Self Storage Rents Show Signs of Improvement

While street-rate rents were down 0.9 percent on a year-over-year basis, the rate actually indicates an 80-basis-point improvement compared to the previous month’s rent rate decrease of 1.7 percent.

Although self storage rents slid in 2018, street-rate rents showed signs of improvement in February. Despite a 0.9 percent decline year-over-year for 10×10 non-climate-controlled units, the slide of street-rate rents actually slowed down by 80 basis points compared to the previous month’s rent rate decrease of 1.7 percent. Rents for 10×10 climate-controlled units fell by 2.2 percent.

Las Vegas still leads all major markets in rent growth, as street rates for the standard non-climate-controlled units have increased by 3.1 percent over the past 12 months. Meanwhile, rents for 10×10 non-climate-controlled units stayed flat in San Diego, however for climate-controlled units of similar size, rents grew by 5.6 percent year-over-year. As a result of limited opportunity for new development, asking rates remained highest in California metros, such as San Francisco ($189) and Los Angeles ($180). At the other end of the spectrum, asking rates were lowest in oversaturated Texas metros, such as Houston ($86), Dallas ($95), Austin ($98) and San Antonio ($99).

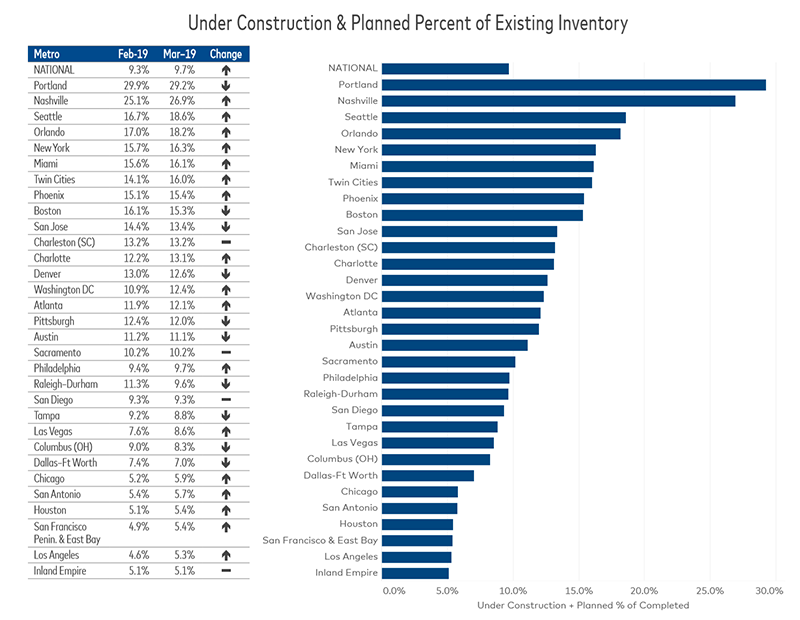

Nationally, the new-supply pipeline accounted for 9.7 percent of existing inventory, a 40-basis-point improvement over the previous month. Although the inventory is increasing, the number of abandoned projects has tripled since mid-2018. In Denver, the existing storage supply per capita has surpassed 7 net rentable square feet, leading to a lull in development activity.

Despite a 70-basis-point slump, Portland still had the most projects planned or under construction—29.2 percent of existing stock. Due to a thriving economy and low unemployment, the Twin Cities continue to attract professionals from outside the metro, driving demand for self storage. The new-supply pipeline accounted for 16 percent of existing inventory, a 190-basis-point increase over February.

You must be logged in to post a comment.