Opportunity Zones Can Make a Great Deal Greater

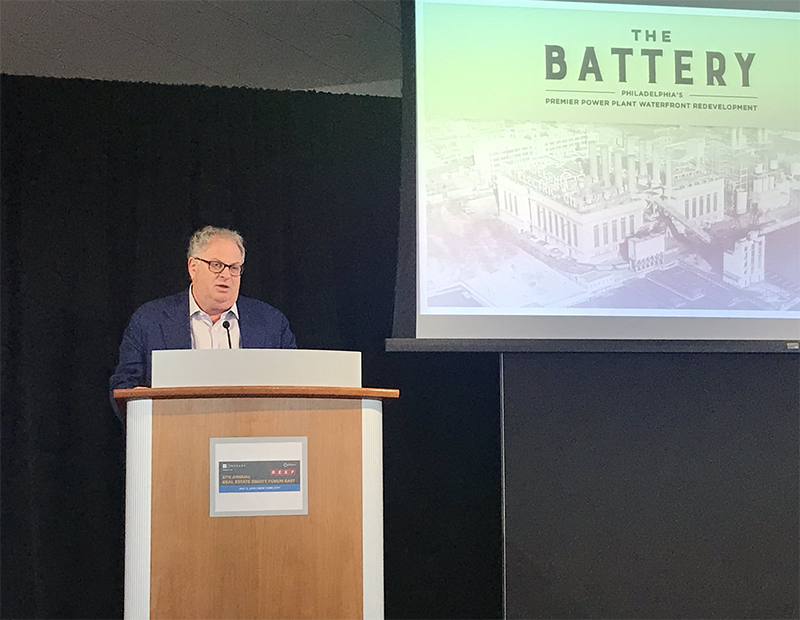

At a recent event organized by Mazars, Dean Adler explained how his team aims to turn a closed power plant in Philadelphia into a 1 million-square-foot, mixed-use destination—with a little help from the IRS.

Members of the real estate community are scrambling to understand how they can profit by investing in one of the more than 8,700 low-income areas designated as federal Opportunity Zones. But it’s the asset that should drive the investment decision, not the tax benefits, says Dean Adler, CEO & co-founder of real estate equity shop Lubert-Adler Partners.

“The question is, many people who are promoting these opportunity zone deals, do they really have the eye of the tiger to create great deals—or is this some macro trend, and let’s throw some slop out there, and if we can find some people to invest in it, let’s bring ’em in?” Adler said at a recent event in Manhattan. “And you’re going find a lot of the latter and, surprisingly, some of the biggest investment houses in New York are starting to distribute that slop.”

Adler, whose firm has more than $6.5 billion in equity and $16 billion of assets under management, made the comments during a talk at a real estate equity forum organized by accounting group Mazars. The property investment veteran explained how his team applied that deal-driven approach to an adaptive reuse project in Philadelphia, which aims to transform a defunct power plant sitting on the Delaware River into a more than 1 million-square-foot, mixed-use destination.

Assembling a solid deal

Dubbed The Battery, the waterfront project bordering the trendy Fishtown neighborhood will feature hundreds of apartment units within the existing building, plus more units on two floors built atop the roof, coworking offices, maker space and an event venue.

“We found the best amenity we’ve been putting into our apartment complexes is our own coworking space, just for our residents,” Adler noted.

The project, involving both repurposing of the 1920s-era power plant and waterfront expansion, will benefit from historic tax credits as well as Pennsylvania’s Keystone Opportunity Zone (KOZ) program, which offers tax credits to attract investment into sites that are abandoned, unused or underutilized.

The Battery is also poised to generate substantial enhanced returns, according to Adler, thanks to the U.S. Opportunity Zone program, launched as part of the 2017 tax overhaul and still in the process of being clarified. Crucially, the capital gains deferral benefits offered by the program allow savvy investors to take a bigger bite out of a deal—but that’s only a positive, says Adler, if the fundamentals of the property work.

“The Opportunity Zone allows one to buy at least 35% more of a deal than they normally could buy,” Adler said. “So the enhancement of the returns may not be solely the tax benefits, it’s because this tax-free IRS loan allows you to buy another third of a deal, and that boosts your returns. So that’s something no one is focused on, but to me that is 100 percent the heart of the Opportunity Zone.”

You must be logged in to post a comment.