Provident Launches Houston Industrial Park

The company is developing the project in partnership with Junction Commercial Real Estate.

Provident Industrial is launching construction on a planned four-building industrial park totaling 740,404 square feet in the North Houston submarket, just east of George Bush Intercontinental Airport (IAH). The site’s acquisition closed on March 27.

Units within the Eastex 59 industrial park will range from 148,000 to 224,000 square feet and feature coveted visibility, efficient circulation and ample trailer storage and car parking.

The North Houston submarket is a top performer within the Houston MSA. Its net absorption, vacancy rates, sales volume and year-over-year rents outperform the Houston market.

“This location was carefully selected based on its extensive frontage along Highway 59, convenient access via Highway 59 and Rankin Road, the competitive tax rate within the city of Humble, and the increasing demand for air cargo at IAH,” Christen Vestal, director of Provident’s Houston office, the lead developer on the project, told Commercial Property Executive.

Junction Commercial Real Estate serves as the capital partner, and this is the sixth time they have gotten together. They have joined on more than 3.2 million square feet of institutional-grade industrial developments.

READ ALSO: E-Commerce Drives Industrial Demand Growth

Provident Industrial, a division of the Dallas-based Provident, has 8.2 million square feet of industrial space under construction or pre-development across Arizona, Texas and the Carolinas.

In February, Provident expanded into Gateway Logistics Park in El Paso, Texas, with three Class A industrial buildings totaling 497,280 square feet. The first three phases comprised three buildings totaling 921,759 square feet. All have been sold. A fourth is under construction, 7.5 miles north of the Ysleta-Zaragoza Port of Entry in Juarez, Mexico.

Houston’s resilient industrial market

Avison Young’s Houston industrial market report for the first quarter of 2025 revealed a resilient sector amid shifting economic and consumer trends, according to Drew Coupe, principal & industrial tenant representation specialist at Avison Young.

“The market is holding steady, supported by consistent job growth and robust performance at the Port of Houston, and features a diverse tenant mix, including companies in e-commerce, logistics, health care and heavy machinery,” he told CPE.

In the first quarter, developers delivered 3 million square feet of new industrial space, nudging the overall vacancy rate up to 7 percent. The construction pipeline remains active at 13 million square feet, with 8.9 percent already spoken for via preleasing agreements. Additionally, 2.3 million square feet of new space broke ground in the first quarter of this year, with another 11.6 million square feet anticipated for completion by year’s end.

Notably, the composition of Houston’s industrial development pipeline has shifted over the past year, Coupe said.

“The share of build-to-suit projects has dropped significantly—from 37 percent to 19 percent—reflecting a more normalized demand environment and a reduced need for custom-built facilities given the speculative availability throughout the market.”

While new supply has slightly outpaced current demand, absorption rates remain healthy, and lease-up times continue to reflect a balanced market, he added.

Houston’s rental rates have steadily climbed over the last few years, with an additional 2.5 percent growth in the first quarter of 2025, according to JLL data.

“This growth has contributed to yield on cost metrics that provide a healthy spread over achieved exit cap rates,” Trent Agnew, senior managing director & industrial group co-lead, JLL Capital Markets, told CPE.

The Houston industrial market this summer will welcome Grand West Crossing Building 2, a Class A warehouse.

Agnew added that EastGroup Properties is ahead of construction timelines, having broken ground in January. The facility is the second of six planned buildings spanning 97,285 square feet in the larger Grand West Crossing business park.

Fueled by growth from several demand drivers, including the port, population/consumer base, housing and the manufacturing sector, “Houston’s outlook for the next few years is among the best of the major U.S. industrial markets, and will spur additional activity,” he said.

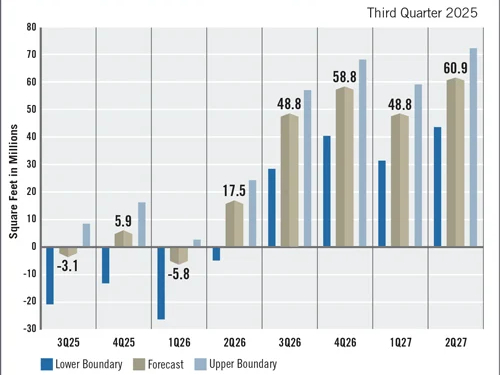

Economists on the other hand forecast Houston to perhaps enter a recession by summer due to the combined effects of tariff indecision and falling crude oil prices, according to Doug Ressler, business intelligence manager at Yardi.

The Port of Houston is experiencing disruptions in both inbound and outbound traffic, affecting warehousing and manufacturing operations.

You must be logged in to post a comment.