Self Storage Rents and Inventory Still Out of Balance

Although metros on the West maintained rent growth, on a national level, street-rate rents have dropped 1.7 percent over the past 12 months.

Although stock expansion pressures are slowly alleviating in select markets, heightened completion levels continued to weigh down on street rates in November. On a year-over-year basis, street-rate rents declined by 1.7 percent for the average 10×10 non-climate-controlled and 3 percent for climate-controlled units of similar size. Overall, street rate performance was negative in about 75 percent of the top markets tracked by Yardi Matrix.

Positive rent rates were still registered in western markets, such as Los Angeles (1 and 3 percent), San Francisco (3 percent for climate-controlled units) and Las Vegas (3 and 1 percent). As of November, asking rates were also highest in West Coast markets with San Francisco on the top ($192), followed by Los Angeles ($183) and Seattle ($153). The lowest asking rates were recorded in Houston ($84) and Charleston, S.C. ($92).

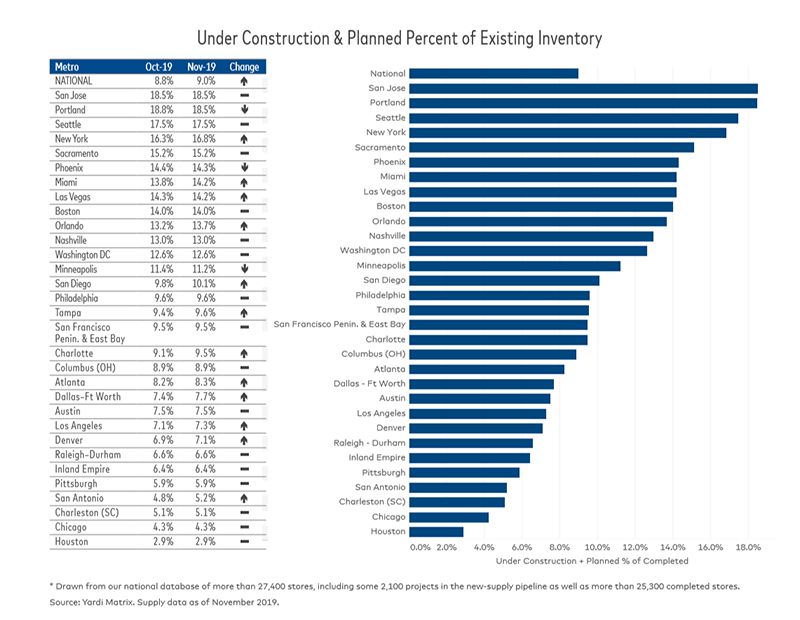

Across the country, projects under construction or in the planning stages accounted for 9 percent of total stock, representing a 20-basis-point increase month-over-month. Metros with considerable development activity include New York City. The city’s new supply pipeline represents 16.8 percent of existing stock, a 60-basis-point increase over the previous month. Job and population growth are fueling the expansion in Orlando, where the percentage of projects underway and in the planning stage increased 50 basis points over the October rate.

Due to fear of oversupply, development has slowed in Portland, where projects planned and in the construction phases account for 18.5 percent, down 30 basis points over October. Texas markets such as Austin (7.5 percent of existing stock), Houston (2.9 percent) and San Antonio (4.8 percent) have the lowest inventory of new supply, as heavy deliveries in the past few years are still considerably affecting rent growth.

You must be logged in to post a comment.