Self Storage Industry Trends

The industry's ability to adapt and control supply is keeping it stabilized during a difficult economy.

Image by Mike Mozart of TheToyChannel and JeepersMedia on YouTube

Self storage real estate has weathered downturns before with aplomb, and current self storage industry trends seem to follow that pattern.

“Self storage has traditionally been viewed as a defensive sector that holds up well in a downturn, and that’s what we’re seeing here, as well,” said Yardi Matrix Vice President Jeff Adler.

The strong fundamentals of the sector, meanwhile, make it attractive to investors who crave stability in uncertain times. “There’s been an enormous amount of interest in self storage,” noted Michael Mele, vice chairman & head of the self storage advisory group for Cushman & Wakefield. “There’s been more buyers than even before COVID-19.”

While some believe that self storage does better during a recession, National Self Storage Association President and CEO Tim Dietz does not believe the industry is countercyclical.

“The concept that self storage benefits from an economic downturn is a myth.” Dietz observed. “Our industry really does best when there is a strong economy. We fared well in what certainly appears to be a dramatic economic slowdown … but we really do best when the economy as a whole is chugging along at a healthy pace.”

REITs report positive results

On the operations side, the outlook is generally positive. In fact, all of the self storage REITs had optimistic second-quarter earnings calls, and none of them reported any location closures. Street rates have even increased in some places where other asset classes are lowering their rents.

“In some places where multifamily rents are under significant pressure, storage rents are going the other way,” Adler observed.

Dietz is cautiously optimistic about the sector. “The industry is faring very well in the context of all real estate,” he said. “Whether or not that continues still remains to be seen.”

Adapting and changing

In many ways, self storage is evolving as it adapts to new technologies and develops greater sophistication as a product. Contactless leasing was already being adopted before the pandemic. As social distancing has become the norm, the shift has become a greatly desired feature for tenants.

“Our culture now has anxiety about togetherness,” said Dietz. “I think that, in most cases, we have adapted, as an industry and a culture, to social distancing and hygiene to avoid this disease. No matter how safe in-person contact becomes, it does not provide the level of peace of mind that contactless rentals provide.”

While other real estate products have implemented contactless leasing features, self storage is uniquely positioned to take advantage of the technology. Self storage customers have little interest in who their property management staff is and choose a location based on amenities and proximity to their homes. Renters enjoy the convenience of contactless leasing, while operators enjoy the reduction in operating costs that it provides.

Is self storage overbuilt?

Many have questioned if the rapid expansion of self storage in recent years has flooded the market with an oversupply of available inventory. While it may appear that way at a market level, Adler prefers a more focused approach to market analysis.

“Storage is a very localized business,” he said. “It’s based around a 10- to 15-minute drive or a 3-mile radius, at most. So it’s really a selection of micromarkets.”

Therefore, a renter may have dozens of options within a 30-mile radius, but as far as they are concerned, they might as well be on the opposite side of the planet. In essence, a market that appears overbuilt on paper may still present opportunities because some neighborhoods are underserved.

Pipeline slows down

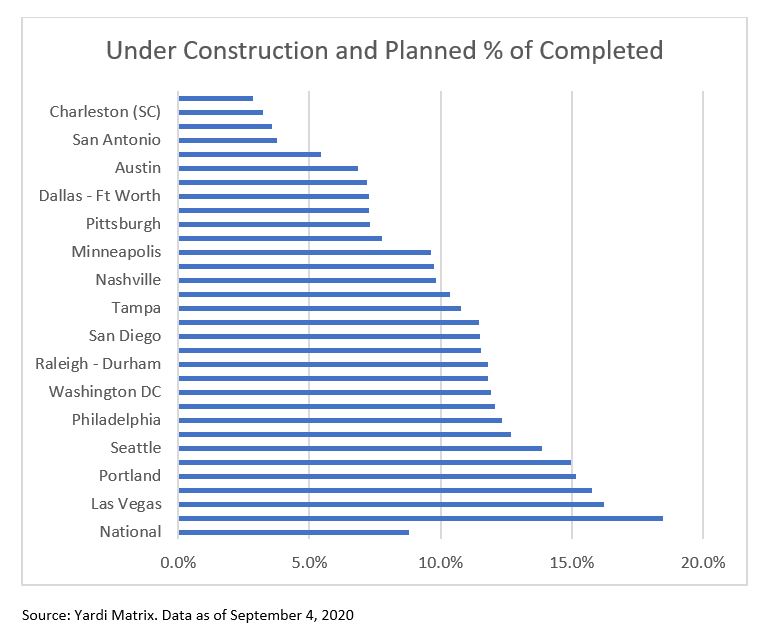

New construction of self storage facilities is continuing at a steady pace after a brief slowdown in the second quarter. The same is not true for projects further back in the pipeline. Developers who change plans are likely to see a reduction in new supply over the next two to three years.

“There is an increase in projects in the early stages that are now being abandoned,” Adler said. “(These projects) are not continuing in the pipeline and the pipeline is not starting.”

Mele expects street rates to rise with supply contraction, but there is a caveat to his prediction.

“They are not going to rise until we reach some sort of stabilization on physical occupancy, but we’re still trying to absorb the bulk of the new product added in 2019,” he said.

Ten percent fewer units will be added in 2020 than in the previous year, Mele noted, but it will still be two or three years before the supply contraction is reflected in street rates.

Unwavering investor interest

Unwavering investor interest

Mele has found no shortage of clients looking at self storage. “There’s been an enormous amount of interest in self storage, there have been more buyers than even before COVID-19.” He further observed, “The buying pool is deep, and the cap rates have gone down anywhere from 25 to 50 basis points.”

Mele has found sellers to be less motivated. “The problem is usually with seller expectations. What they projected their numbers to be … they’re not going to hit; a lot of the rates that were projected, not only are they not getting them but they’re getting rates lower than they were two or three years ago.”

For self storage, this point in the cycle would best be described as a brief stagnation following a period of overbuilding. The sector remains strong and continues to deliver acceptable net operating income for owners, as well as present opportunity to investors.

You must be logged in to post a comment.