Self Storage Rents Continue Strong Rebound

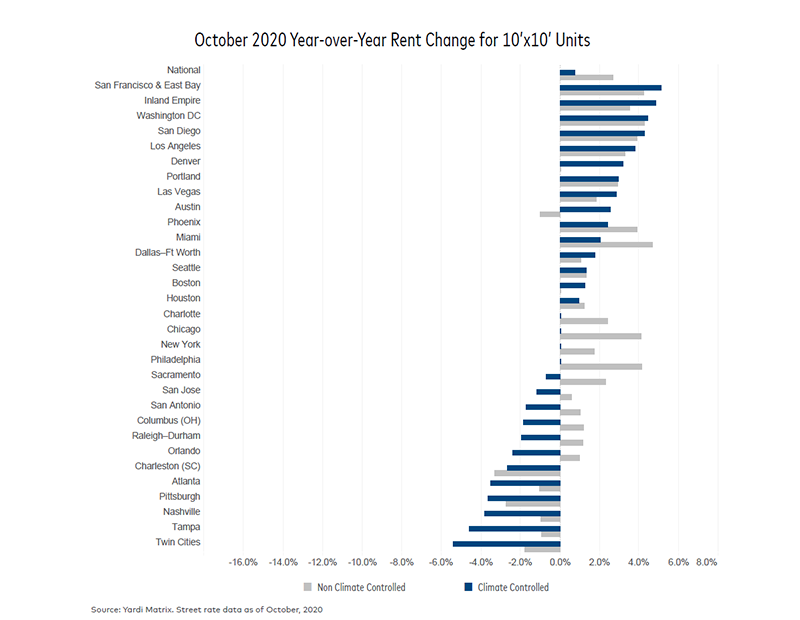

The year-over-year street rate performance was positive for both climate-controlled and non-climate-controlled units for the first time since 2017.

Self storage continued to prove its resilient nature in October, with significant improvement in street rate performance across the U.S. On a year-over-year basis, street-rate rents increased 2.7 percent for the average 10×10 non-climate-controlled and 0.8 percent for the climate-controlled units of similar size. The last time the self storage sector registered positive rent performance for both climate- and non-climate-controlled units was in November 2017.

Overall, listed rates took a downturn in only about 23 percent of the top markets tracked by Yardi Matrix. Year-over-year, 22 of the 31 top markets saw positive rent growth, while rates remained flat in two markets.

Since the onset of the pandemic, national rates for the standard 10×10 non-climate-controlled units have grown by 0.9 percent, while climate-controlled units of the same size have increased 0.8 percent. Positive rent performance continued to strengthen especially during the summer. From July to October, street rates grew 1.8 percent for the 10×10 non-climate-controlled units and 2.3 percent for climate-controlled units of similar size.

With an existing inventory of only 5.2 net square feet available per person, below the 6.7 national figure, Washington D.C. saw significant rent improvement. The metro registered a 4.3 percent-increase for non-climate-controlled and 4.5 percent for climate-controlled units. California markets also experienced positive rent growth. San Diego, the Inland Empire, Los Angeles and San Francisco all recorded year-over-year street rate increases larger than 3 percent for both unit types.

Development activity maintained a steady pace in most markets in October. Nationwide, projects under construction or in the planning stages accounted for 8.5 percent of total stock, up 30 basis points over the previous month. The number of abandoned projects, however, increased by 3.3 percent, or 31 projects, in October.

You must be logged in to post a comment.