REIT Spin-Offs

By Jim Sullivan, Managing Director, Advisory & Consulting, Green Street Advisors: Find out if a REIT spin-off is right for you.

By Jim Sullivan, Managing Director, Advisory & Consulting, Green Street Advisors

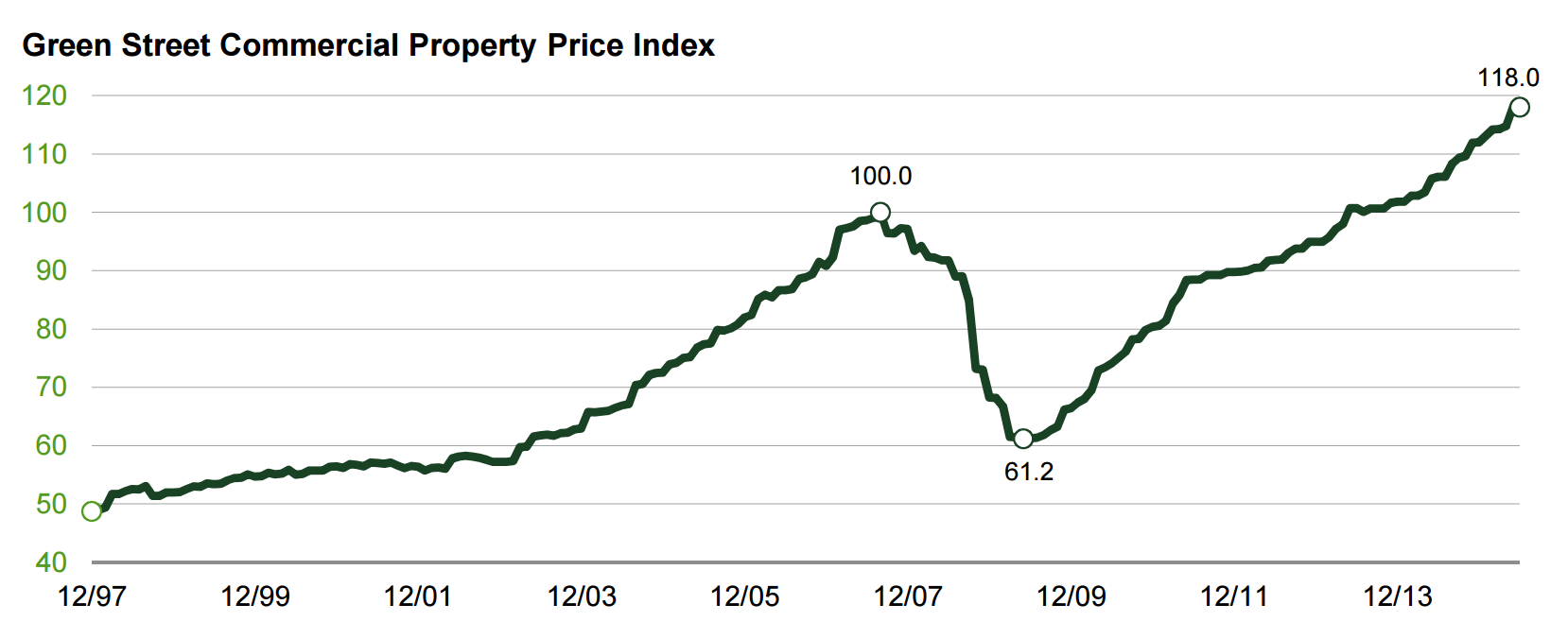

Commercial real estate values have never been higher. Green Street Advisors estimates that average property values are nearly 20 percent higher today than at the previous peak in 2007.

Prices for real estate used by businesses have soared to new highs

View Green Street’s full Commercial Property Price Index release.

These record-high prices are providing interesting opportunities for companies that aren’t in the real estate business – but happen to control large real estate portfolios – to pursue real estate value-maximization strategies. Publicly traded retailers and restaurant chains are the companies most commonly cited as being well-positioned to enhance shareholder value through strategies such as REIT spin-offs.

Retailers in transition have commonly raised capital through real estate transactions in order to shore up their balance sheets. A key difference today is that sky-high real estate prices have created compelling opportunities for thriving operating companies to create shareholder value through creative real estate strategies.

Darden Restaurants, Hudson’s Bay Co., and Sears are three publicly traded companies that are using REIT spin-offs as a means to increase shareholder value.[1] Each company has contributed a portion of its real estate holdings to a newly created property company structured as a REIT. The properties have then been leased back to the operating company, allowing those stores and restaurants to continue operating just as they were prior to the “prop-co/op-co” split. In addition to allowing operating companies to capitalize on high real estate values, REIT spin-offs can generate tax advantages in many situations, as well.

Shareholders have become increasingly vocal in promoting real estate maximization strategies for a variety of publicly traded companies. REIT spin-offs are often at the top of the list of suggested alternatives. Management teams and Boards would do well to proactively explore their alternatives before an investor takes its case to the market in a way the company will not be able to control.

The key questions operating companies should explore include: “What is our portfolio worth?” “What are the options available to us?” “What are the pros and cons of each alternative?” “Will a real estate transaction potentially impact our core operating business in a negative way?”

For some companies, REIT spin-offs will be the right answer. For others, sale-leasebacks will be a better option. And for some, doing nothing at all could be the appropriate path, especially if they have access to more attractively priced sources of capital and/or the impact on the operating company (such as losing control over the real estate) represents too much of a burden.

Real estate capital market conditions are currently very hospitable for any large real estate owner. That said, rising interest rates would certainly represent a headwind for a capital-intensive business such as commercial real estate and potentially place downward pressure on prices. Consequently, shareholders of companies with substantial real estate portfolios should expect management teams to be able to articulate what alternatives they have considered to capitalize on record-high valuations. Management teams that either don’t or can’t should not be surprised when an activist investor shows up and attempts to convince the market that the company is missing out on an appealing opportunity.

For more information about REIT Spin-offs, please visit https://www.greenstreetadvisors.com/Spinoff

[1] See Green Street’s initial in-depth valuation analysis of Darden Restaurants, Inc.’s (NYSE DRI) real estate holdings for Starboard Value. The analysis included a review of each Darden location. The client used this information as part of a publicly-filed presentation to argue for a sale or spin-off of the Company’s real estate to enhance shareholder value in 2014.

You must be logged in to post a comment.