Property Metrics

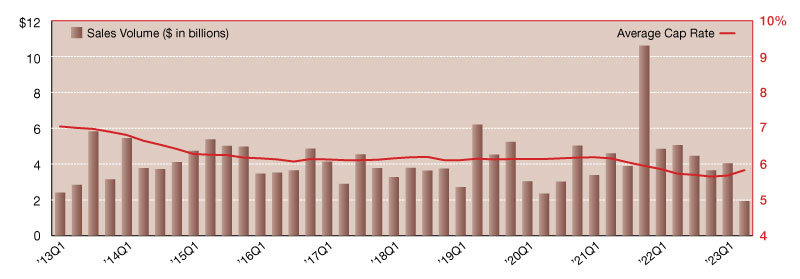

2023 Net Lease Retail Sales Volume & Cap Rates

Investment sales activity within the single-tenant net lease retail sector reported a substantial drop off during second quarter 2023.

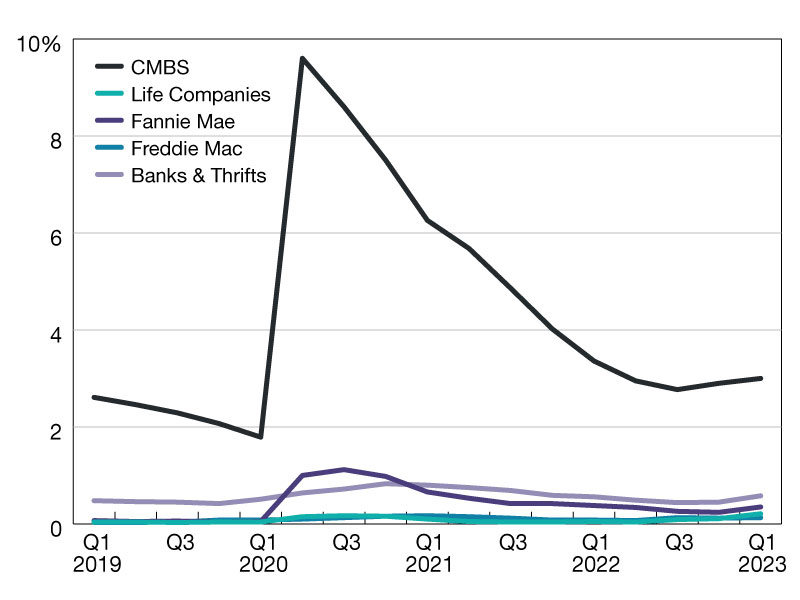

A Private Lender’s Perspective on CRE Finance

BridgeInvest’s Alex Horn shares insights into non-bank debt sources, CMBS market prospects and more.

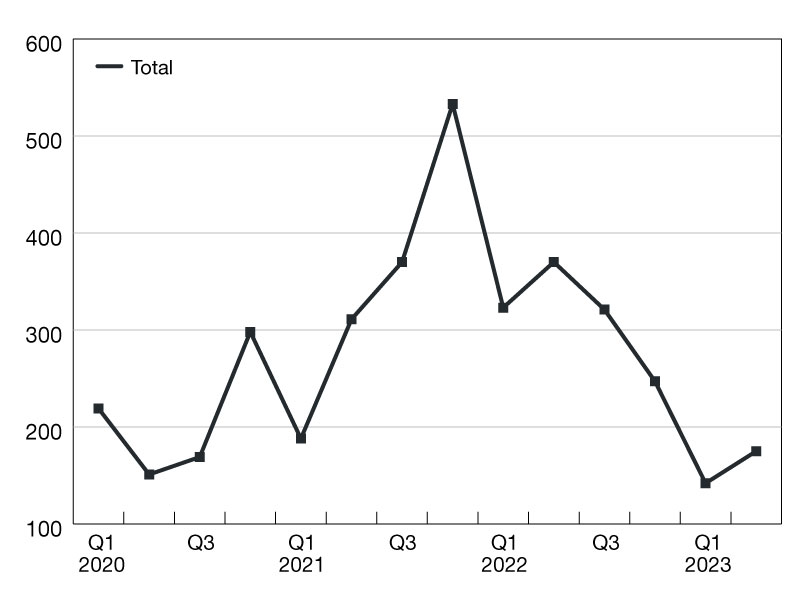

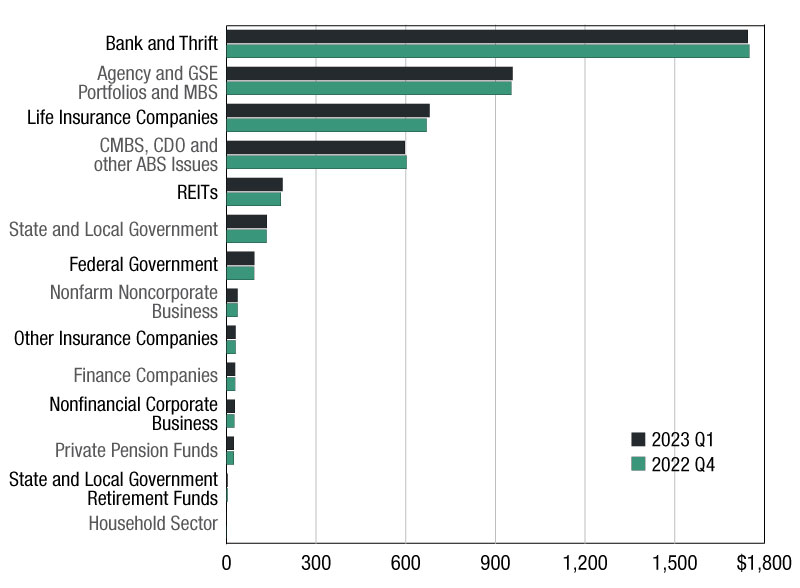

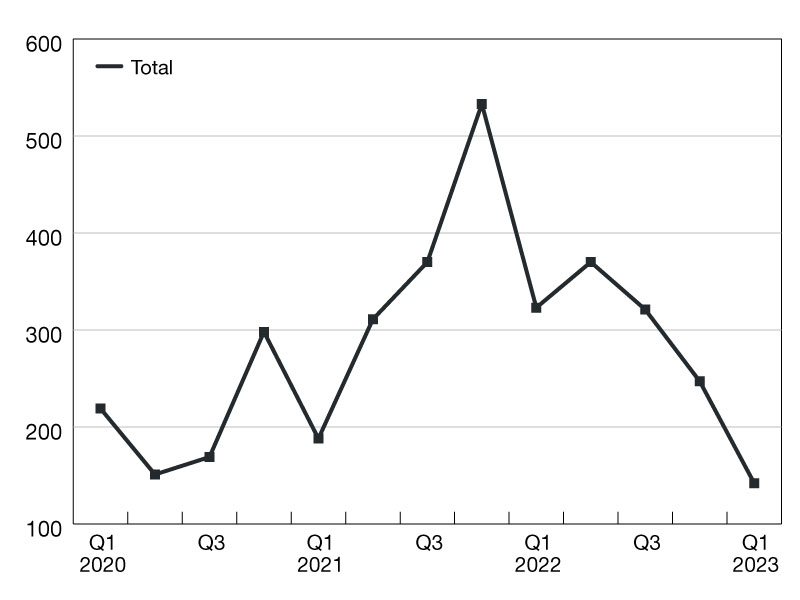

Commercial/Multifamily Borrowing Declines 53 Percent Year-Over-Year in the Second Quarter 2023

Commercial and multifamily mortgage loan originations were 53 percent lower in the second quarter of 2023 compared to a year ago.

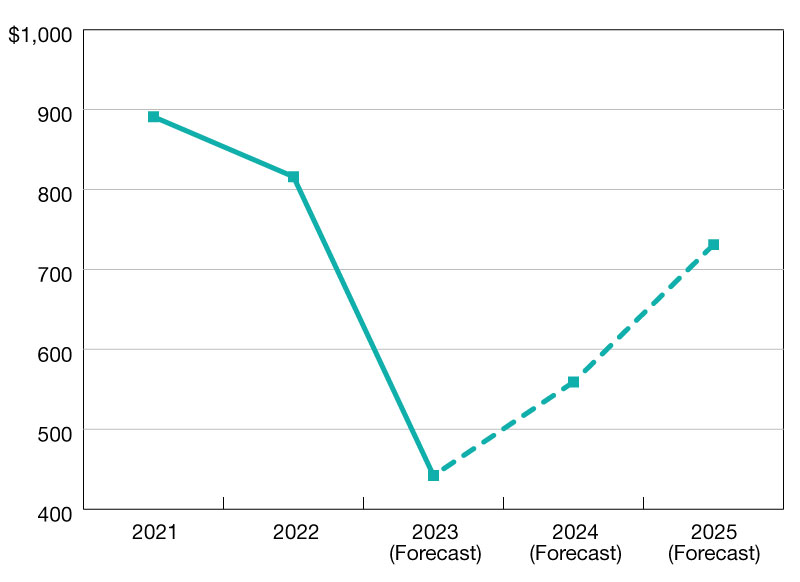

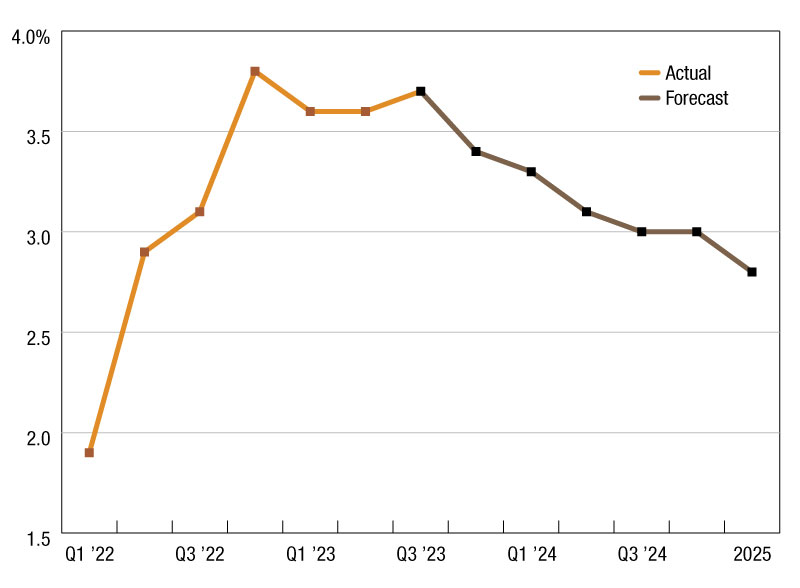

MBA Forecast: Higher Rates, Uncertainty to Slow Commercial/Multifamily Lending in 2023

Total commercial and multifamily mortgage borrowing and lending is expected to fall to $504 billion this year.

Vertical Cold Storage Buys Indianapolis Firm

The acquired company operates 545,000 square feet in two buildings.

Commercial/Multifamily Borrowing Declines 56 Percent in First-Quarter 2023

Commercial and multifamily mortgage loan originations were 56 percent lower in the first quarter of 2023 compared to a year ago.