Return-to-Office Update: Cities Closing the Post-Pandemic Gap

Two bellwether markets have returned to levels of visits last seen before Covid, Placer.ai reports.

Visits to the offices nationwide continued their upward trajectory in July, Placer.ai reports, noting that two bellwether markets, New York City and Miami, have effectively returned to levels of visits last seen just before the pandemic.

In July 2025, New York City’s office visits came in 1.3 percent above July 2019 levels, marking a first for that market, while Miami’s visits were just 0.1 percent below 2019, Placer.ai noted. In New York, the finance industry has been squeezing employees to come back more in recent months, while Miami has a growing financial sector of its own putting pressure on RTO.

“The strong return-to-office trends in both New York City and Miami are largely driven by their significant finance industries,” Placer.ai Head of Analytical Research R.J. Hottovy told Commercial Property Executive.

“Many financial companies in New York City implemented stricter in-office requirements following the pandemic, which has boosted its overall recovery,” Hottovy said. “Also, Miami has developed an emerging financial sector of its own, with companies relocating their headquarters there in recent years, contributing to its near-complete recovery in office foot traffic.”

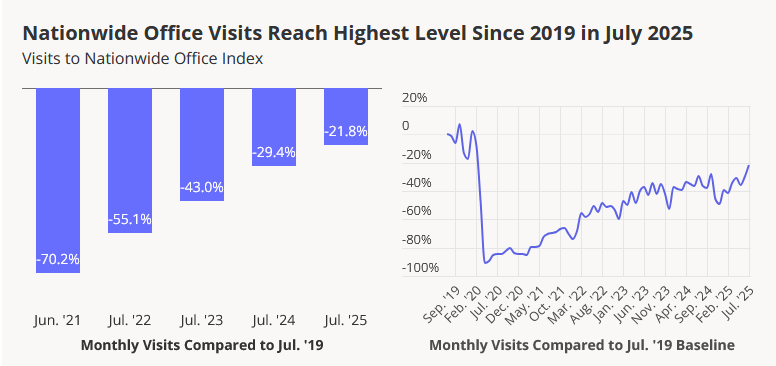

The Placer.ai Nationwide Office Building Index was down just 21.8 percent compared to July 2019, the highest level since then—and up 10.7 percent compared to a year ago.

READ ALSO: Law Firm Leasing Hits Record High

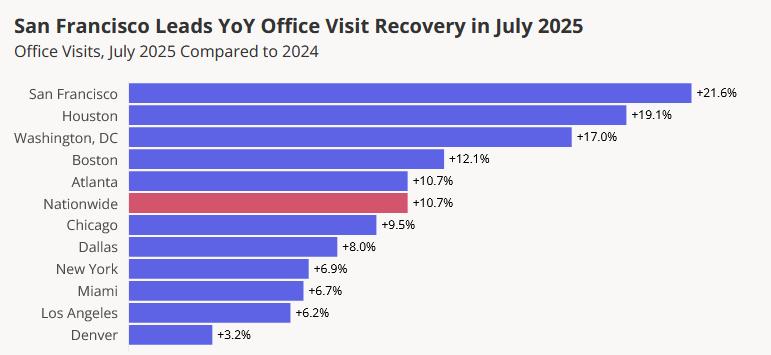

Atlanta and Dallas also made considerable progress in returning closer to 2019 levels, with both markets seeing visit gaps dip below 20 percent compared to 2019, and both besting the national average of down 21.8 percent. Those two cities’ gap between 2019 and 2025 levels came in at 14.8 percent and 18.3 percent, respectively.

Meanwhile, Denver—still one of the most remote-friendly labor markets in the U.S., according to the report—brought up the rear at 40 percent below 2019. In that, the city now has a distinction long held by San Francisco—which is seeing a significant shift in RTO.

San Francisco’s revival

Return-to-office is gaining some steam in San Francisco, which inched back enough in July 2025 in terms of office visits to best both Denver and Los Angeles in that regard, according to Placer.ai.

In fact, San Francisco “appears to be in the midst of a major revival, with rising rents, improving public sentiment, and waves of new restaurant, retail and small business openings breathing fresh life into a city once dismissed as stuck in a ‘doom loop’,” the report said.

In July 2025, San Francisco once again topped the year-over-year office recovery charts, outpacing all other analyzed hubs with 21.6 percent visit growth—more evidence of the market’s recovery.

You must be logged in to post a comment.