Sacramento Office Market Gains Momentum

The sector is picking up, fueled by recovering office-using industries, growing demographics and increasing leasing activity, Yardi Matrix data shows.

By Razvan Cimpean

Sacramento’s office market is picking up, fueled by a recovering office-using employment sector, growing demographics and increasing leasing activity. Demand is bolstered primarily by public initiatives—such as the Mayor’s Office for Innovation and Entrepreneurship’s multimillion-dollar programs—that aim to transform the metro into a startup- and entrepreneur-friendly market.

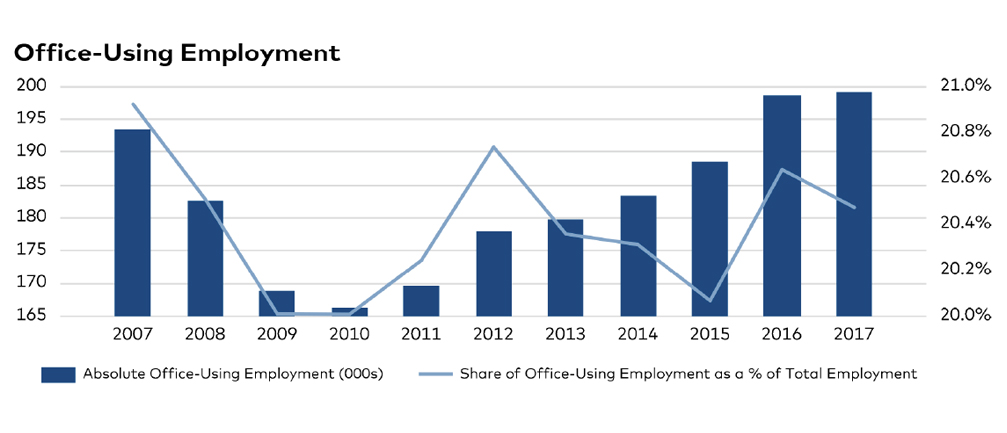

Some 15,500 jobs were added year-over-year through October 2017. Office-using jobs account for 20.5 percent of Sacramento’s total employment pool of more than 970,000 jobs. Job growth has been moderate in the metro; gains in the leisure and hospitality sector (5,900 jobs added year-over-year through October 2017) and education and health services (4,500) have been offset by losses in other sectors, such as manufacturing and construction.

A shortage in development in recent years pushed down the vacancy rate across the metro to 13.9 percent. Vacancies are highest in suburban submarkets, which account for 72 percent of the metro’s office inventory. Meanwhile, vacancy rates in the submarkets of Elk Grove (5.0 percent) and Roseville–Rocklin (9.9 percent) are well below the metro average.

Overconstruction in the late 2000s led to a significant slowdown in development in recent years. Only 110,000 square feet of office space is scheduled for completion by the end of 2017, and less than 170,000 square feet is under construction. However, office development is expected to pick up, as companies continue to look for cheaper alternatives to Los Angeles and San Francisco.

You must be logged in to post a comment.