Reflecting Back on 2013

By Kenneth P. Riggs Jr., Chairman & President, Real Estate Research Corp.: As we take a closer look at the dynamics of the economy, it seems that the economic climate has done little more than putter along in 2013.

By Kenneth P. Riggs Jr., President, Real Estate Research Corp.

As we take a closer look at the dynamics of the economy, it seems that the economic climate has done little more than putter along in 2013.

There has been slight improvement, with third quarter 2013 GDP growing at a seasonally –adjusted annual rate of 3.6 percent, the highest rate in more than a year, and unemployment dropping to 7.0 percent in November, its lowest level since mid-2008. In addition, consumers finally pulled out their pocketbooks and retail spending increased 0.7 percent in November to five-month highs. However, business spending was weak in third quarter, with spending concentrated mostly on the build-up of inventories and almost zero spending on equipment. As for government contributions, spending is down but still running at a deficit, and many investors wonder where the economy would be without the added support provided by the Federal Reserve’s $85 billion in monthly purchases of bonds and securities.

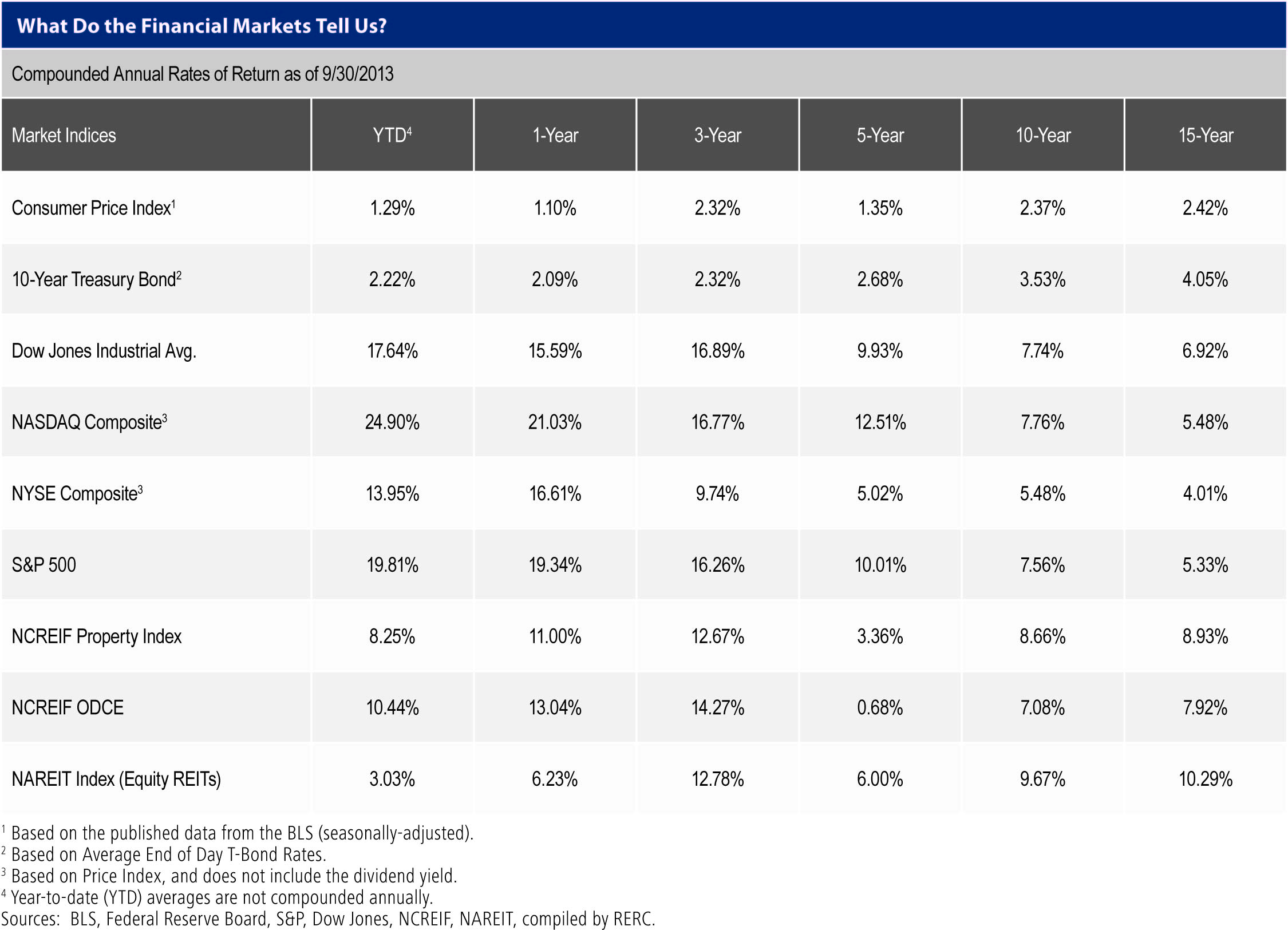

Although the economy may have done little more than muddle along in 2013, however, look at how the investment markets have performed. The new highs in the DJIA Index and S&P 500 this year have delighted investors, as well as their very strong year-to-date returns. We have enjoyed low inflation, and although interest rates have increased slightly, they are still relatively low. As a result, certain properties are commanding near-record high prices, like the $1,766 PSF paid for the General Motors office building in New York or the $660 PSF paid for the Hollywood & Highland Center retail property in Los Angeles.

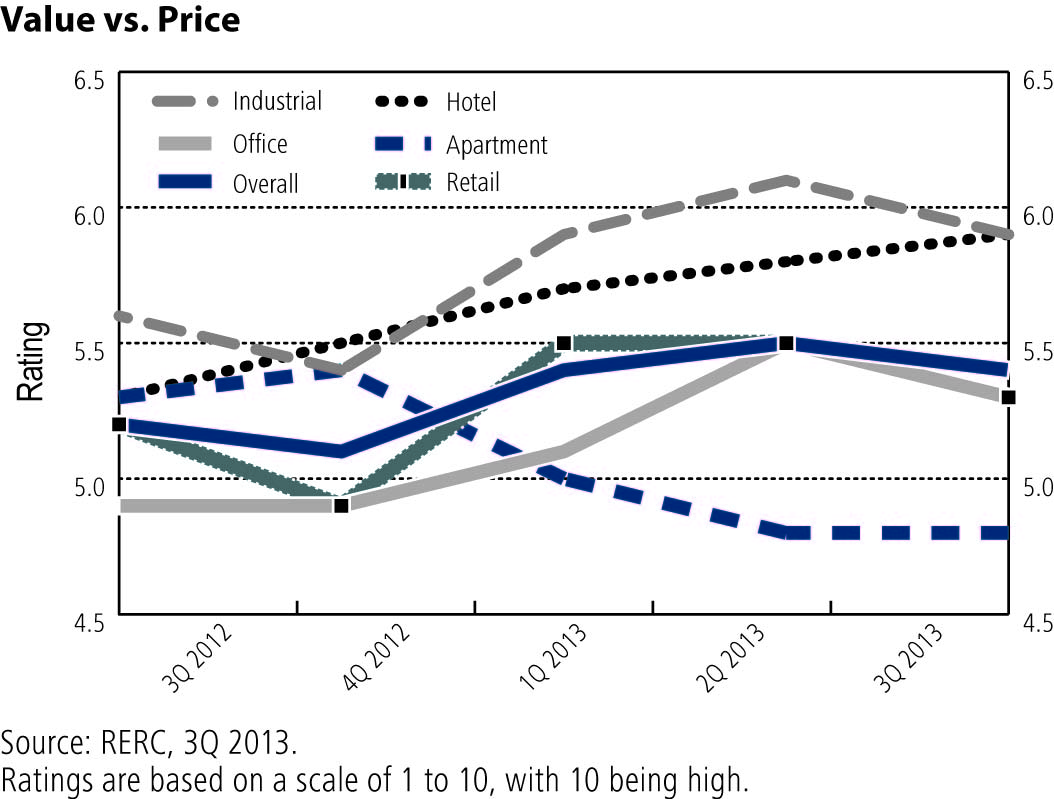

However, we are seeing the value of commercial real estate being challenged relative to price. RERC’s value versus price rating for commercial real estate overall declined slightly in third quarter 2013, to 5.4 on a scale of 1 to 10, with 5 showing value and price being even and with 10 being high. Interestingly, however, the value versus price relationship is holding up relative to the price increase that we have seen. The value-versus-price ratings also declined for the office, industrial, and retail sectors, while the rating remained unchanged for the apartment sector at 4.8, and the rating increased slightly for the hotel sector, as shown below and in the third quarter 2013 RERC Real Estate Report, “Alpha—Confronting Realities.”

With the rating for the apartment sector lower than the midpoint of this scale, investors are indicating that they believe that apartment properties are overpriced in comparison to their value, while the other property types with ratings higher than 5.0 on this scale are generally retaining value over price. Several respondents to RERC’s institutional investment survey noted that the retail sector can still offer good investment opportunity because the value has not been priced in by investors.

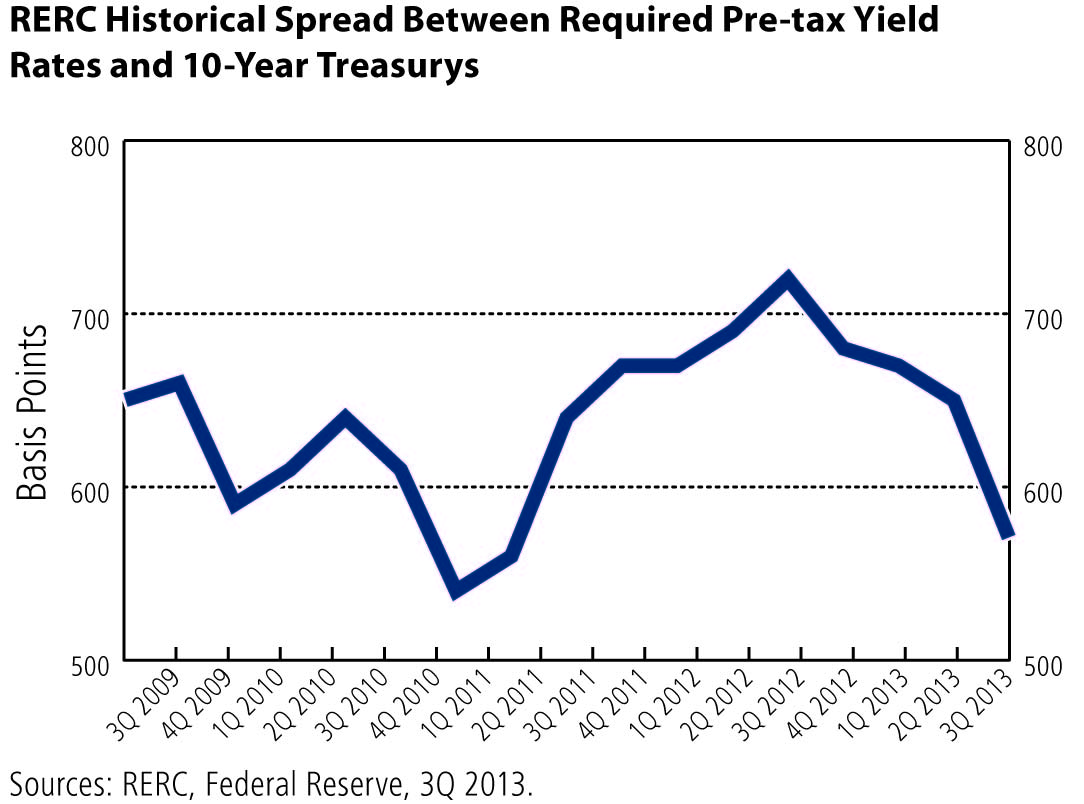

In addition, the spread between RERC’s required pre-tax yield rates and 10-year Treasurys has been declining this year, falling to 5.7 percent in third quarter 2013 from 6.5 percent in second quarter and from 6.7 percent in first quarter, indicating that investors expect returns on commercial real estate will be declining.

This is also what we are seeing with the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index, which although the quarterly return was down slightly, has seen a still very respectable 8.25-percent year-to-date return as of third quarter of 2013.

What does this mean for CREreturns in 2014? Many factors—including basic supply and demand fundamentals for commercial real estate, interest rates and the Federal Reserve’s plans to begin tapering their bond purchases, as well as new headwinds or tailwinds to the economy—will have a hand in determining returns, but we do expect appreciation, and total returns by extension, to slow slightly in the coming quarters. However, we anticipate the economy catching up with the financial markets next year, and for commercial real estate to hold its own.

But for now, we recognize the small steps the economy made in 2013, the slight clarity we are gaining in the investment environment overall, and the very strong returns for commercial real estate already achieved in 2013. That, indeed, is something to appreciate as we reflect back on this year.

You must be logged in to post a comment.