REITs

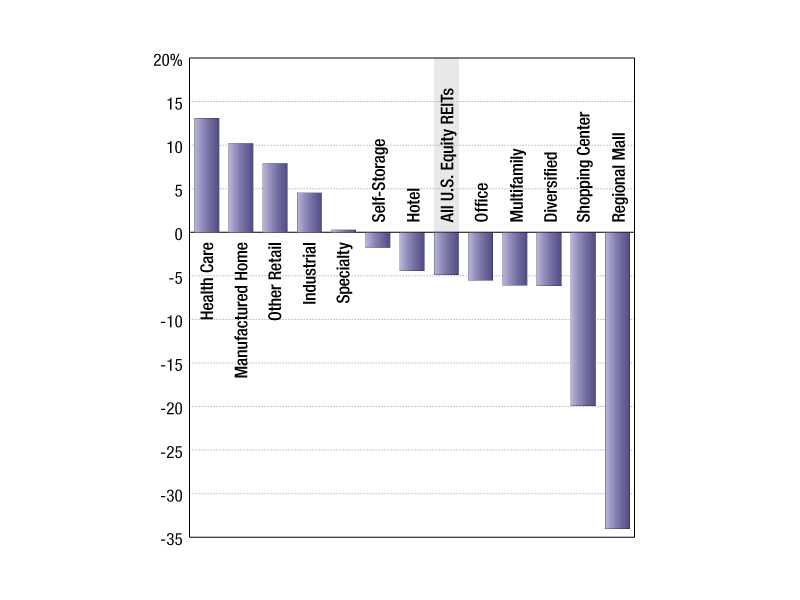

The Health Care REIT sector traded at the largest median premium to NAV, at 13.10 percent. Manufactured Home and the other Retail REIT sectors followed next trading at median premiums to NAV of 10.19 and 7.92 percent, respectively.

Median U.S. equity REIT premium to NAV by sector

As of April 28, publicly traded U.S. Equity REITs traded at a median discount to consensus net asset value of 4.88 percent.

The Health Care REIT sector traded at the largest median premium to NAV, at 13.10 percent. Manufactured Home and the other Retail REIT sectors followed next trading at median premiums to NAV of 10.19 and 7.92 percent, respectively.

On the other hand, trading at the greatest median discount to NAV at 34.04 percent was the Regional Mall mall REIT sector. The Shopping Center REIT sector also had a notable 19.92 percent median discount to NAV as of the last trading day of April.

On the company level, Health Care REIT CareTrust REIT Inc. traded at the greatest premium to NAV, at 32.04 percent. Right behind were Diversified REIT Gladstone Commercial Corp. and a fellow Health Care REIT Community Healthcare Trust Inc., which traded at premiums of 31.18 percent and 30.17 percent, respectively.

CBL & Associates Properties Inc. traded at the largest discount of all U.S. REITs, at 55.99 percent. Other Regional Mall REITs trading at large discounts included Pennsylvania Real Estate Investment Trust and Washington Prime Group Inc. at 48.26 percent and 38.03 percent, respectively.

Carl Dizon is an analyst in the real estate product operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.