Signs of Stability Emerge as Office Downsizing Eases

Only one-third of office occupiers are planning to further reduce their space, according to Cushman & Wakefield and CoreNet Global.

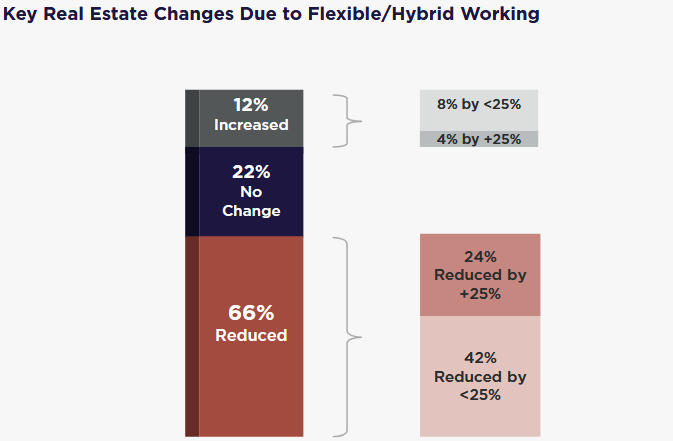

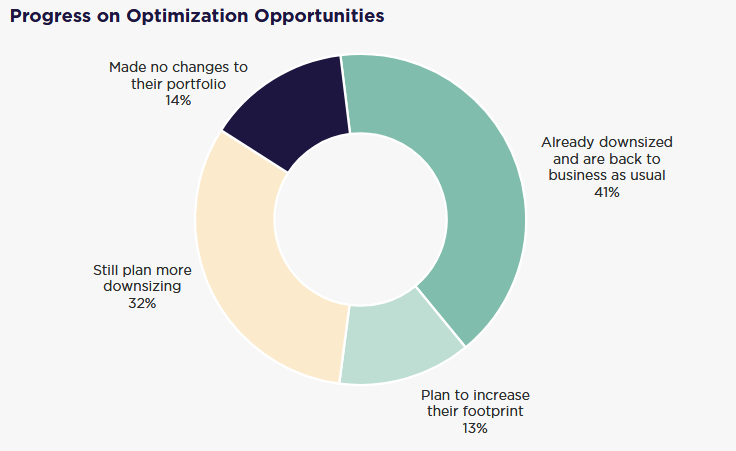

The contraction of office space utilization is easing, according to a new report by Cushman & Wakefield in partnership with CoreNet Global. Over the last two years, two-thirds of major space occupiers reduced their office space usage, but only about one-third (32 percent) are planning further downsizing.

Indeed, one in eight occupiers plans to expand their footprint, the report noted. The shrinkage inspired by post-pandemic realities thus seems to have stabilized, and office lease sizes are on rebound, up 13 percent over the last two years, in the U.S. and other office markets.

Cushman & Wakefield received responses from over 235 of the world’s largest space occupiers, companies with a total of 8.1 million employees using about 430 million square feet of office space. More than half (52 percent) of the respondents were based in the U.S. and the rest of the Americas, with the balance in Europe and the Middle East, and the Asia-Pacific region.

Average office occupancy each week has risen to the range of 51 to 60 percent, which seems to be the new standard. That is below the utilization range of 65 to 75 percent before the pandemic, but current utilization rates are still rising and may eventually catch up.

READ ALSO: Top HQ Relocation Trends

In that, the U.S. and the rest of the Americas lag, with only a fifth of the occupiers in the region reporting utilization above 50 percent. Over 40 percent of European or Asia-Pacific respondents reported that.

The key driver of real estate decisions in the Americas is still cost, as it is in most places. Growth (including mergers and acquisitions) is second, followed by employee sourcing and retention, which tends to be second in the rest of the world, according to the report.

Flexible location strategies are the new norm when it comes to hiring, the report explained. Nearly two-thirds of occupiers (61 percent) have expanded flexibility in their hiring practices, “using real estate portfolios strategically to tap into diverse and distributed talent pools,” the report noted. In the U.S. and the rest of the Americas, hybrid schedules lead the way.

Using CRE in employee satisfaction

Subtle shifts in corporate organization in the U.S. and elsewhere point to the growing importance of employee satisfaction with their workplaces, according to Cushman & Wakefield. Corporate decision-makers are increasingly taking employee satisfaction into their deliberations. But there are still improvements to be made, the report noted.

One-third of respondents have recently changed who their CRE staff reports to, reassigning them to be under human resources, rather than finance or operations. That shift reflects the realization that better working conditions for office workers are generally good for productivity. For landlords, it will encourage the utilization of office space,

Organizations need new performance metrics that link workplace investments to employee engagement and productivity—not just financial outcomes, Cushman & Wakefield Head of Americas Insights David Smith told CPE. Corporate real estate is about more than square footage and costs, he said. It’s about employee experience.

Cost pressures, shifting organizational models, and a stabilizing office footprint are compelling Corporate Real Estate industry priorities to evolve in response to the growing demand for workplace flexibility.

Yet most companies continue to rely heavily on traditional financial measures. The report calls for a “balanced scorecard” approach that puts cost control and workforce impact on a more equal footing.

You must be logged in to post a comment.