Return-to-Office Rebounds

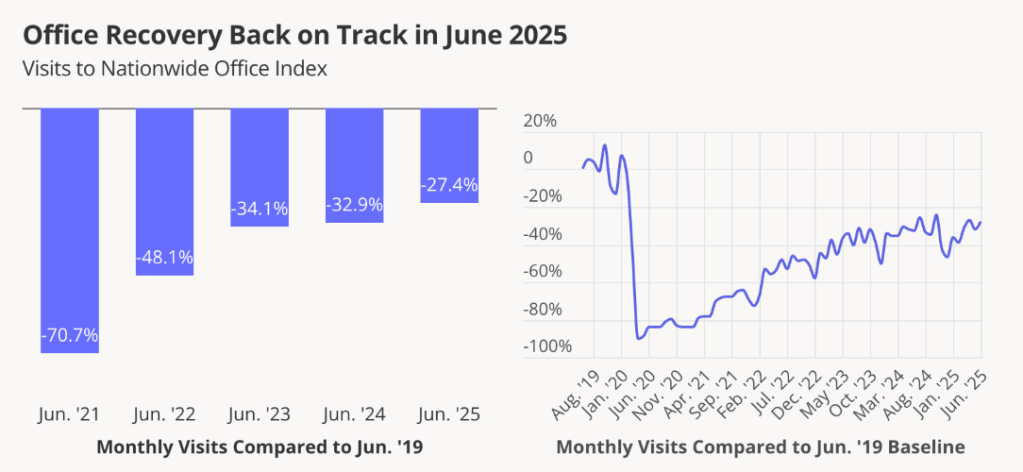

June ranked as one of the busiest months for office visits since the pandemic, according to Placer.ai.

Visits to offices nationwide swung back upward in June, following a modest drop in May that came on the heels of a vigorous increase in April, Placer.ai reported, noting a bit of unusual volatility.

“The magnitude of the dip in return-to-office trends from April to May was noteworthy,” R.J. Hottovy, head of analytical research at Placer.ai, told Commercial Property Executive.

“While the calendar shift of one less workday likely contributed, we’ve typically seen these trends remain stable or even improve during this period in past years,” Hottovy says. “We’ll be watching this trend in the months ahead.”

Office foot traffic trends upward

Office foot traffic nationwide increased 8.3 percent year-over-year in June, according to the Placer.ai office index, while between April and May, foot traffic was down 1.1 percent. Between March and April, traffic was up 5.8 percent.

Office visits are still considerably below pre-pandemic totals, Placer.ai noted, down 27.4 percent nationwide in June this year compared to June 2019.

The Placer.ai index analyzes foot traffic data from about 1,000 U.S. office buildings, including some properties with a small retail component. It doesn’t include government buildings or mixed-use buildings that are both residential and commercial.

READ ALSO: Law Firm Leasing Hits Record High, Targets Premium Assets

Despite the index’s recent gyrations, the trend is generally up for office attendance. And despite having only 20 working days, June 2025 ranked as the fourth-busiest in-office month since the pandemic. Only October 2024, July 2024 and April 2025—each with 22 working days—saw more foot traffic.

Placer.ai chalks the upward trend to tighter return-to-office policies, though “rolling out these mandates hasn’t been entirely smooth sailing,” the report explained. Many workplaces still strive to strike a balance between RTO and WFH.

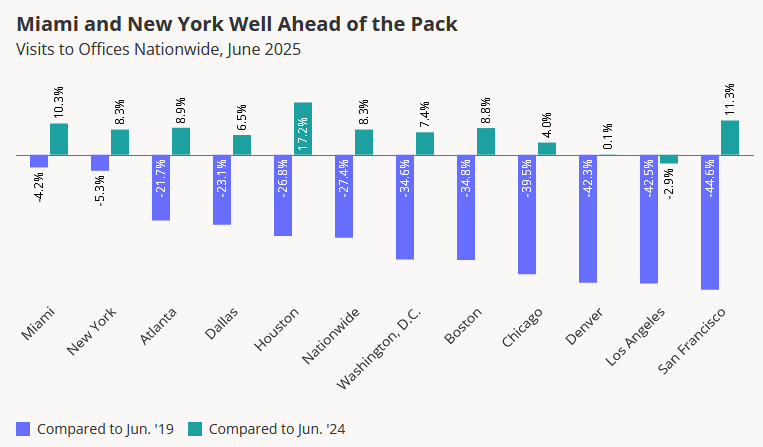

Miami and New York City continue to lead the RTO trend

Individual cities, including Miami and New York, continue to inch back to pre-pandemic levels, with those two in particular leading the pack. Visits to Miami office buildings were down just 4.2 percent in June compared to June 2019, and in NYC, they were down 5.3 percent, Placer.ai reported.

Sun Belt cities are also outperforming in terms of RTO, including Atlanta, Dallas and Houston, though their visits to office in June 2025 were still more than 20 percent below June 2019 for each of them (down 21.7 percent, 23.1 percent and 26.8 percent, respectively).

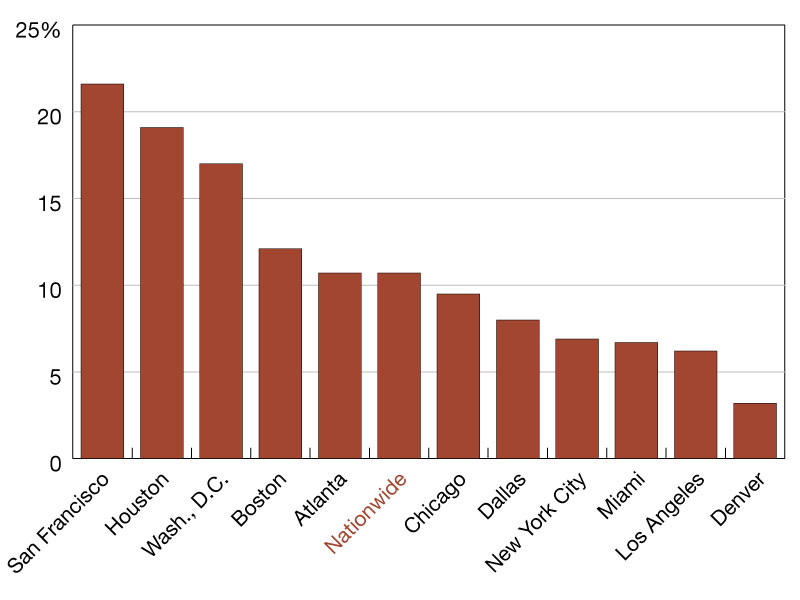

Other major metros trail the national average, with Washington, D.C., at 34.6 percent below June 2019, Boston at 34.8 percent below, and Chicago at 39.5 percent below. At the bottom of the RTO barrel when compared to six years ago is tech-heavy San Francisco, off 44.6 percent from 2019. Los Angeles and Denver came in slightly higher, off 42.5 percent and 42.3 percent, respectively.

Nine of the 10 cities covered by the report have higher RTO rates than a year ago, with only Los Angeles losing ground in that regard, down 2.9 percent. San Francisco’s year-over-year jump was the second-highest of the 10 cities, up 11.3 percent, only outpaced by Houston, up 17.2 percent since June 2024, though during that particular month, Houston was still feeling the aftermath of a major storm the month before.

You must be logged in to post a comment.