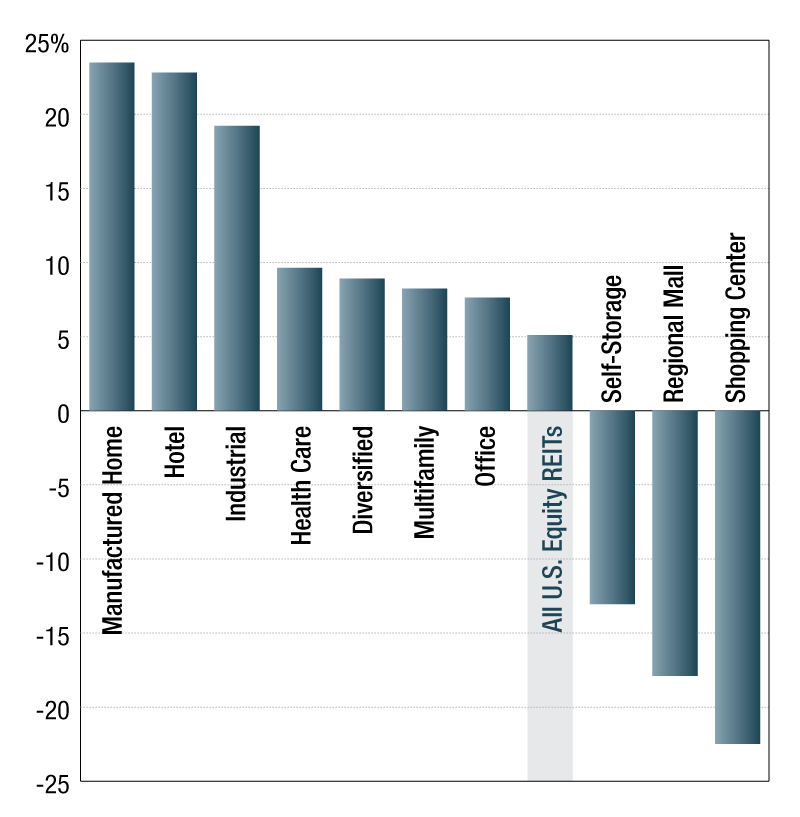

REIT Returns

Among the SNL U.S. REIT sector indexes, the manufactured homes sector recorded the highest one-year total return at 23.5 percent, beating the broader U.S. Equity REIT index by 18.4 percentage points.

U.S. equity REITs one-year total return comparison

As of May 31, the SNL U.S. REIT Equity index recorded a one-year total return of 5.1 percent. Among the SNL U.S. REIT sector indexes, the manufactured homes sector recorded the highest one-year total return at 23.5 percent, beating the broader U.S. Equity REIT index by 18.4 percentage points. The SNL U.S. REIT Hotel and SNL U.S. REIT Industrial indexes also posted significant one-year gains with a one-year total return standing at 22.8 percent and 19.2 percent, respectively, as of May 31. On the other end of the spectrum, the retail sector indexes posted significant losses. The SNL U.S. REIT shopping center and SNL U.S. REIT regional mall indexes recorded one-year total returns of negative 22.5 percent and negative 17.9 percent, respectively. The underperformance of these sectors can be associated with the large number of retail store closures and bankruptcies.

Khamile Armhynn Sabas is an analyst in the Real Estate Product Operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.