Proper Payout

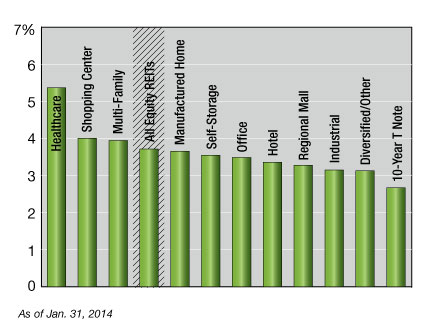

(REIT dividend yield by sector) By Jason Lail REIT dividend yields are an important metric to consider when determining investment allocations in the equity REIT space. REITs are required to pay out 90 percent of taxable income each year to maintain elected REIT status, so REITs are generally considered appealing for yield-seeking investors. Spreads between…

(REIT dividend yield by sector)

By Jason Lail

REIT dividend yields are an important metric to consider when determining investment allocations in the equity REIT space. REITs are required to pay out 90 percent of taxable income each year to maintain elected REIT status, so REITs are generally considered appealing for yield-seeking investors.

Spreads between the 10-year Treasury and equity REIT yields ranged between 0.77 and 1.65 percent over the last year, with a spread as of Jan. 31, 2014, of 1.05 percent. The 10-year T-note yield has increased by 65 basis points over the last year, while equity REITs have seen a price decrease of 0.45 percent and the S&P 500 enjoyed a price increase of 19 percent. These stark differences in price changes indicate that REITs could indeed be rate sensitive, and that REIT stock performance in 2014 may be at least partially dictated by the Federal Reserve’s adjustments to its quantitave easing policy.

Looking at different REIT property sectors, the SNL Healthcare REIT Index provided investors a yield of 5.37 percent as of Jan. 31. Physicians Realty Trust provided the highest dividend yield of all healthcare REITs, at 7.26 percent as of the end of January. Senior Housing Properties Trust, Medical Properties Trust and Omega Healthcare Investors all had dividend yields greater than 6 percent at the end of January, with yields of 6.93, 6.33 and 6.14 percent, respectively. The healthcare REIT sector is currently projected to pay out a median of 81 percent of 2014 estimated Adjusted Funds From Operations per share in the form of dividends, making healthcare the second-highest-ranking REIT sector for estimated AFFO payout ratios. Healthcare REITs continue to trade at the highest premium to estimated net asset value of all REIT sectors, with the long-term, triple-net nature of leases in the healthcare space being part of the appeal of the sector.

Shopping center REITs were the only other property sector that finished January with a dividend yield greater than 4 percent. Wheeler Real Estate Investment Trust, Whitestone REIT and Excel Trust provided the highest yields among shopping center REITs, at 9.33, 8.35 and 6.13 percent, respectively, as of Jan. 31. There are concerns that e-commerce may continue to eat into brick-and-mortar retail sales in 2014, with e-commerce sales making up nearly 6 percent of total retail sales at the end of the third quarter of 2013. On the other hand, analysts point to limited new shopping center supply as a positive catalyst for shopping center REIT fundamentals. Shopping Center REITs currently have about 40 development projects in the works in the U.S., with 25 percent of those taking place in Florida.

A total of 94 REITs increased dividend payments in 2013, with the specialty and multi-family sectors topping the list at 17 and 14 percent increases, respectively. With the median estimated AFFO payout ratio for the REIT sector at 73.7 percent, there appears to be room for further dividend increases in 2014.

—Jason Lail is manager of real estate research for SNL Financial.

You must be logged in to post a comment.