Poll Results: The Impact of Rising Insurance Costs

Commercial Property Executive’s latest monthly reader poll asked about the impacts that rising insurance costs are having on commercial real estate investment, development and property management. At a time of more frequent severe weather events and declining property values, owners and operators of commercial real estate have found their current coverage is increasing in price, bleeding into net operating income in the process.

Commercial Property Executive’s latest monthly reader poll asked about the impacts that rising insurance costs are having on commercial real estate investment, development and property management. At a time of more frequent severe weather events and declining property values, owners and operators of commercial real estate have found their current coverage is increasing in price, bleeding into net operating income in the process.

In the first quarter of the year, property insurance rates increased by 20.4 percent, more than four times the previous quarter’s hike of 4.8 percent, according to a June article from the Insurance Business. Additionally, the market for insurance has seen increased demand, at the same time as some carriers roll back their coverage of commercial properties.

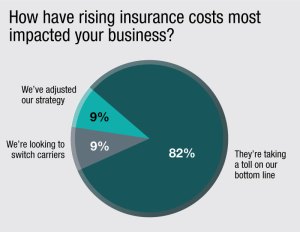

Consequently, the vast majority of respondents—82 percent—stated that the rising costs are having some impact on their bottom lines, likely exacerbated by already strict insurance requirements on part of lenders, as well as inflated operational costs at properties located in regions vulnerable to hurricanes, floods and wildfires. Nine percent of respondents stated that they are either adjusting their strategy, possibly through disinvestment or building up resilience at their properties. The same number seeks to switch carriers that are willing to accommodate their assets’ vulnerabilities.

Click here to see CPE’s latest poll, and the results of previous surveys.

You must be logged in to post a comment.