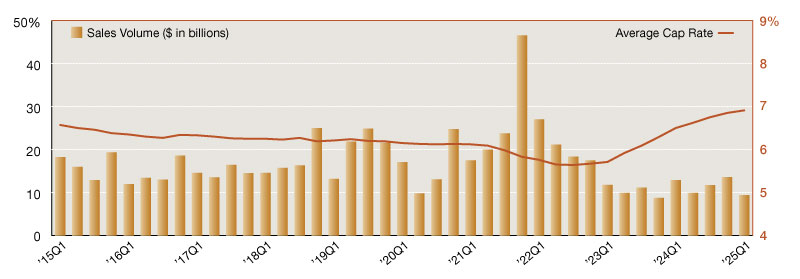

2025 Single-Tenant Net Lease Sales Volumes & Cap Rates

Top trends impacting the market, according to Northmarq.

The single-tenant net lease market faced headwinds in first quarter 2025, as transaction activity declined. Total sales volume for the period reached only $9.4 billion, marking a 30 percent contraction from fourth quarter 2024. With one of the weakest starts to a year in recent history, investors continue to exercise caution as they navigate elevated borrowing costs and broader market uncertainty.

Overall single-tenant cap rates edged upward for the tenth consecutive quarter, averaging 6.91 percent at the end of first quarter. This figure represents a modest six-basis point increase from the prior reporting period and a larger 41 basis point rise year-over-year. The steady climb in cap rates reflects the recalibration of asset valuations to align with higher interest rates, which continues to impact investor pricing strategies.

Private investors maintained a dominant position in the net lease sector, comprising 46 percent of all buyers. Institutional investors, now representing 27 percent of the buyer pool, demonstrated a noticeable uptick in activity compared to full-year 2024 levels, especially in the industrial sector. Conversely, REITs reported sharply reduced activity, involved in just 4 percent of the quarter’s acquisitions. Notably, REITs remained completely absent from the single-tenant office segment, underscoring persistent challenges within the sector.

Sector-level trends revealed varied performance. The industrial sector continued to lead in investor demand with $4.6 billion in sales, although this volume was down more than 47 percent from fourth quarter 2024. Retail showed resilience recording $3.05 billion in sales and marking a 9 percent increase quarter-over-quarter despite a 26.7 percent year-over-year decline. Office transactions, on the other hand, fell to $1.8 billion – a staggering 56.2 percent decline from a year ago.

Looking ahead, cap rates are likely to expand further, and evolving buyer profiles will shape activity as investors assess risk-reward dynamics across the net lease landscape, especially as the impact of tariffs, projected interest rate cuts and other market dynamics become clearer.

—Posted on May 30, 2025

You must be logged in to post a comment.