2025 Commercial REIT Values

S&P Global Intelligence’s latest snapshot of REIT performance. Read the report.

As of June 2025, the Dow Jones U.S. Real Estate Industrial posted the highest multiple based from the last 12 months funds from operations among the three focused indexes. The Dow Jones U.S.Real Estate Industrial index posted a 19.48x, followed by the Dow Jones Equity All REIT index with price to LTM FFO multiple of 19.21x and the Dow Jones U.S. real estate office index with 9.78x.

Among all industrial REITs, Americold Realty Trust Inc.had the highest price to LTM FFO multiple of 39.1x.

Iman Niazi is an Assistant Manager for the Real Estate Client Operations department of S&P Global Market Intelligence.

—Posted on June 27, 2025

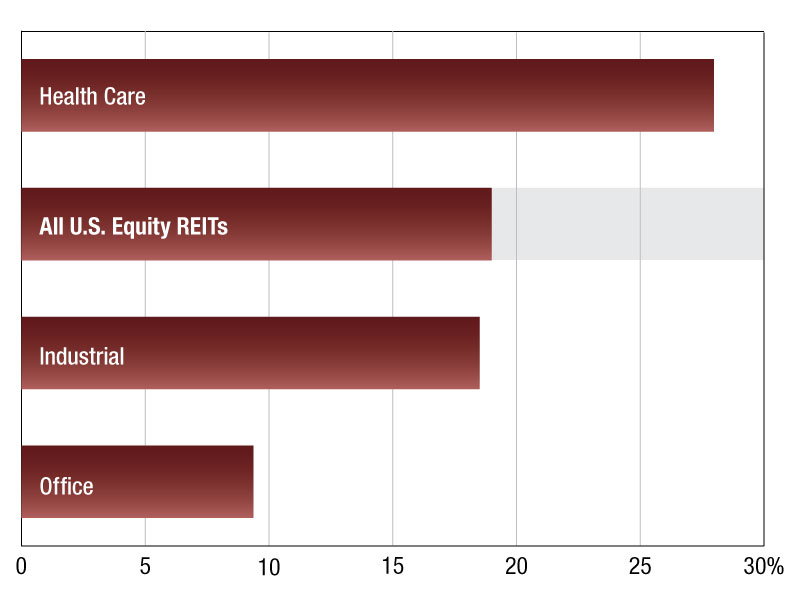

As of May 2025, the Dow Jones U.S. Real Estate Health Care Index posted the highest price to LTM FFO multiple based on the previous 12 months funds from operations among the four focused indexes. The Dow Jones U.S. Real Estate Health Care Index posted a multiple of 27.98x, followed by the Dow Jones Equity All REIT Index with 19.00x, the Dow Jones Equity U.S. Real Estate Industrial Index with 18.51x and the Dow Jones U.S. Real Estate Office Index with 9.37x.

Among all the U.S. health-care REITs, Welltower Inc. had the highest price to LTM FFO multiple of 37.5x.

Jerra Joy Agravio is a senior associate for the Real Estate Client Operations department of S&P Global Market Intelligence. If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on May 29, 2025

You must be logged in to post a comment.