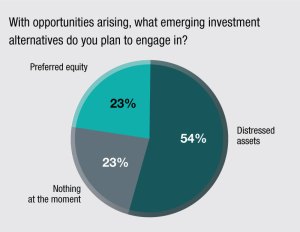

Poll Results: Emerging Investment Alternatives

Distressed assets stood well above all other areas of interest.

Commercial Property Executive’s latest monthly poll asked readers about their planned investment alternatives, at a time of deflated transaction volumes and shortages of available capital for investments in nearly all asset classes.

Commercial Property Executive’s latest monthly poll asked readers about their planned investment alternatives, at a time of deflated transaction volumes and shortages of available capital for investments in nearly all asset classes.

More than half of respondents identified distressed assets as their biggest area of interest, at a time when the office and retail sectors suffer from both latent and acute struggles.

Often, the deals that do take place for distressed properties include some form of longer-term investment in a redevelopment or substantial capital improvements. For their part, some distressed office assets are being converted to multifamily housing or are undergoing vast amenity-focused capital improvement projects, while many recent high-profile retail investments have included some form of redevelopment plan.

READ ALSO: How Cautious Lending Impacts Construction Financing

The remainder of responses were split evenly between investments in preferred equity, alongside identifying no further investment plans. Preferred equity is emerging as a viable opportunity, as owners and operators of commercial space face maturing loans, high interest rates and deflated property values. According to Steven Peterson, a partner in Alston & Bird’s Real Estate Group, the investment type is becoming lucrative in part due to the potential for stable, guaranteed returns, with a lesser risk of loss in comparison to many common equity investments.

Click here to see CPE’s latest poll, and the results of previous surveys.

You must be logged in to post a comment.