Retail Investors Pull Back Amid Mall Woes

A new JLL report finds that buyers are getting more selective as structural changes rock the sector. Overall transaction volumes fell in the first quarter, while power center and grocery-anchored assets outperformed.

Retail investment volume in the U.S. dropped 4.9 percent year-over-year in the most recent quarter, with investors pulling back and getting more selective in the hunt for assets amid news of thousands of store closures.

The apparent store-pocalypse is also putting a damper on retail construction, which declined by 8.9 percent year-over-year in the first quarter of 2019, according to a new report by JLL. Net retail absorption plunged by 67.4 percent quarter-over-quarter and 61.9 percent year-over-year across major U.S. markets, the brokerage found.

It’s not all grim news, as vacancy remained flat at the low rate of 4.4 percent for overall retail, while mall vacancy remained at 3.6 percent. Retail rents grew 1.4 percent from the prior quarter and 5.4 percent year-over-year.

Power centers are booming

According to JLL’s retail investment outlook report, retail transaction volume totaled $11.1 billion in the first quarter. After a series of mega-deals such as Brookfield’s more than $15 billion purchase of mall owner GGP in 2018, buyer interest is now focusing on opportunities for assets under $100 million.

Power centers outperformed in the first quarter, with transaction volume surging by 30.4 percent year-over-year. Outdoor shopping centers anchored by multiple big-box retailers are proving popular with certain investors who see value-creation potential in the asset class, despite the risks involved.

Grocery-anchored properties are also doing fine, with single-asset grocery deal volume rising 2.3 percent in the first quarter. The largest deal in the space was the acquisition of the 493,459-square-foot Port Chester Shopping Center in Port Chester, N.Y., by M&J Wilkow and MetLife Investment Management for an undisclosed price in February.

Quality and location are key

News of rampant store closures and retail bankruptcies appears to be weighing on investors’ minds. According to Coresight Research, US retailers have announced 6,378 store closures during the year through May 17—exceeding the 5,864 closures for the full year 2018. Just this week, Dressbarn owner Ascena Retail Group said it would shutter all of the roughly 650 locations of the women’s clothing chain.

But reports of the retail sector’s death may be exaggerated. JLL says that investor appetite for retail assets is growing, and the agency foresees a slight uptick in transaction volume for 2019, supported by a healthy financing market. Institutional and high-net-worth players are still buying actively, though cautiously, with a preference for well-located shopping centers and urban retail corridors. Larger and higher-quality assets are hitting the market, which is reactivating investor interest.

Great service trumps robots

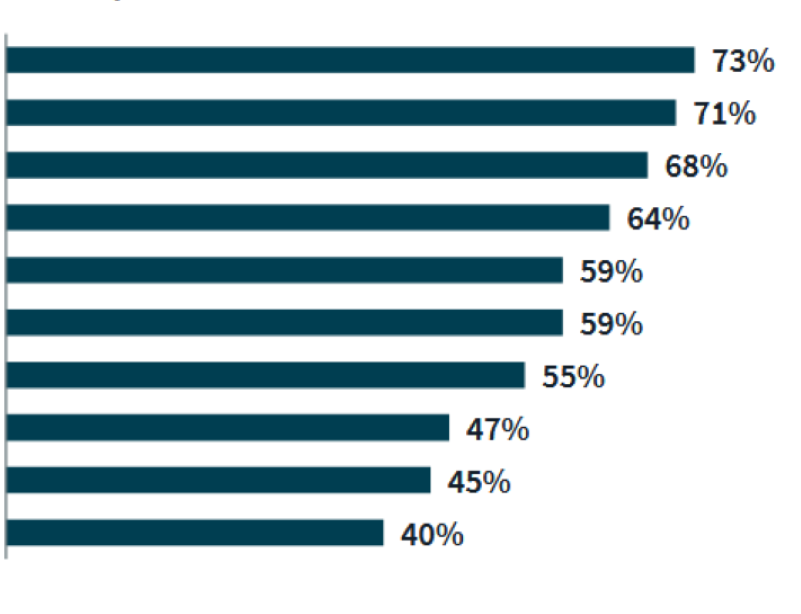

A separate report by JLL suggests a path forward for landlords and retailers looking to survive the industry’s structural changes. Drawing on a survey of more than 1,500 U.S. consumers in March, the report finds that the human touch is decisive in where people shop. About half of respondents said a skilled customer service person would make their experience better, whereas about 19 percent and 8 percent said the same for their smartphone and an AI robot assistant.

More than one-third of customers want to see more entertainment and dining options in their malls in the next 10 years. Significant numbers of customers demanded chef-driven food halls, high-end dine-in movie theaters and urgent care clinics. More than 57 percent are willing to rent well-made, trendy products from a store.

JLL suggests that shopping center owners should think beyond the traditional lease and consider offering short-term leases for emerging brands that can offer novel experiences to customers. Technology investments should be focused on back-of-house operations.

You must be logged in to post a comment.