RICS Survey: US CRE Market at Its Peak

The latest research on occupier and investor sentiment in the U.S. indicates steady momentum, with an increasing number of contributors signaling the cycle peak.

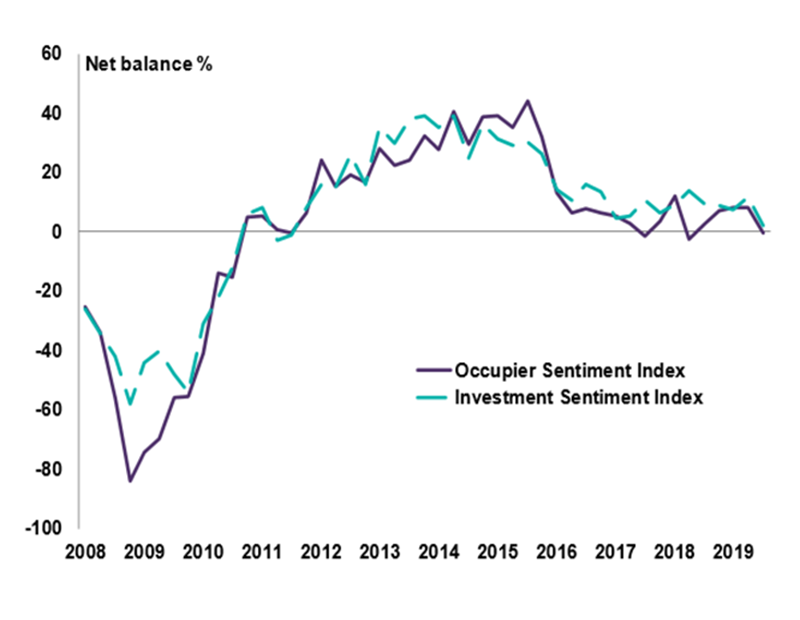

The latest U.S. Commercial Property Monitor, compiled by the Royal Institution of Chartered Surveyors, shows that in the third quarter of 2019, momentum across the market remains steady. “The occupier and investment sentiment indices (combined measures of short-term supply, demand and expectations) have both returned readings close to zero, pointing to a flat picture overall,” the report shows.

However, there are variations when it comes to each property segment. Office and industrial benefit from strong demand, in contrast to retail, which is still impacted by the transformation of consumers’ shopping habits and expectations. This scenario is not likely to change soon.

PODCAST: Global CRE Markets: Downturn Talks Intensify

“Looking at the year ahead, rental projections point to strong gains across the office and industrial sectors with expectations for prime locations a little more elevated than those for secondary. At the same time, contributors envisage only a modest pick-up in prime retail rents over the coming twelve months, whilst rental values are projected to fall in secondary locations,” the research highlights. This pattern applies to 12-month capital value projections as well—positive across all sectors, apart from retail.

What will tip the scale?

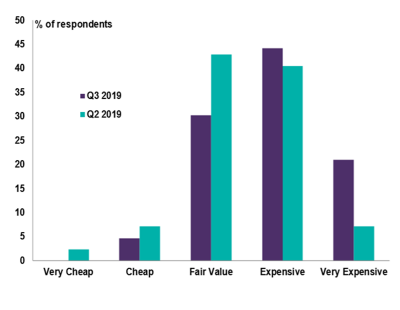

The majority of contributors—52 percent—see the market in the peak phase of the cycle, an increase compared to the first (41 percent) and second quarter of the year (49 percent). Going forward, monetary policies will be a decisive component of market perception.

“The Fed has cut interest rates three times in relatively quick succession and, although comments from Fed officials suggest they now intend to pause rate cuts, it is still anticipated that further policy easing could come in 2020. If this feeds through into looser financial conditions across the commercial real estate sector specifically, this may support investment activity to a certain extent,” RICS Economist Tarrant Parsons told Commercial Property Executive.

In addition, 26.2 percent of respondents claim the U.S. CRE market is in an early downturn, while 11.9 percent point to a mid-upturn and 4.8 percent see it as bottoming. Mid-downturn and early upturn each gained 2.4 percent of contributors.

Recent GDP and employment data paint a rather optimistic picture, even though momentum is set to fade and volatility across the global economy will also have an impact on the industry. For now, investor appetite is still healthy, even though research revealed lower investment volumes compared to 2018.

“Aside from the general caution around the economic outlook, the main challenge for investors is to determine, following a long period of growth, whether or not prices are at an appropriate level to invest given the current fundamentals of the market,” Parsons added.

The RICS report is based on a quarterly survey targeting industry professionals in all major markets across the globe.

You must be logged in to post a comment.