Specialty REITs Eating More of the Pie

A new wave of specialty REITs is outpacing the slowing growth of the larger sectors.

By David Dent, Real Estate Market Analyst, Yardi Matrix

The REIT market has traditionally focused growth on the major commercial property types, which have performed especially well during the long recovery from the Great Recession. However, a new wave of specialty REITs is outpacing the slowing growth of the larger sectors.

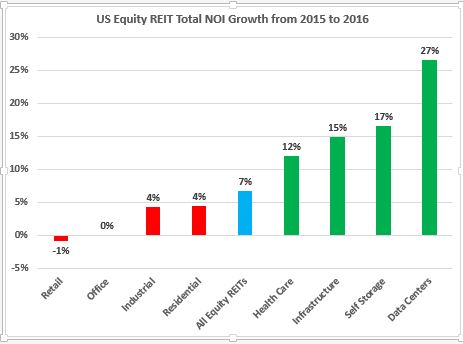

While net operating income (NOI) grew by an average of 3 percent for major property categories and 7 percent for all equity REITs in 2016, it surged by an average of 16 percent in specialty sectors, including data centers (+27 percent), self-storage (+17 percent) infrastructure (+15 percent) and health care (+12 percent), according to the most recent National Association of Real Estate Investment Trusts’ (NAREIT) Total REIT Industry Tracker Series (T-Tracker®). The four specialty categories represent only 30 percent of total equity REIT NOI but garnered over 60 percent of total NOI growth last year.

The higher growth of specialty REITs come from a combination of factors. Major property types that have healthy fundamentals in recent years–including apartments and hotels–are starting to see a moderation in the rate of rent growth. Property types that have longer operating histories and more established sectors have less room for growth.

What’s more, while specialty property types require more focused design and management than some of the broader categories, demand for new property classifications continues to grow and is reflected in rising NOI.

An interesting sidebar to the structure of the REIT industry over the last 15 years is the slow disappearance of the diversified REIT, which is a company that owns a variety of property types. Over time, REITs have generally come to focus on a specific property type for strategic and tactical reasons. For example, diversified REITs were accused of investing in sectors that were outside the area of management expertise. But as rent growth slows in the larger sectors, REITs might begin to invest more in both direct ownership of higher-growth specialty property types as well as whole REIT acquisitions by larger property groups.

Specialty REITs represent about 20 percent of the 167 equity REITs tracked by NAREIT, and so there are many interesting combinations to consider. In each major property type, there are few very large REITs with another dozen or so mid-capitalization REITs, in addition to several dozen small cap owners. Strategy teams at major REITs are believed to be identifying smaller REITs to buy or emulate in order to boost NOI growth. That could lead to a new wave of more diversified approaches to REIT portfolio construction to capture emerging opportunities.

You must be logged in to post a comment.