Solving the Split Incentive Dilemma in Energy Retrofits

An historic San Francisco office property addresses the issue with a new program from the local utility.

A supply motor installed on the rooftop of 550 Montgomery St. Image courtesy of Gridium

Energy upgrades at commercial buildings often amount to a contradiction in terms: The owner makes most of the investment and the tenant reaps most of the benefits.

A utility in California is addressing that issue by rolling out an innovative alternative at an historic property in San Francisco’s Financial District.

Pacific Gas & Electric Co. has unveiled a new program that tracks efficiency savings through an approach called Normalized Metered Energy Consumption. Utilizing advanced smart meters, the program measures energy at the meter as a first step in bringing about deeper energy efficiency.

Because it measures changes in use at the whole building level, NMEC promotes comprehensive energy upgrade projects that yield reduced transaction costs for building owners.

The NMEC approach also makes possible customized building baseline use calculations. That facilitates accounting for non-routine events, such as the pandemic’s impact on occupancy levels and resulting declines in energy use.

READ ALSO: Energy-Saving Efforts Continue, Albeit at a Slower Pace

Landmark Building, Fresh Approach

Leveraging the NMEC approach, PG&E’s Commercial Whole Building program has been rolled out for the first time at 550 Montgomery St., an historic 93,000-square-foot commercial building in San Francisco’s financial district. From its completion in 1908 to 1921, the building was the headquarters of Bank of Italy, the predecessor to Bank of America. Menlo Park, Calif.-based Gridium undertook the energy efficiency retrofit on behalf of Downtown Properties.

An energy upgrade at Downtown Properties’ historic 550 Montgomery St. in San Francisco uses on-bill financing to address the split incentive problem. Image courtesy of Gridium

The retrofit included upgrading the interior lighting to high-efficiency LED lights, delivering higher-quality lighting while cutting energy usage by 60 percent.

High-efficiency motors and controls were incorporated in a rooftop makeup air unit, allowing for reduced fan speeds that match ventilation demands precisely. Additionally, a hydronic heat boiler controller enables outdoor air resets and sequencing control efforts that yield energy savings. The project is expected to improve building operations, provide energy savings that exceed project costs in five years, and slash total energy costs by 15 percent.

The initiative is part of a performance-based program that rewards PG&E customers for each unit of electricity they save. PG&E’s On-Bill Financing program, rather than the building’s capital budget, financed the upgrades.

Savings are measured over time, allowing incentive payments to be made as energy efficiency is delivered to the electric grid. In effect, PG&E buys energy efficiency resources from the building as though it were buying renewable energy generated from a wind turbine installed on the roof.

READ ALSO: A Closer Look at Energy Retrofit Financing

Rewarding the Operator

For Downtown Properties, a key benefit of the utility’s on-bill financing program is that it helps solve the split incentive facing owners which pay for energy upgrades that largely benefit their tenants. The NMEC-powered incentive reimburses operators for their efforts to save energy costs.

“Most of the time, (owners) want to upgrade their facilities, but they are stymied by short payback rules,” said Tom Arnold, CEO of Gridium. “The tenants usually benefit. This allows for third-party financing to come in, and for the loans to be slowly paid back.” The loan is administered through the utility bill; the financing is paid back at zero percent.

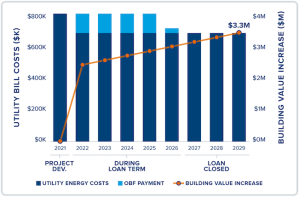

An illustration of Gridium’s on-bill finance program impact on a building’s value over time. Image courtesy of Gridium

The 550 Montgomery St. project is a good example of how “normalized meter energy consumption and on-bill financing can be leveraged for customers,” said Caroline Massad Francis, manager of energy efficiency strategy at PG&E in San Francisco.

“It’s the next step in how we measure, track and incentivize savings,” noted Monika Jesionek, program manager of the commercial whole building program for PG&E.

“NMEC has the potential to capture stranded savings, such as those types of projects customers might not be able to address if measuring savings in other ways than at the meter. This is one way that lets us get at a whole number of interventions we can undertake through energy efficiency that help improve the quality and reliability of projected energy savings in existing buildings,” Jesionek added.

And being able to track savings ensures the potential of the commercial customers’ investments while also supporting their goals and climate action plans.

While 550 Montgomery St. is the first project to receive incentives, PG&E has additional projects in its pipeline that will receive incentives in the coming months, according to Jesionek.

You must be logged in to post a comment.