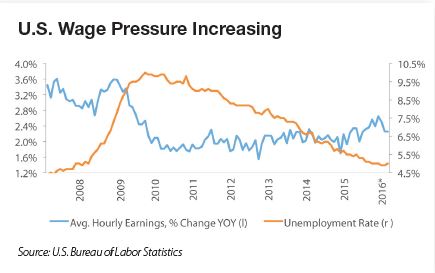

The beginning of 2016 has seen the healthy growth that the multifamily industry has come to expect, but the report says the historic rent highs may start to level out. While population and job growth bolstered numbers in 2015, Yardi Matrix’s analysis predicts a slight decrease from the 6.3 percent rate recorded last year. Factors like stock market volatility, depressed oil prices and weak economic growth overseas are poised to curtail the market’s generous growth rates, but only slightly. The capital markets could also be a factor, with a record total volume of multifamily debt. Yardi Matrix expects rent growth to slow from 6.3 percent in 2015 to a more feasible level in the 4 to 5 percent range. However, as the report states, “Any decrease is likely to be shallow, though, since demographic factors will keep occupier demand high, as apartments have a host of virtues that should continue to appeal to investors.”

After two years of above-trend rent growth, many keep expecting it to moderate. However, rent growth shows no signs of slowing just yet, with April’s national rental rate at an all-time high of $1,194. A growing number of Millennials are securing jobs and earning enough to start their own households, while Baby Boomers are scaling down into rental units, evidenced by a continually decreasing homeownership rate. For most markets, these fundamentals are signs of healthy growth, but some will begin to soften as new supply emerges, interest rates inch higher and single-family rentals usurp some of multifamily’s demand.

In order to account for these specific changes, Yardi Matrix recalibrated its market rent forecast figures from January. As a result, the overall national number remains unchanged, but of the Matrix Monthly top 30 metros, 13 forecasts were downgraded, 11 increased, and six were kept the same. Markets that declined significantly in the forecast include Denver (now 6.3 percent, down from its previous 11.2), the North Carolina Triangle (2 percent, down from 4.5), Austin, Texas (5.8 percent, down from 8) and Houston (3.4, down from 4.7). Markets that defied expectations for job growth and apartment demand were Los Angeles (now forecasted at 7.1 percent instead of 4.2), San Antonio (3.3 percent, up from 1.5), California’s Inland Empire (6.8 percent, up from 5.4) and Richmond, Va. (1.4 percent, up from 0).

To access this report, visit the Yardi Matrix site.

You must be logged in to post a comment.