Self Storage Rents Still Down Year-Over-Year

Despite robust growth in western markets, street-rate rents dropped 3 percent nationally as of June 2018.

By Evelyn Jozsa

Substantial inventory expansion and slowing economic fundamentals continue to affect street-rate rents for 10×10 units. On a year-over-year basis, rents have dropped 3 percent in June 2018, after contracting by 1 and 2 percent in April and May. Western markets, such as Las Vegas and Phoenix maintained surging growth, having gained 11 and 5 percent year-over-year through June. Southern California rents also continued their slow rise, as limited opportunity for new supply has pushed improvement.

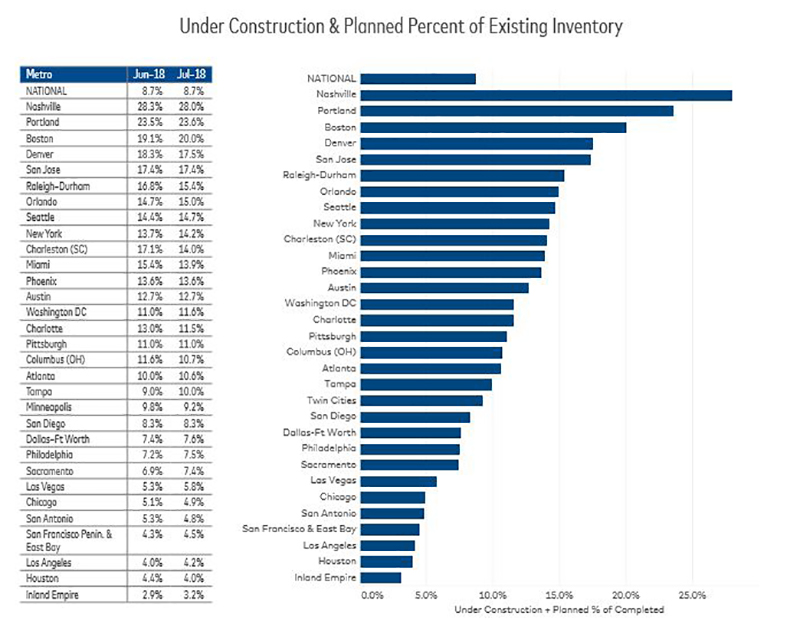

In contrast, Texas is still considerably oversupplied and metros such as Houston and San Antonio have limited their pipelines to around 5 percent of existing inventory. Nationally, planned and under construction assets represent 9 percent of total supply—the same as in previous months—which suggests a peak in inventory expansion in 2018.

Nashville, Portland and Denver stayed the most active metros, although historically underpenetrated markets, such as Boston, are also among metros with heightened construction activity. Additionally, retiree destinations like Tampa are encouraging heightened development. The metro’s planned or under construction projects account for roughly one tenth of existing inventory, up 100 basis points month-over-month.

Other southern cities, including Miami and Charlotte, are experiencing heavy-lease-up pressure, leading to depressing street rates, and to developers canceling potential projects. Metros in California, however, continue to have the thinnest new-supply pipeline─Los Angeles and Inland Empire ranked at the bottom of the list with 4.2 and 3.2 percent.

Read the full Yardi Matrix report

You must be logged in to post a comment.