REITs Cautiously Optimistic About Next 12 Months

By Robert Lehman, Director of REIT Services, Ernst & Young: Ernst & Young’s Global Real Estate Center recently surveyed 82 chief financial officers running North America’s top real estate investment trusts. The survey revealed that many of the nation’s top REITs are feeling positive about their business prospects.

By Robert Lehman, Director of REIT Services, Ernst & Young

By Robert Lehman, Director of REIT Services, Ernst & Young

Ernst & Young’s Global Real Estate Center recently surveyed 82 CFOs running North America’s top real estate investment trusts. The survey revealed that many of the nation’s top REITs are feeling positive about their business prospects. For example: More than 82 percent expect REIT performance to be better this year than in 2010, and over 91 percent expect 2012’s financial results to exceed those in 2011.

When asked if they thought the current economic and financing market was more favorable for private real estate companies or public REITs — more than 65 percent felt public REITs had the advantage right now.

Nearly two thirds of the CFOs expected to see an increase in merger and acquisition activity and most of the CFOs surveyed (61 percent) expect public companies to acquire private companies as opposed to the other way around.

Eighty two percent of the group surveyed said they had no plans to buy back their stock. Forty nine percent expected to increase their dividend in the next 24 months, and 44 percent said they anticipate no change in their existing dividend policy. Only 7 percent expected to cut their dividends.

The general consensus among the REIT CFOs surveyed was that real estate operations and investment activity is unlikely to slip from current levels:

- Three quarters of the group expected tenant demand to be somewhat higher this year, and more than half felt that their recent growth, leasing, access to capital and external growth potential was “good.”

- West Coast markets led the pack among the CFO’s as being among “the most attractive regional market in the next 24 months.” The Northeast was next, followed by Texas, the Southwest, the Mid-Atlantic and Southeast.

- Forty percent rated acquisitions and 36 percent rated organic rent and occupancy growth as their highest priority, followed by refinancing and continued expense reduction measures. On the other hand, the respondents were split on whether opportunities to acquire properties would come from distressed sellers.

- Fifty nine percent expected no change in their company’s geographic footprints in the next 24 months.

- Forty seven percent expected to see property acquisition candidates offering modest discounts to replacement cost and 80 percent felt that that those assets would be purchased directly from owners.

- When asked about their expectations for the supply of competitive investment properties, half of the respondents said they expected levels to remain the same for the remainder of the year.

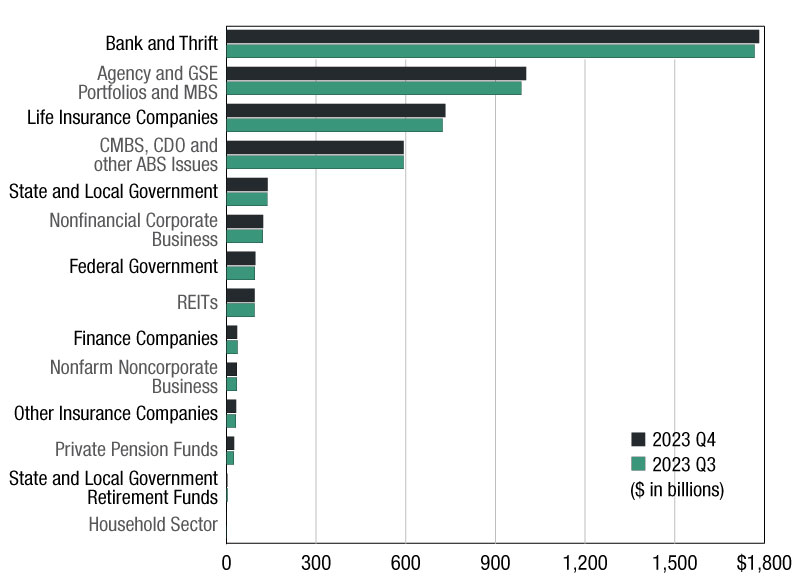

The chief financial officers indicated that they expected banks to become a larger factor in providing growth capital:

- The CFOs expected the top two sources for capital to be commercial banks (51 percent) followed by insurance companies at 17 percent . More than 75 percent of the respondents said their companies’ long term debt will not mature until after 2014.

- A strong majority (67 percent) expect convertible debt to be the source of capital for refinancing and/or growing their businesses. That is a significant change from first and second quarter survey results which ran just over 16 percent.

- The strategy of using either secured or unsecured debt to fuel growth dropped significantly. Only 4 percent in the survey group saw unsecured debt as the preferred option and just over 11 percent favored secured debt.

- More than half of those surveyed (57 percent) felt that terms available for accessing debt, such as collateral requirements, covenants and interest rates, would remain about the same as they are today. A quarter of the group felt that terms may become even more favorable.

- Little change is expected by the CFOs in debt-to-total capitalization (DTC) ratios. Respondents indicated that current DTC ratios fall between 20 percentand 50 percent Forty one percent expected their targeted debt-to-capitalization ratio to be between 36 percent and 50 percent — while 20 percent indicated they are shooting for 20 percent to 35 percent

- Half of the CFOs felt that changes in accounting and governance systems have become a more frequent topic of conversation with analysts and investors.

You must be logged in to post a comment.