Mark Zandi on the Real Estate Economy in 2020

The chief economist at Moody's Analytics believes the office market should start discounting for progressively slower job growth. Here's what else he said about the year ahead.

Zandi discussed which property types will be winners and which will struggle in light of current economic conditions.

You can also watch Video: Mark Zandi Sizes Up the 2019 Economy and Mark Zandi: Economic Measure.

CPE: Hi, I’m Therese Fitzgerald, Senior Editor, Commercial Property Executive. We are very lucky to have with us today Mark Zandi, chief economist for Moody’s Analytics.

Mark is one of the most respected and consulted minds in the financial community, and he is the author of two highly acclaimed books on the financial crisis. Today, he is going to talk to us about current economic conditions and their impact on property markets. Mark, welcome.

Zandi: It’s good to be here thank you.

CPE: Very happy to have you.

Job Market and Office Occupancy Trends

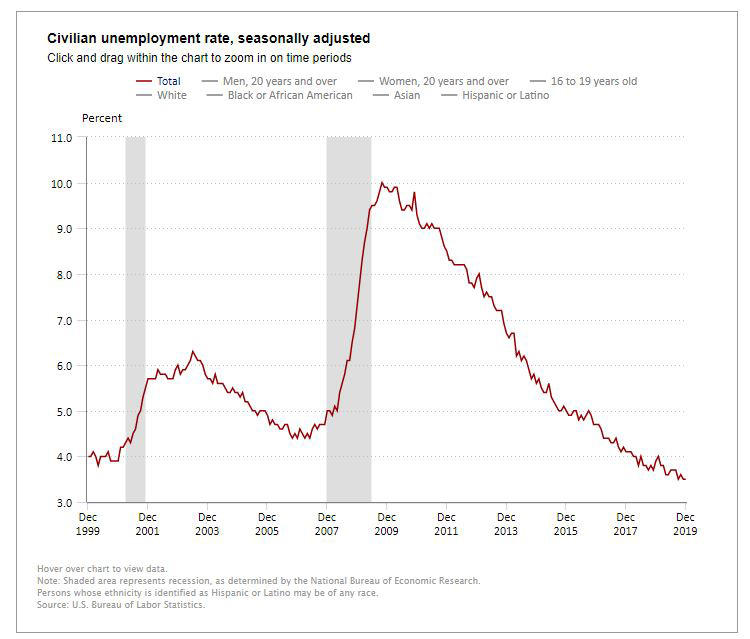

CPE: Last year when you were here, you were talking about slower job growth and how that could be a disruptor of property markets. Jobs did slow down but not as much as people expected. What is your projection for jobs in 2020?

Zandi: I’m sticking to my guns. I think 2020 will see even slower job growth. In 2018, we created 225,000 jobs per month. In 2019, we’re down to about 175,000. In 2020, I’d say about (we’ll have) 125,000 per month.

We are going to get a benchmark revision as the employment data is based on a survey of businesses and, once a year, the Bureau of Labor Statistics benchmarks to actual employment counts based on unemployment insurance records. Now that will come out next month, and the BLS has already told us that they will revise down significantly the employment gains in 2019. So, my guess is we’ll see the numbers are much slower for 2019 than they currently suggest, and 2020 will be even slower.

Source: Bureau of Labor Statistics on Jan. 10, 2020

Economy Challenges

CPE: What are your other hot buttons for the economy? What are the drivers what are the challenges?

Zandi: Well, a lot depends on, in my view, on the policy and the election. With the trade war on hold, that threat to the economy feels less threatening at this point, which is a good thing. I think if the president decided to escalate the trade war, recession risks would be high for 2020. But he decided not to go down that path. That’s a good thing, but I do think the election itself is going to create a fair amount of uncertainty and cause business people to be still cautious, and that’s because the president’s policies around trade, immigration, fiscal policy, tax spending policy…they’re very, very different than those proposed by his Democratic rivals.

Now there’s a lot of variability among those different Democratic candidates, but they’re very, very different. So, if you’re a business person trying to handicap what the world looks like in 2021, that’s pretty tough to do. And so, I think the result is, you don’t cut, you don’t lay off, but you just are more cautious in your hiring. And that goes to why I think we’ll see slower job growth—one of the reasons why I think we’ll see slower job growth in 2020.

And then, in just thinking a little bit forward into 2021, I think policy’s going to matter a lot. (If) the president wins re-election, he’s going double down on his policies and, (if) the Democrats win, they’re going to do a 180. So, it could it be a pretty tricky year I think just to adjust to the new policies.

Rising Interest Rates?

CPE: On interest rates, specifically, what do you think the Fed is going to do with those. They’ve kept them low to keep the economy growing, but there are concerns that individuals and pension funds are not earning as much and they might go into risky investments. What do you think will happen?

Zandi: I got interest rates wrong last year. If you remember back this time last year, rates felt like they were going higher. Then the trade war started to do some real damage, like slowed growth, and the Fed respondended to that by cutting rates—not raising rates. Here we are a year later, and it feels like the Feds are on hold. I don’t think they make a move one direction or another in 2020. It’s an election year, too, and, of course, the Fed, I think, is loath to get involved in the election process.

So, I think, they’ll work really hard to keep policy where it is. I mean something really would have to change for them to cut rates or to increase rates. I think the next move by the Fed is probably to raise rates. I mean right now monetary policy (is) interest rates are very accommodative to the economy. It’s juicing up the stock market, juicing up valuations in the commercial real estate market. Housing values have been juiced up, so these are things that I think the Fed may be a little bit more concerned about a year from now and would be a reason for them to start pushing rates back closer to what they would consider to be long-run equilibrium—consistent with a neutral economy as opposed to having this accommodative stance. So, the next move by the Fed will probably be for higher rates, but I don’t think that happens in 2020.

Property Market Impact

CPE: In light of all those factors, how are they going to impact the property markets. Who are the winners going to be and who are the strugglers?

Zandi: I think we’ll see slower absorption. So, if you kind of buy into the idea that job growth will slow, that means the office markets will feel that. There will still be positive absorption—just a slower rate of absorption. So, I think office markets, if you think out a little longer run, next 3-5 years, need to prepare for much slower absorption because demographics are very compelling. Here we’re going to see much slower job growth down the road. If you told me two, three, four years from now—extracting for the ups and downs in the economy—we’re creating 25,000-50,000 jobs per month, that sounds right to me. So, I think office markets need to start discounting for that reality, and so it’s going to be a very different kind of world in the not-too-distant future.

Obviously, retail (is) struggling with online. Fortunately, there, the supply side of the market has responded. The actual construction put in place for brick-and-mortar retail has fallen very sharply over the past two to three years. Negative absorption but also much weaker construction. So that kind of offset. The high-end apartment market also feels like that hasn’t really changed. This time last year that was the problem. It’s still a problem. It’s still too much supply relative to demand.

The strength will probably be in affordable housing. I mean there’s a severe shortage of affordable rental, affordable single-family. Demand for warehouse/industrial space should be good—the flip side of what’s going on with brick-and-mortar retailers. I do think we will see a pickup in global trade despite all the trade conflicts, but that does depend on, to some degree, who the next president is and what policies they pursue. Along the spectrum, I think high-end apartment, office and brick-and-mortar retail soft. Affordable housing, industrial/warehouse stronger.

Capital Markets 2020

CPE: How about the capital Markets? Capital continues to pour into real estate because of its relative safety, but cap rates are falling and it’s harder to find good deals. What’s your outlook for buyers, sellers and lenders?.

Zandi: Valuations are too high, Evaluations are rich across all asset classes. You can see the run-up in the stock market. Housing values now feel stretched—not everywhere but where you’d expect them to be.

Commercial real estate prices are very high. Now to some degree, they should be high. Interest rates are low, and long-run equilibrium interest rates are lower than they have been historically. That should support higher valuations. But it feels like to me they’re beyond fair value—even accounting for the low rates—and there will be a correction. Now, the thing is these asset markets take on a life of their own, right, and go on for a while and valuations can get even more stretched. So far, it doesn’t feel like things have turned speculative yet. It’s not like Y2K- Internet-bubble kind of thing, but we’re moving in that direction. If we’re back here a year from now and stock prices are up another 10, 15, 20 percent and cap rates are even lower, then I think the alarm bells should start going off. By the way, that goes back to Fed policy. I think the Fed is focused on this as an issue, and it’s not to a point where they’re going to react. But at some point, they will, and they will push rates up because they’re worried about valuations and what it would mean to the economy if evaluations corrected in a significant way in a short period of time.

Are We In a Tech Bubble?

CPE: You mentioned a tech bubble. Do you think there is one? Do you think there will be one?

Zandi: I’m getting older, so I’ve got some history and I think back to the late ‘90s, early 2000s. That was a tech bubble. There were companies that were very aspirational. It wasn’t clear what their business model was and there was no business model at the end of the day. Their stock prices had gone skyward in anticipation of something good that never happened. I don’t sense that here. I think the tech companies are creating real value. They’re doing things that people want. Are they making money? No. To some degree, that’s by design. They’re still building out their platforms and trying to create scale. So, again, valuations might be high. You might see a correction, but I wouldn’t characterize it as a bubble. It’s not Pets.com. It’s more like Economy.com. Remember economy.com? That was my company that I sold to Moody’s. Real value there!

So, no, I don’t think there’s a bubble. I think valuations are stretched. For some companies, the stock prices are certainly overvalued but, no, I don’t think it’s a bubble.

Opportunity Zones Predictions

CPE: Opportunities Zones. That’s something we talked with you last year about, and you said you didn’t think they’d be a game changer. Did you see anything (in 2019) that impressed you more about them?

Zandi: No. I’m a little bit disappointed actually. Money has flowed in. There are more funds, but I don’t really sense it taking off and I feel—this is more anecdotal than based on data because there’s not a lot of data—but my sense is it’s losing energy. I don’t sense that OZs are really capturing the imagination and that it’s really going to be a game changer. So, my views on that have not changed. Politics here matter a lot, right, because this thing is going to start winding down unless there’s new legislation and the benefits of the OZs, from an economic perspective, start to fade away over time. We need lawmakers to step up and say: “O.K., this was a good idea. Let’s expand it and let’s try to fix some of the problems that are obvious here in terms of disclosure and other things.” But I don’t sense that sort of political constituency forming. On the progressive side, they don’t really like this. Intuitively, you say, progressives should like it right because you should help underserved communities. But they don’t like it because there’s no connecting the dots to real results. How does this help under-served communities? You can get the OZ benefit without demonstrating any benefit to the community that you’re in and, of course, there’s been a series of New York Times articles showing the abuses, which it’s not surprising that there would be abuses.

And then, on the conservative side, they just don’t like that kind of policy, right? “They’re mucking with the market, so I’m not really enthusiastic about that.” I’m parroting a conservative. So, if you have conservatives and progressives not really all that enthusiastic about it, politically, it’s hard to see how that comes together with a piece of legislation, particularly in this political environment, right? I don’t know. I’m where I was a year ago. I don’t see this as game changer.

Is a Recession Coming?

CPE: O.K. We’ll check back with you. Mark, thank you so much for being here. One more question: Recession. Do you see it somewhere on the horizon? Can you put a year on it?

Zandi: I would have said 2020. When the president was going full bore on his trade war, I think that was prescription for recession. I think since he pulled back, much less likely now in 2020. There’s this view that expansions don’t die of old age, and this is an old expansion, right? It’s 10-and-a-half years–longest in history. That’s not true. Once the economy is operating beyond full employment—3-5 percent unemployment rate to me qualifies as being the optimal—the clock starts ticking on the expansion. I think we are going to have a recession. If it’s not 2020, maybe given the politics and the environment, maybe 2021. So, again, another reason for being a bit cautious if you’re business person. By the way, I’m writing a third book called The Next Recession. So, now, stay tuned. I might even give you a day for the next recession in the book.

CPE: That’s awesome. Mark, thank you and thank you for watching.

You must be logged in to post a comment.